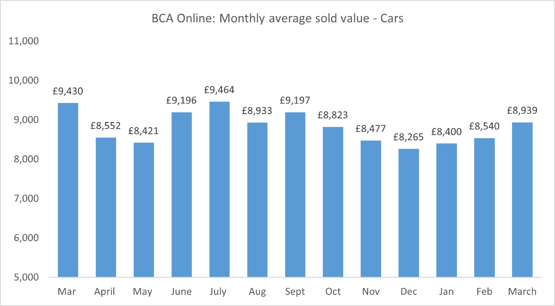

Used cars ended Q1 with a third successive month of rising values at BCA auctions after what chief operating officer Stuart Pearson described as a “very encouraging start to 2023”.

Car values rose 4.7% (£399) to average £8,939 across BCA’s remarketing operations in March despite an increase in sale volumes, as a sector trading against the backdrop of a cost-of-living crisis “surprised some commentators”, according to Pearson.

And his observations came as car retailers told Startline Motor Finance’s monthly Used Car Tracker survey that more than a third (35%) that this year was turning out better than they expected.

Pearson said: “There’s definitely been a feeling of seasonality for the used car sector since Christmas which has helped to deliver a very positive first quarter performance with rising demand and improving values.

Pearson said: “There’s definitely been a feeling of seasonality for the used car sector since Christmas which has helped to deliver a very positive first quarter performance with rising demand and improving values.

“Given the economic background and continuing pressures on household budgets, it has been a very encouraging start to 2023 across the used car market and one that has, perhaps, surprised some commentators.”

He added: “The Easter trading period, while often a watershed moment for used car values, has seen trading remain very positive. While the coming weeks will likely deliver some value erosion to the overall market, we are many months from seeing normalised supply levels.

“Our expectation is that used car values will remain robust for some time to come and we’ll continue to work very closely with our customers as the market develops.”

Despite its positive assessment of the used car sector, BCA said Q1 had remained volatile for electric vehicle (EV) pricing.

However, it added that many models had “levelled out” towards the end of the period and demand has improved, in spite of increased supply.

Cap HPI director of valuations Derren Martin alluded to this model-by model variance in his mid-month catch-up with AM earlier this week, in which he revealed that the price declines among many of the market’s more premium EVs had started to slow.

EVs will be one area that retailers are eyeing closely as they seek to grow their inventories to maintain profitability in 2023.

While Startline’s latest survey indicated a positive start to the year, with 15% maintaining profitability and stating that 12% that stock availability was improving, 32% said staying profitable was proving difficult with 62% adding that stock supply remains a problem.

Startline Motor Finance chief executive Paul Burgess said: “It’s probably a measure of how low expectations have been across both the used car sector and the wider economy that a significant minority of dealers are saying that this year has, so far, been something of pleasant surprise.

Startline Motor Finance chief executive Paul Burgess said: “It’s probably a measure of how low expectations have been across both the used car sector and the wider economy that a significant minority of dealers are saying that this year has, so far, been something of pleasant surprise.

“Certainly, while conditions are not as bad as some experts predicted, they still remain tough.”

He added: “The used car sector remains remarkably resilient but there is no question that most dealers are having to work hard to make money and continually find new ways of maximising the potential of their business against a difficult backdrop.”

Login to comment

Comments

No comments have been made yet.