By Debbie Kirlew

The masters of upselling are surely the fast-food chains. But while the rest of retail is now well and truly on the upsell bandwagon, it is Amazon, which analyses individual digital footprints to create a tailor-made shopping experience, which we look to as the data process and utilisation leaders.

Arguably, its ability to analyse and act on its data since the early days of online shopping has been the key to its success. If emulating Amazon feels like a step too far, dealers do have one distinct advantage compared to many other retailers: the data they collate on customers, prospects and vehicles is massive. The trick, though, lays in its extraction, analysis and application.

In reality, dealers need to apply the lessons from companies like Amazon and McDonald’s. The ‘do you want fries with that?’ upsell easily translates online with some dealers undertaking it exceptionally well. By comparison, though, making suggestions based on an individual’s search and browsing history or product and service purchases and imitating Amazon’s ‘customers who bought this item also bought’ and ‘frequently bought together’ has yet to be fully exploited in automotive retail.

In the long term, as manufacturers and dealers become accustomed to properly mining all the customer data at their fingertips, this must come. Audi is already looking at how it can analyse data to identify any particular customer group’s propensity to buy certain items so these can be presented as a priority.

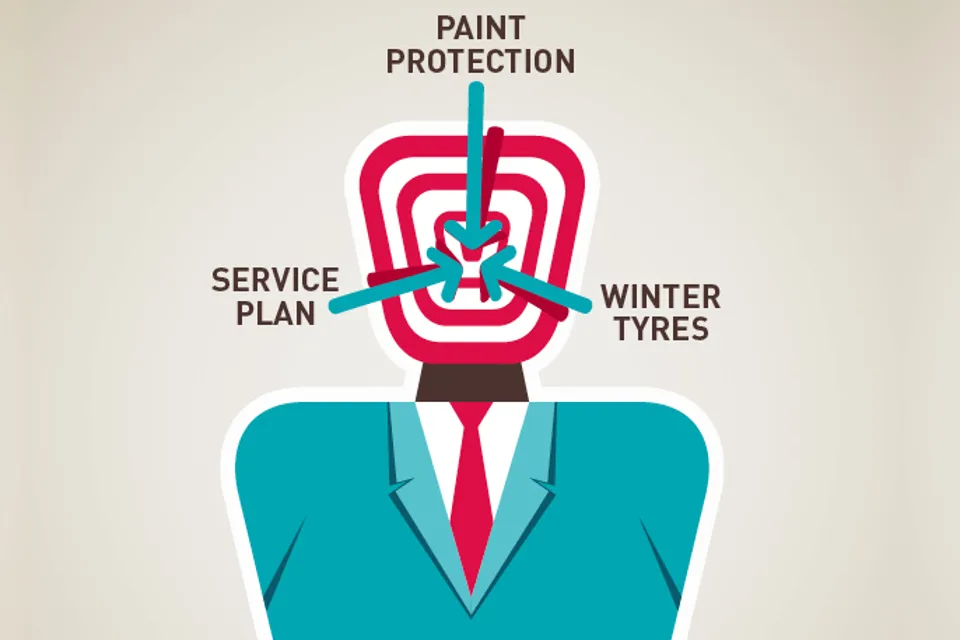

The fact is upselling comes in many shapes and sizes and dealers need to be accessing as many levels as possible to maximise sales. From cookies on websites, personalised search, purchase suggestions, ‘bundle’ offers (‘would you like the meal deal, sir?’) and implementing highly-targeted marketing campaigns, dealers need to be doing it all.

Building intelligence out of information with integrated data

Nick Gill, Capgemini’s senior vice-president and chairman of its automotive council, said: “There’s a lot of data which is difficult to extract and to understand, but it’s worth a lot of money. The problem can be lots of information but very little intelligence.”

Predicting the need to employ a ‘data scientist’ in the future, Gill’s advice is to utilise the skills of a data analysis partner to cut through the vast swathes of information and devise campaigns accordingly. He suggests experimenting in cycles to test a thesis, for example, drivers who change their oil regularly may be more likely to switch to winter tyres, then record the outcome.

Login to comment

Comments

No comments have been made yet.