Global parts shortages and rocketing labour rates drove up average car warranty claims by 13.5% last year to £459, according to Warranty Solutions Group (WSG).

Labour charges increased by an average of 12% between 2022 and 2023, predominantly due to the rise in utility prices and motor trade insurance premiums. The national shortage of qualified vehicle technicians also continued to remain strong, which has forced many garages to increase salaries to attract the right talent.

Additionally, parts prices rose on average by 8% during 2023. The main factors for this were the conflict in Ukraine reducing availability coupled with the additional duties on parts imported from Europe post-Brexit. The latter has also resulted in a subsequent rise in driver salaries across the supply chain to combat driver shortages.

The parts in shortest supply last year across all manufacturers were NOx sensors and engine control units. Both components had average waiting times of 3-4 months as a result of the global shortage of semiconductor chips. Although supply has greatly improved, demand is still exceeding the availability of supplies for certain types of chips.

Parts for Jaguar Land Rover, Mercedes-Benz and the premium brand models in the Volkwagen Group portfolio were the most difficult to source due to the lack of aftermarket components and suppliers available in the UK.

The most complicated parts to repair or replace during 2023 were engine and gearbox control units (ECUs), along with various control modules. The average engine ECU claim reduced by 5.32% since 2022 to £658.24 due to greater availability of these parts.

However, gearbox ECU claims rose by 7.93% to an average of £1,387.68 which was linked to the increase in these complex components being installed in automatic transmissions.

Control modules had the biggest fluctuation out of all three components, dropping by 24.30% on average to £473.13. This was due to rapidly growing demand because of vehicles becoming increasingly advanced and manufacturers adding extra control units to engine management systems.

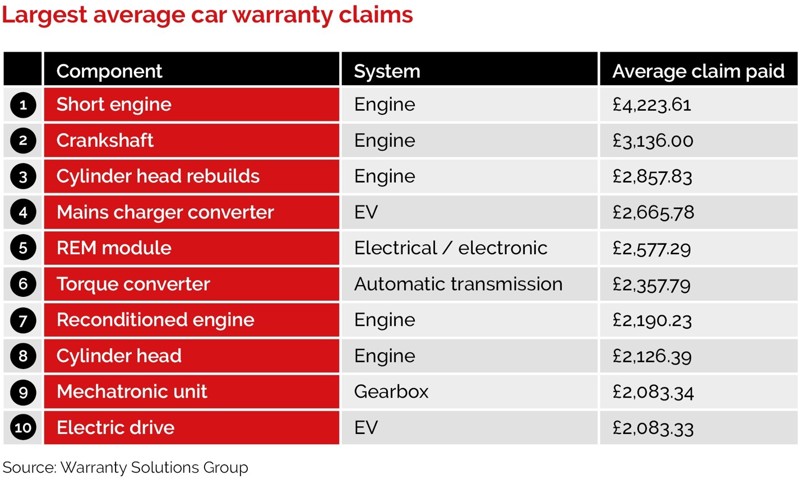

Largest average car warranty claims by specific component

The table below shows the ten most expensive vehicle components to repair or replace on average, based on WSG’s claims data for these parts during 2023.

Short engines were the components with the highest average claim values, due to the limited availability of certain internal engine components and the subsequent part price hikes.

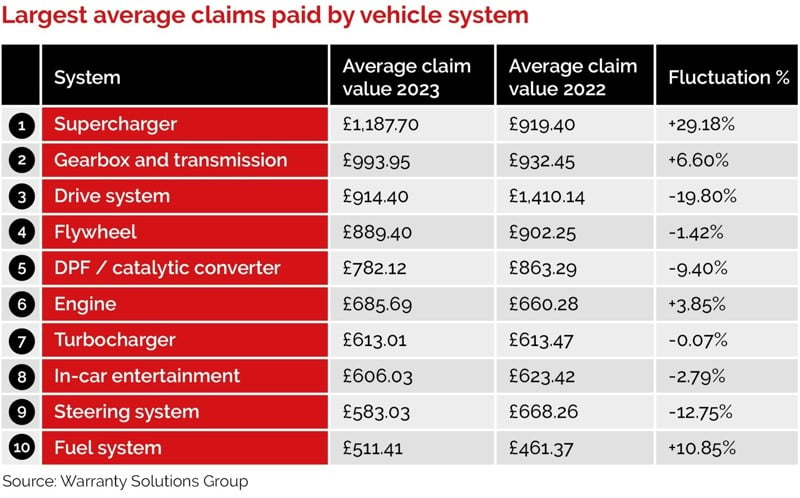

Largest average car warranty claims by vehicle system

Largest average car warranty claims by vehicle system

The table below shows the 10 largest average claims paid by vehicle system during 2023, and the fluctuations in average claim values since 2022.

Supercharger systems had the highest claim cost on average. They also saw the highest fluctuation increase, which was largely due to the increasing cost of remanufactured parts.

Supercharger systems had the highest claim cost on average. They also saw the highest fluctuation increase, which was largely due to the increasing cost of remanufactured parts.

The parts shortage combined with the shift towards a more environmentally friendly world has resulted in many aftermarket parts suppliers and garages turning their attentions to recycled and reconditioned components.

This is particularly prevalent with reconditioned drive systems and steering systems. As a result, availability of these systems has improved significantly over the past 12 months, which has reduced their average claim values by 19.80% and 12.75% respectively.

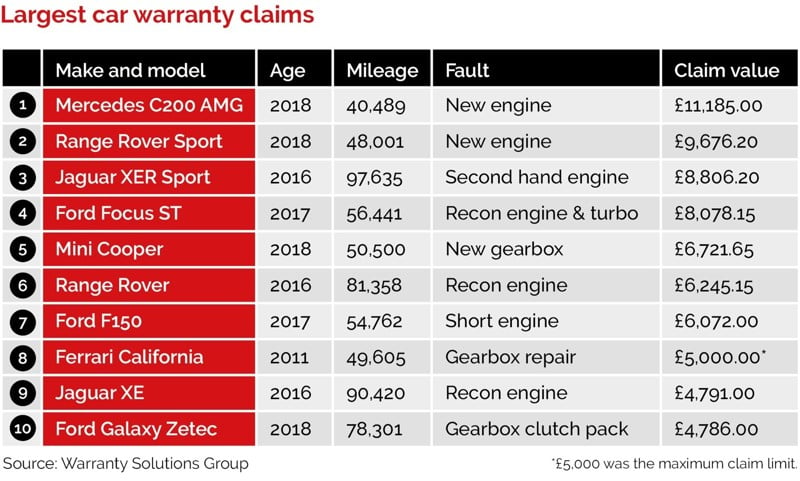

Ten largest claims paid by WSG in 2023

The table below shows the ten largest claims paid by WSG last year.

Neil Monks, WSG’s group commercial director commented: “Many dealers are now using premium warranties as selling tools to help convert more enquiries into sales and reduce the risk of customer complaints post-handover.

Neil Monks, WSG’s group commercial director commented: “Many dealers are now using premium warranties as selling tools to help convert more enquiries into sales and reduce the risk of customer complaints post-handover.

“This is reinforced by WSG’s sales data which shows that our top two car warranty plans made up over 80% of all warranties issued via our dealer network last year. Naturally with more parts covered, this has increased the number of large claims over £2,000.”

Certain manufacturers have also replaced individual components with sealed units which can only be replaced as whole units, subsequently driving up repair costs. Two examples of this are engines across Ford’s compact car range, and differentials on BMW and Range Rover models.

The average car now contains some 6,000 mechanical, electrical and electronic parts. For dealers offering Dealer Fund admin schemes, this presents an enormous risk as one large claim can quickly evaporate any profit made on the vehicle.

Monks added: “Using a reputable third party warranty provider instead transfers the risk, significantly reducing the chance of potential large warranty claims consuming dealer profits and impacting cashflow.

“Third party warranties also reduce the chance of customers rejecting a vehicle if faults develop as providers can take an independent and impartial approach, with the ability to mediate if applicable.”

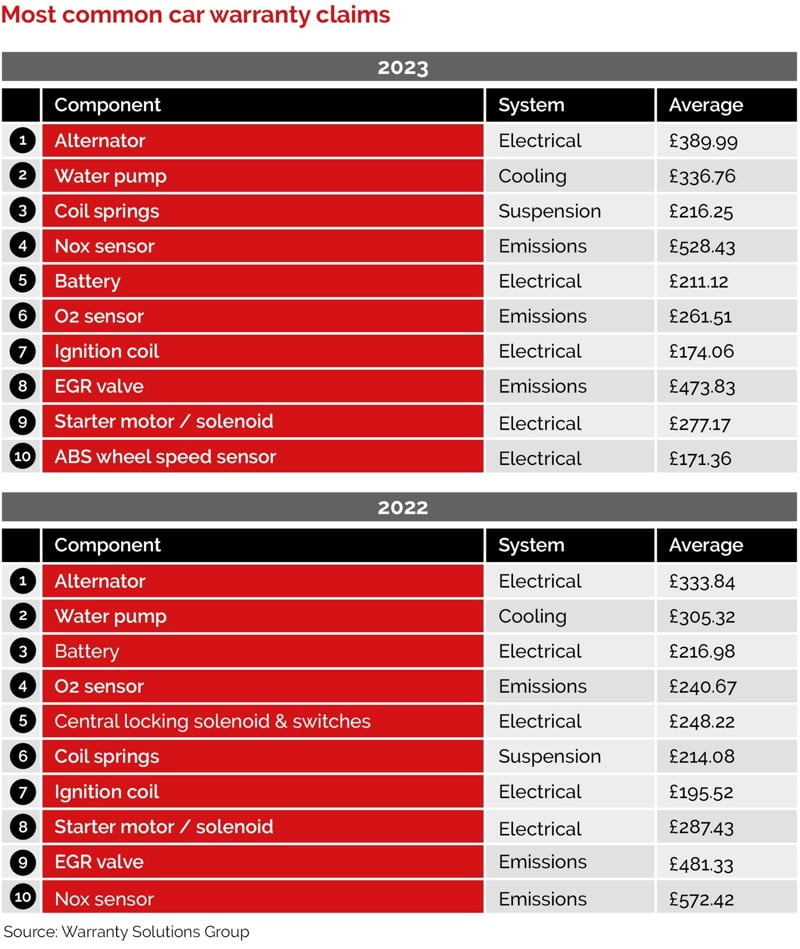

The most common car warranty claims 2023

The tables below show the ten most common warranty claims by specific components paid by WSG last year compared to 2022, along with the average claim values for each period.

The most common faults on cars aged 5-7 years old specifically were NOx sensors, alternators, water pumps and suspension failures (mainly coil springs or shock absorbers).

The most common faults on cars aged 5-7 years old specifically were NOx sensors, alternators, water pumps and suspension failures (mainly coil springs or shock absorbers).

Clutches, flywheels, driveshafts and wheel bearings were the most common faults reported on cars aged 7-12 years old.

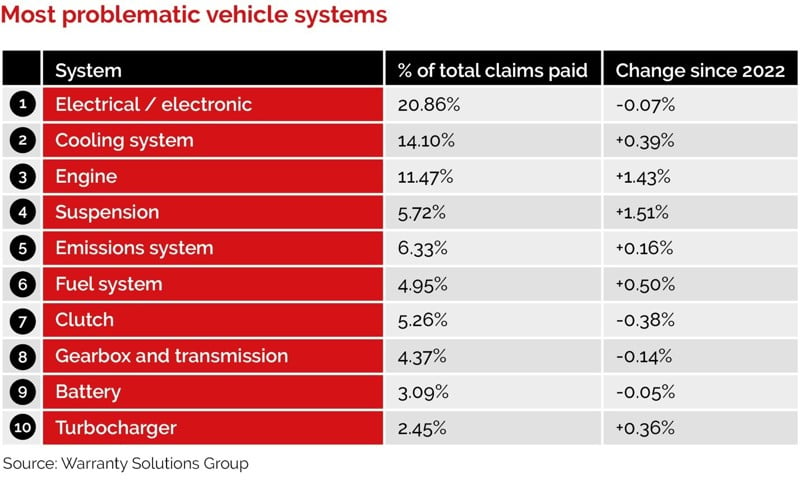

The most common claims by vehicle system 2023

The table below shows the ten most common vehicle systems that WSG received claims on, along with the percentage of claims that each system made up out of the total claims paid.

Electrical and electronic systems were the most problematic, making up 20.86% of all car warranty claims paid by WSG last year due to the increasing complexities within these systems.

Electrical and electronic systems were the most problematic, making up 20.86% of all car warranty claims paid by WSG last year due to the increasing complexities within these systems.

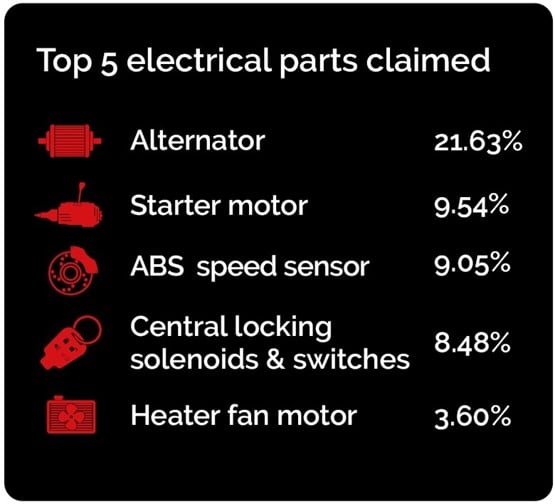

Alternators made up 21.63% of the total electrical / electronic claims. This was primarily due to stop-start technology increasing the workload of the alternator, in turn reducing the life span.

The cost-of-living crisis is also causing drivers to cut back on essential maintenance to save money, which is causing added strain to the electrical systems and leading to more expensive repair bills.

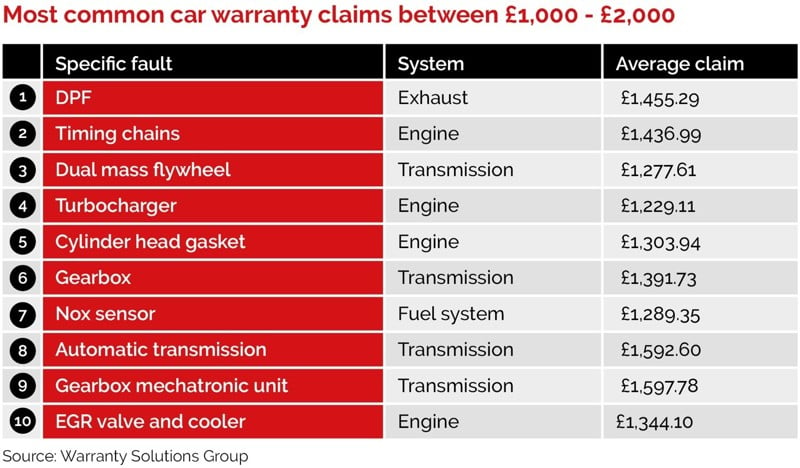

Claims between £1,000 - £2,000

The table below shows the average claim costs for the top 10 mid-sized repairs (between £1,000 and £2,000).

2023 saw a 169% increase in the number of mid-sized claims compared to 2022. Whilst this figure was influenced somewhat by the growth in WSG’s sales data, the two main factors were the increasing cost of repairs generally and the cost-of-living crisis, which has driven consumer expectations regarding warranty coverage to an all-time high.

Diesel Particulate Filters (DPFs) were the most common failures in the midsized claims range with an average repair cost of £1,455.29. This can be attributed to motorists delaying maintenance and covering smaller mileages than before save fuel, both of which are factors that contribute to the reduction of DPF lifespans.

Diesel Particulate Filters (DPFs) were the most common failures in the midsized claims range with an average repair cost of £1,455.29. This can be attributed to motorists delaying maintenance and covering smaller mileages than before save fuel, both of which are factors that contribute to the reduction of DPF lifespans.

Claims between £100 - £300

Additionally, there was a 4.46% increase in the number of smaller claims (between £100-£300), predominantly due to many drivers no longer having the spare cash for repairs and needing to have their vehicle repaired under warranty instead.

This data is backed up by The Motor Ombudsman’s latest survey, which revealed that 53% of garages had experienced customers avoiding bringing their car in for repairs to reduce the level of spend on their vehicles.

An article released by the Ministry of Justice also highlighted that the number of convictions issued to motorists driving with defective parts during 2022 grew to an all-time high, rising 18% since 2021.

Login to comment

Comments

No comments have been made yet.