With the new car market experiencing more than its fair share of challenges over the past 12 months, used car sales have taken on more importance than ever. Franchised dealers, on average, now sell 1.5 used cars for every new car, but how do they maximise their return on those sales?

Mike Jones, the chairman of ASE Global, said: “A couple of the businesses that we’ve been working with have trebled their used car profit this year, compared to last year. The used car market at the moment remains very strong. Done right, it can be phenomenally lucrative.”

Jones said stocking policy is at the core of profitability: “Because there’s such great visibility across the country on available cars, using the big internet platforms and then the manufacturer used car platforms, and that sort of stuff, everybody can see the car. Getting the right car at the right price is the skill.”

Cambria Automobiles CEO Mark Lavery agreed: “Don’t go taking a punt. We’ve all got access to the data streams: we can see what guest demand is. We can see by territory. We can see what they’ve searched, we can see how long they’ve been on the website, we can see what they’ve looked at on the website and we can consider alternatives as well.

“It’s just harnessing technology and data to make sure that bought right, it’ll be sold right. We sell one-and-a-half used cars for every new car we sell. If you’ve got a strong used car operation, inevitably you’ll have a strong new car operation.”

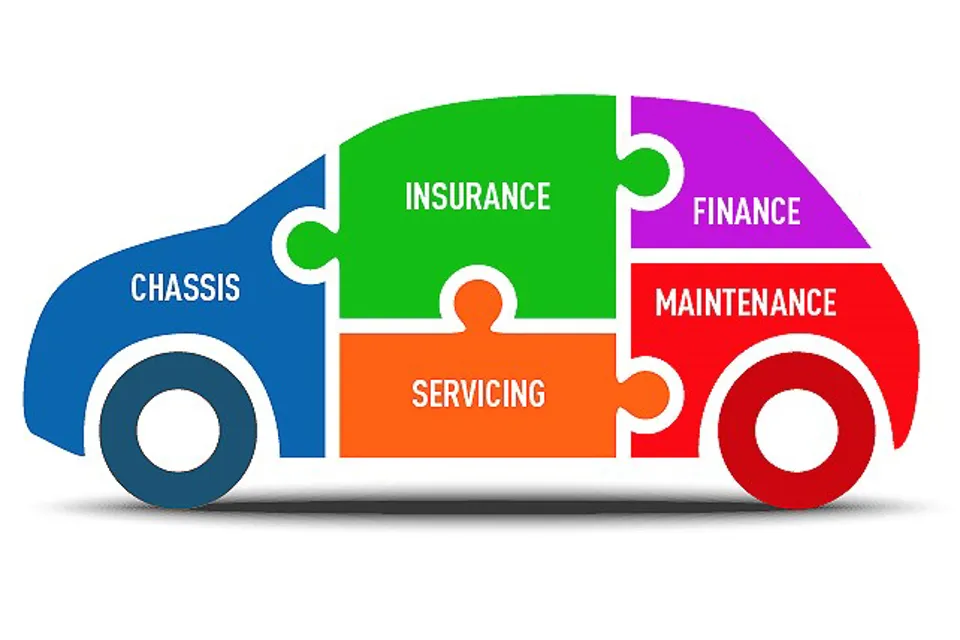

The car itself is just the start, said Lavery, with about half the profit coming from the chassis and the rest coming from a mix of finance and other add-ons.

“Now in that other half, 57% is the finance itself and 43% is other related ancillaries – tyre and alloy wheel insurance, cosmetic insurance, warranty, etc. Just over 51% of the people who purchase a used car from us, purchase it on some form of finance instrument.”

Lavery said Cambria prices its cars just below the market price, because the long-term relationship is more valuable than the short-term profit.

He added: “We work on a basis that the car should be priced just below the market price. We’ve got multiple data sources that produce that: we’ve got our own internal algorithms that do that for us, along with BCA Auction Pro, which tells you what you can dispose of it at, and Auto Trader. If you combine that data with our own, plus our own algorithms based on demand in our own geographical territories, we find that means if we can sell a car, we don’t have to take a huge margin out of it.

“But if we can retain the car and a guest for life, that means we get lots of retention, and lots of repeat business.

“We sell them the warranty. On top of the warranty, they buy a service plan, which leads to coming into us every year.”

When customers come in every year, Cambria conducts an account review.

“When we have an account review, we get an opportunity to change the car. Basically, if it’s on finance they’ll renew on finance. So it’s just making sure when we get the opportunity and the touchpoint, it’s all driven primarily by price. Little and often is our underlying strategy, and a car and guest for life,” said Lavery.

Jones agreed: “Building finance into it, building from an aftersales point of view, I want to keep all those customers, or keep hold of those vehicles all the way through that customer’s ownership journey. I want to tie the customer into service plans, so looking at promoting service plan sales at the right price for the customer, so it makes sense for both the customer and the dealership, but it helps me build my aftersales.

“Whenever I’m looking at used vehicle profitability, I always look at it as the gross profit, including the finance and add-on sales. As long as that level is okay, then to a certain extent how a dealer chooses to split it within the business is entirely up to them.”

Craig Thomas

Steve Ure - 19/06/2019 18:29

Great article! It underlines all the reasons eDynamix has built all the solutions mentioned as a single sign-on platform...