Used car sales slowed as the average price of a car advertised for sale declined by 4.7% in Q2 according to eBay Motors data which showed the impact of the UK’s growing cost-of-living crisis.

While market analysts noted that limited supplies and bulging order books meant that the new car retail sector would be isolated from the impact of soaring inflation for some time to come, the online marketplace’s data showed that the tide could be turning for used car dealers.

Dealers’ average days to sell increased by nearly three full days, from 36.7 to 39.5 days, in June as the average advertised used car price on eBay Motors Group’s platforms dropped 1.4% from £16,872 to £16,627, the fifth consecutive monthly fall.

Lucy Tugby, head of marketing at eBay Motors Group, said: “June’s average £245 drop in advertised prices represents further evidence of them heading back to more normal levels as consumer demand eases.

“We are seeing the impact that rising household costs is having on prospective buyers, supporting our recent Consumer Insight Panel research which found one-in-five car purchases are being delayed because of the cost-of-living crisis. Reduced demand meant dealers took longer to sell cars from smaller inventories in June.

“However, the average price of a used car is still tracking at over 20% higher than last June, a difference of £2,804, so dealers holding firm on transaction prices are continuing to maximise on the opportunities available.”

According to eBay Motors franchised dealers suffered most from June’s slowing of consumer demand, their average days to sell having increased 14% from 31.2 to 35.6 days, followed by independents up 3% from 45.3 to 46.5 days, while car supermarkets remained steady at 28.5 days, compared to 28.1 in May.

According to eBay Motors franchised dealers suffered most from June’s slowing of consumer demand, their average days to sell having increased 14% from 31.2 to 35.6 days, followed by independents up 3% from 45.3 to 46.5 days, while car supermarkets remained steady at 28.5 days, compared to 28.1 in May.

June’s drop in advertised prices on eBay Motors – to a level which remained 20.3% ahead of June 2021 – was led by a 1.5% to £14,496 in the independent dealer sector.

Franchised retailers’ used car values declined by a lesser 0.6% to £19,872 and used car supermarkets just 0.5% to £16,802.

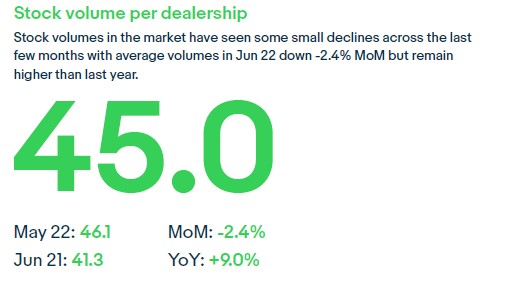

In-line with the sector wide shortage of used cars, stock levels dropped for the second successive month, down 2.4% from 46.1 to 45 units. The average remains 9% ahead of June 2021’s 41.3 units, however.

The data from eBay Motors indicated that used car supermarkets bore the brunt of the shortage with inventories down 3.1% from 293 to 284, while franchised dealers were down 5.4% from 56 to 53. Independents remained unchanged at 36 units.

The data from eBay Motors indicated that used car supermarkets bore the brunt of the shortage with inventories down 3.1% from 293 to 284, while franchised dealers were down 5.4% from 56 to 53. Independents remained unchanged at 36 units.

Speaking in AM’s recent General Managers’ Guide to ‘Holding the Right Stock’ webinar Car Shop chief executive Nigel Hurley said that the Sytner-owned business had adjusted its stock to include older, more affordable vehicles in response to vehicle shortages and the cost-of-living crisis.

Tugby said: “Although the first half of the year saw a general stabilisation in prices and days to sell, we recommend that dealers pay close attention to consumer needs as demand alters with the cost-of-living impact. By remaining sharp on stock type, pricing and online visibility, savvy dealers will be able to roll with the incoming waves.”

Login to comment

Comments

No comments have been made yet.