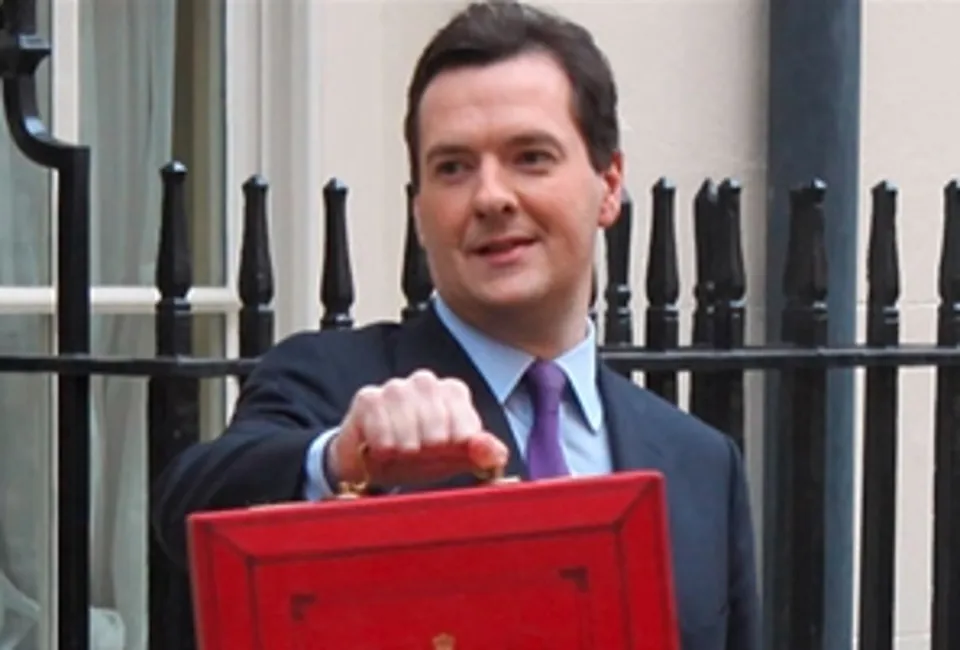

Motorists had little joy in today's 2014 Budget announcement by Chancellor George Osborne, with VED charges due to rise next month.

The Budget confirmed that fuel duty will not rise in September but on April 1 VED for cars, motorcycles and most vans will increase by the RPI measure of inflation.

So there were no great giveaways, but there was good news in terms of economic growth.

The Office of Budget Responsibility (OBR) revised its growth forecast up again, saying the economy will grow 2.7% in 2014, 2.3% next year, 2.6% in 2016 and 2017 and returns to long-term trend of 2.5% thereafter.

To increase consumers' disposable income, the personal allowance threshold above which workers start paying income tax will rise to £10,500.

Businesses' annual investment allowance will be doubled to £500,000, and Osborne announced a £7bn package to cut energy costs for businesses.

For dealers' corporate sales teams, Budget 2014 gave further clarity on company car tax by clarifying the rates for 2017-18 and 2018-19, but there was no scrapping of the 5% BIK tax rate for EVs being introduced in 2015/16.

The appropriate percentage of list price subject to tax will increase by 2 percentage points for cars emitting more than 75g/km, to a maximum of 37%, in both 2017-18 and 2018-19.

In 2017-18, there will be a 4 percentage point differential between the 0-50 and 51-75g/km bands and between the 51-75 and 76-94g/km bands.

In 2018-19 this differential will reduce to 3 percentage points. The differential will reduce further to 2 percentage points in 2019-20 in line with the Budget 2013 announcement.

The Government says in the Finance Bill that it remains committed to reviewing incentives for ultra-low emission vehicles in light of market developments at Budget 2016, to inform decisions on company car tax from 2020-21 onwards. Legislation will be in Finance Bill 2015.

Login to comment

Comments

No comments have been made yet.