The “swapper” has always been a core element of automotive retail. The part-exchange process is intrinsically linked to securing a new car sale and many trade-ins are quality stock for the forecourt. However, with unwanted part-exchanges, turning the vehicle into cash as quickly as possible has to be the goal.

Guy Thomas, head of product for BCA, said the critical steps for dealers are accuracy, a realistic valuation and making an informed decision to retain or trade.

He said: “If the vehicle is not retained for retail then it must be remarketed quickly and efficiently for the best possible price.”

The accuracy of the part-ex appraisal can mean the difference between breaking even on a vehicle or making a loss when it is disposed of. Many dealers do not aim to make a profit on the part-exchange, instead looking to make their money on the new car deal.

As one dealer put it: “If you’re making a profit at disposal, you need to think about how many deals you’re missing out on due to the price you’re quoting for the part-ex.”

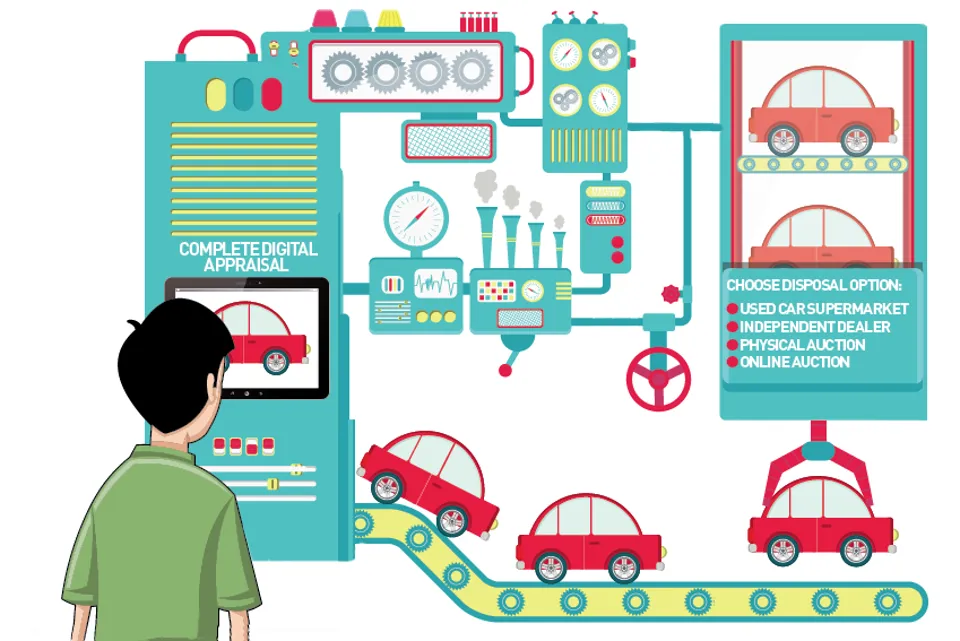

While the part-exchange process hasn’t changed much in decades, it is currently going through a transitionary period, with many dealers throwing out the clipboards and paper of old and switching to digital systems.

“A lot of dealers are still using Auto Trader as a way to gauge what sort of price they should be looking for and while that’s fine, it’s not the Bible” Matt Dale,G3 Remarketing

Current best practice of conducting a digital appraisal through a tablet computer means that a set process must be followed – a sales executive cannot progress to the valuation until they have completed specific sections. In addition, such systems feed the data into reporting tools, allowing the sales manager or dealer principal to identify any poor practice by individual sales executives, such as logging incorrect mileage or service history data or failing to check a spare key is present.

Repeated poor practices could result in part of the sales executive’s commission being held back.

Where possible, the appraisal should also be conducted with the prospective customer alongside, to ensure they see how the value they are quoted has been calculated. It helps to create trust and avoid confrontation.

Barry Cooper, Cooper Solutions managing director, said: “The way the appraisal is done is massively important in determining whether the customer will do a deal.”

Cooper, who was a BMW dealer principal before starting his technology company, said dealers should not rush an appraisal, with the ideal duration being at least 10 minutes.

He said: “Every customer will check the value of the vehicle before they come to the showroom. You’ve got to help them understand that you’ve evaluated the tyres, the scratches, the chips, the lack of service history and you can show them why you’re coming to a specific conclusion.

“I think where dealers can go wrong is disappearing to the sales manager’s office and coming back with an offer with no real explanation.”

Technology aside, there are standard checklists for an appraisal (see ‘Back to Basics’, left), but bringing systems into the picture can help increase accuracy.

Back to basics appraisal checklist

■ Body condition

■ Tyre depth

■ Next service due

■ Service history

■ Mileage

■ Registration number

■ Specification

■ Options

■ MOT due date

■ Two keys

■ V5C

■ Warning lights

Cooper said: “You can punch in the reg and look up the exact details of the vehicle. If you’ve missed that it’s an automatic and you’ve got it down as a manual, it can make a huge financial impact. It also helps massively if the part-ex is out of franchise.”

Matt Dale, G3 Remarketing joint director, estimated that an inaccurate appraisal could mean a 10% difference in the return from an individual unit.

He said unlike the big used car supermarkets, most franchised dealers don’t have dedicated appraisers, so having a tool helps to increase accuracy.

Tim Hudson, managing director for Manheim Remarketing, said data from its SellerAdvance digital appraisal tool shows a 97% accuracy rate.

Digital systems, such as SellerAdvance, Cooper Solution’s FullAppraisal or BCA’s Dealer Pro, can also pull in data from pricing guides to provide a starting point for part-ex values.

The sales manager or dealer principal should also be generating reports tracking how many of the appraisals being done have been converted into sales. The appraisals can also be provided to customers, with supporting images or video, so they can review how a dealer came to their conclusion.

Dale believes the adoption of digital appraisals will increase rapidly over the next 12 months. Cooper estimated that about 80% of dealers operated a paper-based part-exchange appraisal system two years ago, and said this proportion had fallen to about 50%.

Philip Nothard, CAP Black Book editor and retail and consumer specialist, said: “One of the big things that’s becoming difficult is the specification check and making sure all the technology is accounted for and working.

“This is going to become even more difficult when cars have different levels of connected features and options which aren’t even visible.”

The registration or VIN look-up functions of digital systems will be crucial to identify the exact specification.

Which disposal method is best?

Dealers have four main options to dispose of vehicles – retailing stock themselves or at their used car supermarket sites, trading to an independent dealer, putting them out to a physical auction or putting them through an online auction.

Dale said the part-ex ideal is for a dealer to be clear of the vehicle and for it to be sold within 24 hours: “Realistically, if you’ve got things all working efficiently, that 24-hour window can happen, but you’re looking at three to four days and perhaps up to a week before the cash is back in the business.”

Many of the digital appraisal tools can connect the process to disposal systems, allowing the dealer to offer the car online to the trade while it is still on their premises.

When pricing a vehicle for auction, Cooper said dealers need to look at the stand-in value (the price the dealer needs to reach to break even on the vehicle), the reserve and the starting price.

He said: “You want bidders, and so setting the starting price low is a good idea and never higher than 75% of the reserve.

“The reserve really depends on what the dealer is looking to achieve with that vehicle. A lot of dealers will put the reserve at CAP Clean even if it’s not in that condition.

“Some dealers are happy to cover the cost of the physical auction fee on the disposal and call it even. It really depends on how well they think they’ve bought it.”

Integration

Integrating digital appraisal with a dealer management system (DMS) helps to smooth out the process and joins it up with CRM and disposal at auction.

However, CAP’s Philip Nothard said integration is one of the biggest hurdles facing digital appraisals: “Integration is happening and I think the DMS suppliers are aware of that and want to make it happen, but it takes time.”

The two dealers AM spoke to do not currently have their digital appraisal system integrated with their DMS supplier.

Nothard said: “What you want is to be able to put in the reg and it will take you all the way from appraisal, pull in all the relevant details from the DMS and then through for disposal with no re-keying.”

Thomas said any non-retail vehicles should be valued to sell, so an accurate appraisal leads to a realistic auction grade.

Nothard said the only thing that will come of an inaccurate appraisal is a dealer making a loss at auction.

He said: “If these vehicles go to auction and the dealer has missed the detail, part-ex stock can miss the first sale and then vehicles get a stigma. It slows down the sales process and stock turn.”

Dale said the key to setting a price at auction is being realistic: “A lot of dealers are still using Auto Trader as a way to gauge what sort of price they should be looking for and while that’s fine, it’s not the Bible.

“Ready-to-retail stock will always carry a premium. The other trend we are seeing is that outlets buying up that part-ex stock don’t want to acquire vehicles they’re going to have to refurbish.

“If the vehicle needs work and it can’t be done within most dealers’ £150-£200 limit, it has to be priced accordingly to sell.”

Physical auctions vs online auctions

Online-only auctions continue to grow in popularity and, according to Cooper, the choice between physical and online is based on time and logistics and the majority of the AM100 use a mix of the two.

He said: “It’s a bit of a race against time as you’re always looking to get that vehicle to sale before there’s a drop in residual value and that will happen within the month.

“You want to get stock moving as quickly as possible and if you’re looking at a physical auction, you may get one pick-up slot or two a week, but the time it takes you to get your money back will be at least 10 days.

“There are also a lot more overheads and transaction costs involved with physical auctions. The costs involved would be up to nine times higher than online only, from what we have seen.”

Thomas said dealers should target the remarketing channel that has the buying power to deliver the best possible return in the shortest time.

Hudson said a physical auction had the benefit of letting buyers carry out their own visual inspection of vehicles, rather than relying on images and video provided on an online auction listing.

He said: “Seeing and hearing the vehicle moving can be advantageous to buyers in the physical auction environment.”

The big physical auction players like Manheim and BCA will also offer dealers the mix of online and physical for the best of both worlds. G3 Remarketing was previously an online-only auction, but has now set up a physical auction space near its headquarters in Leeds.

He said: “The majority of our volume comes from ex-fleet vehicles between £6,500 and £7,000, which buyers are comfortably buying online, but we were finding it difficult to attract buyers for part-ex stock below £3,000 online.

“It’s a confidence thing, because buyers like to see and touch vehicles that are a bit older.”

Dealer case studies: Soper BMW Lincoln and Stephen James BMW Blackheath

Soper BMW Lincoln changed to a digital appraisal process more than six months ago and hasn’t looked back.

Soper BMW Lincoln changed to a digital appraisal process more than six months ago and hasn’t looked back.

Nigel Storey, general sales manager, said: “One of the main things it has done is really boost the interaction with customers. We’re getting them much more involved in the appraisal, taking them through the process as it’s done on the iPad.”

Storey said customers come to the showroom having done their research on how much their vehicle is worth, sometimes to the extent that they have done more research on it than on the car they are buying next.

He said: “We’ll accept that they have got a quote from Webuyanycar.com and we’ll even go through the same quote process with them, but with our help, we can point out what they may have missed.

“We find they’re much more accepting of that because it shows where we are coming from and how we come to the price we are offering. They start devaluing it themselves.”

The group is looking to maximise the amount of new or used car deals it is doing, so has a break-even policy at auction.

The aim for Soper BMW is to get part-ex vehicles off site within 48 hours, with the details of the car fed through to the dealer’s auction partner as soon as it is appraised. An auction collection once a week generally means cash is back in the business in under a week.

Storey tends to put vehicles up for sale for a four-day period, with vehicles generating the most interest over the Friday to Monday weekend period. He uses CAP as a guide for the value and usually sets the reserve at 10% below in order to drive interest.

Stephen James BMW also switched to a digital process last summer. Jon Taylor, general sales manager at its Blackheath site, said one of the benefits was it links the appraisal process across all four Stephen James sites.

If someone has gone in for a quote in the group’s Bromley branch and walks away from a deal, but then visits another branch in the group to try someone else, every dealer in the group will know the part-ex has already been appraised and what price has been offered.

Taylor said: “It means we can be much more consistent. Making that process digital also means we’ve got a much better paper trail.”

Login to comment

Comments

No comments have been made yet.