The motor industry has called for the UK Government to take action to safeguard UK automotive interests and maintain economic stability.

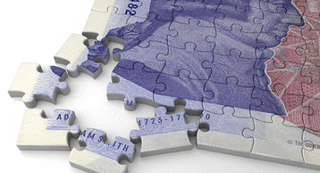

It comes following the vote by 52% of participants in yesterday's referendum for the UK to leave the European Union.

At the Society of Motor Manufacturers and Traders (SMMT), chief executive Mike Hawes said the British public has chosen a new future out of Europe.

“Government must now maintain economic stability and secure a deal with the EU which safeguards UK automotive interests.

“This includes securing tariff-free access to European and other global markets, ensuring we can recruit talent from the EU and the rest of the world and making the UK the most competitive place in Europe for automotive investment,” he added.

At the National Franchised Dealers Association, director Sue Robinson said: “Following the result of the vote the NFDA will work with our members and their manufacturer partners to help determine the correct next steps.

“The UK is the second largest car market in Europe, with £35.3 billion worth of cars imported to the UK from Europe of which over 820,000 are from Germany alone, 20% of their production.

“We urge the UK government to swiftly negotiate a trade deal across Europe and the rest of the world and to secure currency stability, such that there is a level playing field for our members to operate in. Clearly it is as important to European importers as it is to the UK market that a deal is put in place very quickly.”

David Kendrick, head of national automotive at UHY Hacker Young, said he hopes the "severe battering" to the stock market and pound this morning is a slight overreaction and there is a recovery ahead.

Kendrick added: "There will definitely be a period of uncertainty for a short while, although business must go on and in the long term it may turn out to be the right decision.

"If the pound remains at a lower level, there is potential for UK automotive businesses to become more attractive to international buyers, assuming they have confidence in the UK’s longer-term economy.”

The Financial Conduct Authority has warned F&I providers and dealers that they must continue to abide by their existing regulatory obligations.

Much financial regulation currently applicable in the UK derives from EU legislation. This regulation will remain applicable until any changes are made, which will be a matter for Government and Parliament, said the FCA.

“Firms must continue to abide by their obligations under UK law, including those derived from EU law and continue with implementation plans for legislation that is still to come into effect.

“Consumers’ rights and protections, including any derived from EU legislation, are unaffected by the result of the referendum and will remain unchanged unless and until the Government changes the applicable legislation.

“The longer term impacts of the decision to leave the EU on the overall regulatory framework for the UK will depend, in part, on the relationship that the UK seeks with the EU in the future. We will work closely with the Government as it confirms the arrangements for the UK’s future relationship with the EU,” said the FCA.

Login to comment

Comments

No comments have been made yet.