September recorded the UK’s lowest new car finance volumes since 2010 as supply issues continued to disrupt the automotive sector, the Finance and Leasing Association (FLA) has reported.

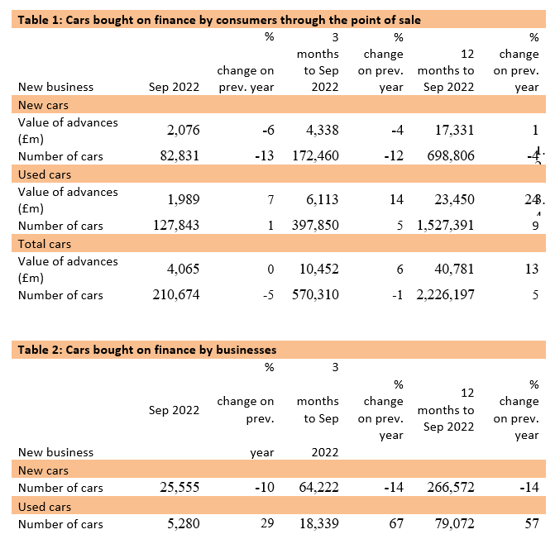

The overall volume of new business across new and used cars fell by 5%, to 570,310, during what is traditionally a key month for the retail sector but remained flat from a value perspective, at £4.07 billion.

The result left new business volumes 4% up year-to-date.

In the new car sector consumer car finance delivered a 6% decline in the value of new business, to £2.08bn, as volumes dipped 13% by volume to 82,831 despite a 4.6% uplift in registrations during the key numberplate change month.

Geraldine Kilkelly, director of research and chief economist at the FLA, said: “The latest figures show that disruption to the supply of new cars continued to weigh on the consumer new car finance market which reported its lowest September new business volumes since 2010.

Geraldine Kilkelly, director of research and chief economist at the FLA, said: “The latest figures show that disruption to the supply of new cars continued to weigh on the consumer new car finance market which reported its lowest September new business volumes since 2010.

“The consumer used car finance market saw further new business growth, but at a slower rate than in recent months.”

The consumer used car finance market reported new business up 7% by value, to £1.99bn, and 1% by volume, to 127,843, in September compared with the same month in 2021.

This left new business volumes in this market up 10% year-to-date.

Last week the Society of Motor Manufacturers and Traders (SMMT) reported that the volume of sales transactions dipped 12.2% to leave the sector down 9.7% year-to-date at 5,319,482 transactions.

Kilkelly said: “Consumer confidence about the outlook for their personal financial situations has weakened as the impact of higher inflation and interest rates have squeezed real household incomes.

“The FLA’s Q4 2022 Industry Outlook Survey showed mixed expectations for growth over the next year among motor finance providers, with 24% expecting some increase in new business, 28% anticipating new business to remain stable, and 48% expecting some decrease.

“As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”

Login to comment

Comments

No comments have been made yet.