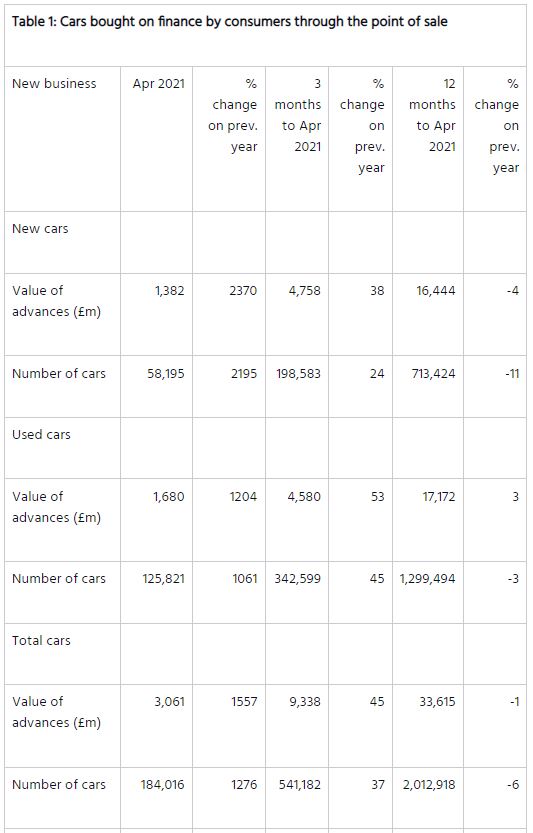

The Finance and Leasing Association (FLA) has said that the consumer car finance market is expected to grow by 19% in 2021 and 22% in 22% following resurgent April trading.

Car retailers across the UK helped the sector to a 1,276% increase in new business volumes in April, a year on from the UK’s lockdown under stringent COVID-19 coronavirus mitigation measures.

Data published by the FLA this morning (June 7) showed that new business volumes ended the first four months of the year 13% higher than in the same period in 2020.

Geraldine Kilkelly, the FLA’s director of research and chief economist, said: “The consumer car finance market received a boost in April as showrooms re-opened, with the significant growth rate also reflecting the all-time low level of new business recorded in April 2020 at the start of the first lockdown.

“Pent-up demand and an improvement in consumer confidence are expected to contribute to a strong recovery during the second half of 2021, with our latest research suggesting that consumer car finance new business by value will grow by 19% in 2021 as a whole, and by a further 13% in 2022.”

The consumer new car finance market reported new business volumes up by 2,195% in April (to 58,195) compared with the same month in 2020, while the value of new business grew by 2,370% to £1.38bn.

The consumer new car finance market reported new business volumes up by 2,195% in April (to 58,195) compared with the same month in 2020, while the value of new business grew by 2,370% to £1.38bn.

In the first four months of 2021, new business volumes in this market were 8% higher than in the same period in 2020.

The consumer used car finance market reported new business volumes up by 1,061% in April (to 184,016) compared with the same month in 2020, while the value of new business grew by 1204% (to £3.06bn).

In the first four months of 2021, new business volumes in this market were 17% higher than in the same period in 2020, the FLA said.

Login to comment

Comments

No comments have been made yet.