Optimists will point to the fact that June 2023 was the 11th consecutive month of growth, with the market up 18.4% YTD. Pessimists will point out that, in the first half of the year, the UK market was still 27.7% below where it was five years ago.

Meanwhile, the SMMT is currently forecasting a total figure of 1.83 million for 2023, which is about where the market was in 1994, writes David Francis.

At a manufacturer level, the major development YTD has been VW retaking the No. 1 spot from Ford. It seems unlikely that VW will relinquish its position any time soon, as Ford ended production of the Fiesta in June, with the Focus due to follow by 2025.

With a narrow crossover-focused car range (some of which will be based on VW platforms), it is hard to see how Ford can compete with VW’s “access all areas” 16-model line-up.

In fact, third-placed Audi is more likely to catch VW than Ford, given long-term trends – although whether that would be allowed by the VW hierarchy is another matter. It is interesting to note, however, that the A4 E-tron has sold more so far this year than any electric VW.

It is therefore no surprise that there has been an emergency facelift of the fairly lacklustre ID3. This was named as it was to be the third seminal VW after the Beetle and the Golf: so far its performance looks more new Jetta than new Golf.

Kia has slipped behind Audi, and is now only just ahead of Toyota, which sits in fifth place. Nonetheless, Kia’s market share of over 6% is still a superb figure for a manufacturer that, 20 years ago was an economy brand with minimal market awareness.

That is both an inspiration and a warning – you can bet the Chinese brands have been studying Kia’s UK success very carefully.

Toyota’s progress has some parallels with Kia – it has had good growth in recent years, but has seen a fall in market share this year. As Asia’s pre-eminent car manufacturer, it certainly won’t be happy about being outsold by a relative upstart from South Korea. The major difference is that Kia has one of the best ranges of battery electric vehicles in the industry, while Toyota has struggled to even get its first BEV (the BZ4X) to market: the first 2700 cars made had to be recalled for wheels potentially falling off (the news headline wrote itself).

Toyota’s progress has some parallels with Kia – it has had good growth in recent years, but has seen a fall in market share this year. As Asia’s pre-eminent car manufacturer, it certainly won’t be happy about being outsold by a relative upstart from South Korea. The major difference is that Kia has one of the best ranges of battery electric vehicles in the industry, while Toyota has struggled to even get its first BEV (the BZ4X) to market: the first 2700 cars made had to be recalled for wheels potentially falling off (the news headline wrote itself).

Behind Toyota (and uncharacteristically adrift of Audi) is BMW. Its market share of 5.5% YTD is its lowest for many years. One of the main reasons is a 2.5% fall in 3 Series sales – the car that was traditionally BMW’s best seller is now outsold by the 1-Series, 4-Series and 2-Series.

On the subject of once best-selling models, seventh-placed Vauxhall is struggling with the new Astra. It is still not even in the Top 10 C-segment hatchbacks (behind the Mini Countryman) or the Top 25 C-segment models if crossovers are included. Surely outselling the Mazda CX-5 should not be too big an ask for a model that used to fight for segment leadership?

On the subject of once best-selling models, seventh-placed Vauxhall is struggling with the new Astra. It is still not even in the Top 10 C-segment hatchbacks (behind the Mini Countryman) or the Top 25 C-segment models if crossovers are included. Surely outselling the Mazda CX-5 should not be too big an ask for a model that used to fight for segment leadership?

The segments under scrutiniy

The segments under scrutiniy

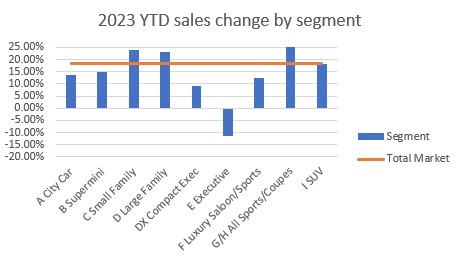

At a segment level, it is a story of ever-greater concentration, regardless of whether the market is examined by bodystyle or vehicle size.

For the first time, over half of total sales were crossovers/SUV. C-segment cars (the leading exponent having morphed from the Focus to the Qashqai) took a record 38.7%, while B-segment superminis (now led by the Ford Puma) took 31.7% - not quite a record, but close.

Premium/large SUVs (from the Volvo XC40 upwards) took 17.9%, which meant that the three biggest segments took their highest-ever combined share of 88.2%.

The result was that six other segments had to share less than 12% of the total market.

The biggest casualty has been Executive saloons and estates, such as the BMW 5-Series. This segment took just 1.1% share YTD, down from 2.4% in the same period of 2020. Could the executive saloon go the same way as the C-segment saloons of the 1980s like the Ford Orion and Vauxhall Belmont – or the way of the Ford Mondeo and Vauxhall Insignia of more recent years?

With crossovers now the default choice, where will new buyers of executive saloons come from – could the segment fade away along with its, er, mature clientele?

With crossovers now the default choice, where will new buyers of executive saloons come from – could the segment fade away along with its, er, mature clientele?

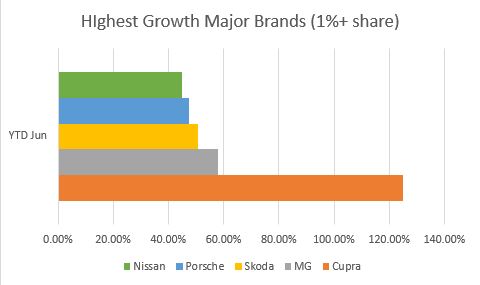

The other major trend so far this year has been the rise of new brands – or at least some of them. Cupra has doubled its market share compared to the same period of 2022 (0.6% to 1.2%), as a stylish re-invention of Seat.

Polestar has achieved the same feat (0.35% to 0.7%), as a cooler, more stylish Volvo. The Polestar 2 is currently the second best-selling Compact Executive model, behind only the BNW 4-Series. It is even outselling the Tesla Model 3 which given Tesla’s unique charging network, is quite a result.

Clearly plenty of buyers prefer Scandi-cool to California bombast.

It is too early to draw conclusions about the bravest new brand to enter the UK market – Genesis. We can say it is no Infiniti – with sales of just over 800 YTD, it is probably doing as well as could be expected at this stage.

It will be fascinating to see if Genesis can make anything like the same rate of progress as its Hyundai and Kia siblings.

It will be fascinating to see if Genesis can make anything like the same rate of progress as its Hyundai and Kia siblings.

Unfortunately, it is not too soon to comment on the fate of some new brands. DS is becalmed at just 0.2% market share, mainly because no-one seems to know what it is for.

Finally, in these difficult times, let’s finish on two positive stories of possible brand redemption. After 20 years of spiralling downwards, the new Avenger has finally given Jeep a model that could sell in decent numbers in the UK.

Meanwhile Lotus has seen sales increase from basically nothing to 667 YTD. Its reinvention under Geely is underway, and we should hope that this brand, with a history of more unfulfilled promise than almost any other, can finally flourish.

Login to comment

Comments

No comments have been made yet.