Peugeot’s 208 hatchback ended the Volkswagen Golf’s 15-year reign as Europe’s best-selling car as the region’s troubled automotive sector suffered a third consecutive year of declining sales in 2022.

Registrations declined by 4.1% to 11,309,310 units across the 30 markets analysed by Jato Dynamics, leaving it 5.6% down (674,000 units) on COVID-19 impacted 2020 and 29% down (4.53m units) on pre-pandemic 2019.

Europe’s overall decline outstripped the 2.1% dip seen in the UK as vehicle shortages, soaring inflation and the energy crisis proved to be “major challenges for the already troubled market”, said Felipe Munoz, global analyst at JATO Dynamics.

He added: “The fallout of the pandemic, followed by the semi-conductor shortage throughout 2021 and 2022, was only compounded by Russia’s invasion of Ukraine and subsequent energy price increases, impacting consumer confidence and spending.”

He added: “The fallout of the pandemic, followed by the semi-conductor shortage throughout 2021 and 2022, was only compounded by Russia’s invasion of Ukraine and subsequent energy price increases, impacting consumer confidence and spending.”

Launched in 2019, the Peugeot 208 became Europe’s best-selling car for 2022 with 208,816 registrations to ensure the Stellantis-owned French car brand led the standings for the first time since the 207 achieved the same feat in 2007.

The 208’s result ended 15 years at the top for the Volkswagen Golf, which finished fifth in the rankings, behind the Dacia Sandero in second (200,550 units), VW T-Roc (181,153) and Fiat 500 (179,863).

Jato highlighted Volkswagen’s manufacturing issues and the growth in popularity of its SUV models – including the T-Roc T-Cross and Taigo – for the Golf’s decline.

The strength of the overall Volkswagen model range ensured that it remained Europe’s best selling car brand, with 1.2 billion sales – a 6% decline on 2021.

It was followed by: Toyota, down 8% at 766,227; Mercedes-Benz, down 1% at 647,880; BMW, down 5% at 646,526; and Peugeot, which suffered a 15% decline to 623,825.

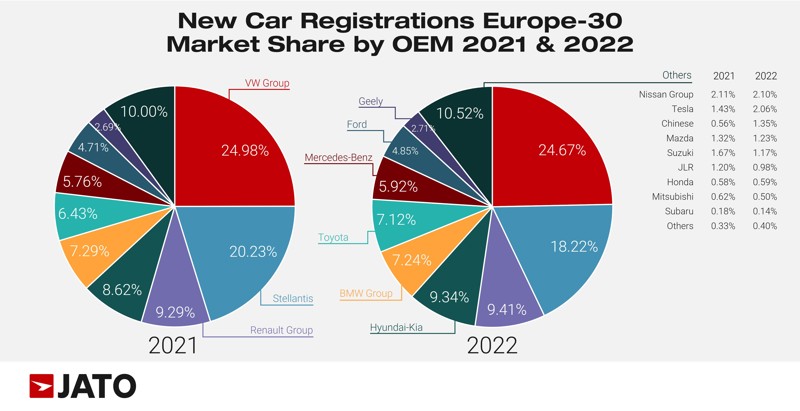

Registrations decline at Stellantis saw it suffer the greatest market share decline of the major manufacturers, with a reduction to 18.22% in 2022 from 20.23% in 2021.

Combined, Hyundai-Kia registrations increased 3.8% to 1.05m units.

Elsewhere, Jato highlighted China’s growing influence in the Europe automotive sector and the rising volumes of Elon Musk’s Tesla brand, which renewed its push for volume with a raft of January price cuts.

Tesla’s market share soared from 1.43% in 2021 to 2.06% in 2022, outselling Seat, Mini, and Suzuki, while trailing Nissan by 4,300 units, as Chinese brands outsold established manufacturers including Mazda, Suzuki, and Jaguar Land Rover (JLR).

Jato said that a large proportion of sales could be attributed to SAIC-owned MG, which saw a volume increase of 116% to almost 114,000 units, outselling the likes of Jeep and Honda.

Jato said that a large proportion of sales could be attributed to SAIC-owned MG, which saw a volume increase of 116% to almost 114,000 units, outselling the likes of Jeep and Honda.

DR Automobiles, an Italian company that sells rebadged vehicles manufactured by Chinese brand Chery in Spain and Italy, outsold Smart and Subaru with an increase in registrations of 197% to almost 25,000 units.

Emerging brands BYD, Hongqi, Maxus, NIO, DFSK, and Aiways, all registered over 1,000 units.

Munoz, said: “A competitive product offering and reasonable sales targets are allowing Chinese brands to make inroads into the European car market. The next step is to build awareness and encourage the shift away from the negative sentiment that has historically dissuaded some consumers from buying Chinese products.”

Login to comment

Comments

No comments have been made yet.