The Financial Conduct Authority has analysed loan data from 20 motor finance providers, plus its own mystery shop exercise and a survey of lenders that examined how they assess affordability and exercise control over credit brokers including car dealers.

Its immediate concern, highlighted by its review of motor finance which it published today, is commission models which link the broker commission to the customer interest rate and allow the brokers wide discretion to set the interest rate.

It suspects these could be costing consumers £300m more annually when compared against a baseline of flat fee models.

“We estimate that on a typical motor finance agreement of £10,000, higher broker commission under the Reducing DiC (difference in charges) model can result in the customer paying around £1,100 more in interest charges over the four-year term of the agreement,” said the FCA.

It found that there is typically little link between a customer’s interest rate under DiC and their credit score, because the rate is instead being determined by a broker’s ability to earn commission.

It said it is not clear why brokers should have such wide discretion, not whether lenders are doing enough to monitor and reduce the risk of harm.

“Change is needed across the market, to address the potential harm we have identified,” said the FCA.

The onus is on a lender to show that any differences in commission rates are justified, based on the work involved for the broker.

The FCA’s mystery shops have raised concerns that consumers are not getting enough information early on when buying a car on motor finance.

“We are not satisfied that firms are complying with regulatory requirements,” said the FCA. Its study has found consumers are not always able to make an informed decision in good time before entering into a motor finance agreement.

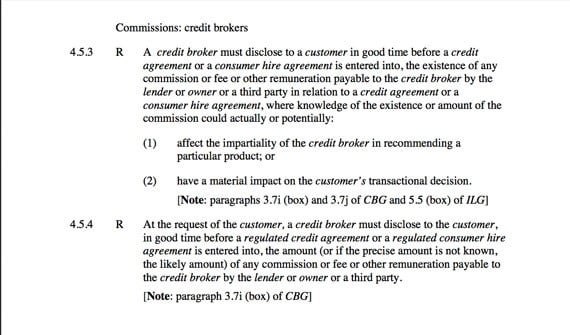

And it said it has significant concerns in relation to brokers’ disclosure of commission, especially in regard to DiC and similar commission models where the broker has discretion to adjust the interest rate.

“There are existing requirements in our Consumer Credit sourcebook (CONC) on disclosure of brokers’ status and remuneration, but we did not see clear evidence of compliance with these,” said the FCA.

The FCA warned motor finance houses that while their contracts with brokers stipulate compliance with CONC, including commission disclosure, its work has found lenders’ monitoring of this may be insufficient and it has “doubts as to whether and to what extent these are always implemented in practice”.

Lax practices drew particular criticism. “We were particularly concerned that some lenders appear to take the view that it is sufficient that a broker is FCA-authorised as it can be assumed they will be compliant with FCA rules,” added the report.

The mystery shopping was conducted at 122 motor retailers, comprising 37 franchised dealers, 60 independent retailers, 14 car supermarkets and 11 online brokers.

“Credit broking often forms a major profit centre for motor retailers, reflecting that significant sums can be generated from the sale of finance. For many consumers, a car is a very significant purchase. So, it is important that consumers are provided with timely information that is appropriate to their needs,” said the FCA.

Login to comment

Comments

No comments have been made yet.