Premium used cars have been hailed as “pandemic proof” by online vehicle stocking source Motorway after the value of Land Rovers, Lexus and Maseratis rose by over 8% year-on-year.

Data nalysed by the digital service provider, which has celebrated record results in connecting private car sellers with dealers across the UK since lockdown, has revealed that the prestige end of the used car market had shown “remarkable resilience” during lockdown and since restrictions were eased.

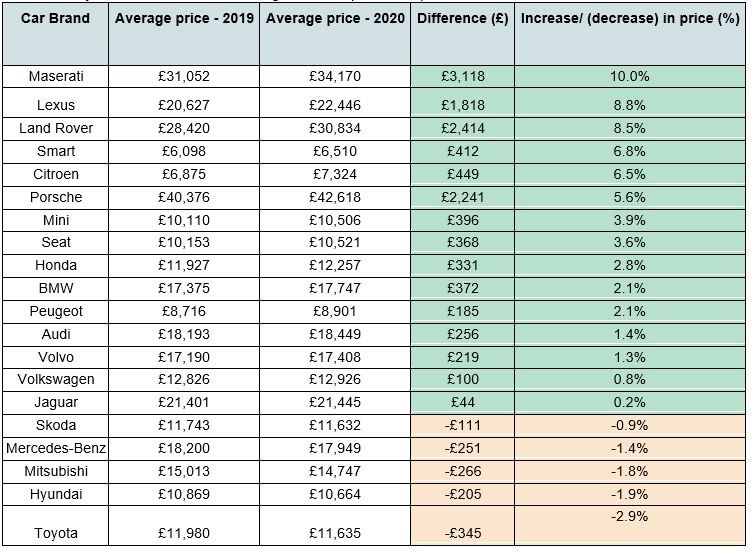

Motorway said that the average price of a used Maserati in June 2020 was £34,170, compared to £31,052 in the corresponding month in 2019 – an increase of £3,118 or 10%.

In the same month, the average price of a second-hand Land Rover was £30,834, up more than £2,000 or 8.5% compared to 12 months ago (£28,420).

The average value of a Lexus was £22,446 compared to £20,627 the previous year, an 8.8% uplift.

Alex Buttle, director of Motorway.co.uk, said: “The prestige end of the used car market has shown remarkable resilience during lockdown and since restrictions were eased, any expected drop off in values just hasn’t materialised.

“This has led to higher-than-expected offers for sellers with quality used vehicles on our website.

“Demand from dealers has been high for top-end brands with car owners attracted to the second-hand market where two to three-year old cars can be picked up at affordable prices.

“For example, Land Rover drivers looking to upgrade their cars, can find three-year-old, fifth generation Discoveries, for just over £30k as opposed to paying upwards of £60k new.”

Other prestige brands such as Audi and BMW have also come out of lockdown unscathed, with average prices slightly higher in 2020 vs 2019. Mercedes-Benz is the only top-end brand which has seen average values drop-off slightly, down 1.4% compared to 12 months ago.

Buttle said that Motorway had seen more luxury car buyers turning to the used car market.

He believes that people still want a nice car, but with the short to medium term economic outlook remaining uncertain, many are reluctant to commit to buying expensive new cars on finance.

“There is a real appetite for quality used cars, and this is born out in our data. This increased demand is squeezing supply levels, particularly on the budget and premium end, but also at the mid-range too. It’s all combining to create upward pressure on prices across the board.

“This trend has continued into July and August, and will likely remain into the rest of the year as people return to work after the summer holidays.”

The chart below shows how average used car prices compare in 2020 vs 2019 for 20 major car brands, according to Motorway’s data:

Login to comment

Comments

No comments have been made yet.