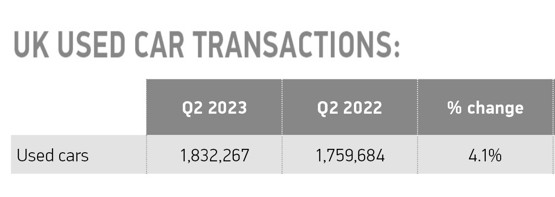

The UK's used car market continues to climb back towards its traditional level, according to data from the Society of Motor Manufacturers and Traders which reveals the first half of 2023 recorded 4.1% used car transactions growth year-on-year.

That equates to 145,381 more used cars changing owners, taking the total H1 transactions to 3.53 million.

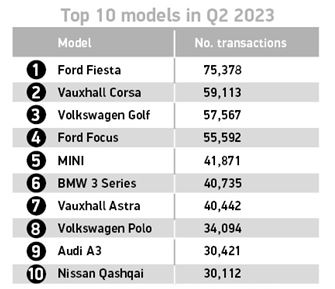

Sales of superminis, such as the Ford Fiesta, Volkswagen Polo and Vauxhall Corsa, were particularly strong, and these small, typically affordable cars accounted for 31.5% of all the second quarter's used car sales, followed by lower medium/C-Segment cars such as the Volkswagen Golf and BMW 1 Series.

Following recent years of growth in sales of new electric vehicles (EVs), naturally there has been growth in UK sales of used battery electric vehicles such as the Nissan Leaf, Cupra Born and Tesla Model 3, but they remain a tiny proportion of the market.

During the second quarter of 2023 the sales of second-hand battery EVs in the UK climbed by 82% to 30,645 units. That represented a 1.7% share of all used car sales, up from 1% in Q2 2022.

During the second quarter of 2023 the sales of second-hand battery EVs in the UK climbed by 82% to 30,645 units. That represented a 1.7% share of all used car sales, up from 1% in Q2 2022.

Sales of plug-in hybrids rose 11.4% to 18,437.

Industry analysts such as Derren Martin at Cap HPI have pointed out this year that tumbling values of pre-owned electric cars have meant that they are more affordable to used car buyers.

The SMMT has pointed out that the current market remains some 10% behind 2019 levels.

Mike Hawes, SMMT chief executive, said: “It’s great to see a recharged new car sector supporting demand for used cars and, in particular, helping more people to get behind the wheel of an electric vehicle.

"Meeting the undoubted appetite for pre-owned EVs will depend on sustaining a buoyant new car market and on the provision of accessible, reliable charging infrastructure powered by affordable, green energy. This, in turn, will allow more people to drive zero at a price point suited to them, helping accelerate delivery of our environmental goals.”

Lisa Watson, sales director at Close Brothers Motor Finance, said she believes the expansion of London's Ultra Low Emission Zone (ULEZ), and the likelihood of other cities adopting similar schemes, could help to drive the used car market recovery.

Diesel cars produced after 2016 are ULEZ compliant, as are most petrol cars produced after 2005.

"As consumers look for compliant vehicles, many will turn to the used market in order to save money compared to purchasing a new car," she said.

But high used car costs - driven by demand overtaking supply between 2020 and 2023 - could mean that some buyers are having to choose an older used car than they would ideally prefer.

And the RAC Dealer Network reports that the number of warranties it has sold for 10 to 20-year-old cars has risen by 67% since the pandemic.

In 2020, 6% of all policies sold through its 1,200 used car retailers were for vehicles in this age range but during the first six months of this year, it had risen to 10%. Similarly, the number of claims in this category have risen from 15% to 21% of the overall total made.

There has also been a marked 34% increase in warranties sold for 5 to 10-year-old cars over the same time period, rising from 34% to 46%. Claims have comparably increased from 61% to 65%.

There has also been a marked 34% increase in warranties sold for 5 to 10-year-old cars over the same time period, rising from 34% to 46%. Claims have comparably increased from 61% to 65%.

Lee Coomber, RAC client director at Assurant, which partners with the RAC in the warranty and aftersales sector, said: “These figures show how post-pandemic vehicle shortages and the subsequent ageing of the car parc are having an increasing impact on warranty claims, with a marked shift towards the upper end of the age ranges in which we offer cover.

“As has been widely reported, dealers are finding themselves in a situation where they are selling more aged vehicles, a development that looks set to continue for some time to come. What has been less widely covered is the role that warranty providers such as the RAC and Assurant have played in helping them through this shift, providing the cover that car buyers desire even though claims on older vehicles are obviously higher and more costly."

Ian Plummer, commercial director at Auto Trader, the UK’s largest automotive marketplace, said that appetite continues to fuel the market. "The supply of used cars has been slow to return after the covid pandemic hit new car sales, but as it does return we’re seeing that available stock is selling well and quickly, in fact cars aged 5-10 years are selling in just 28 days.

“This speed of sale is reflective of the strong levels of demand we’re seeing on the Auto Trader site with overall audience up 17% year-on-year in July which follows eight consecutive months of growth in site visits. This level of demand provides us with a solid trajectory for healthy levels of sales in the coming months.

Login to comment

Comments

No comments have been made yet.