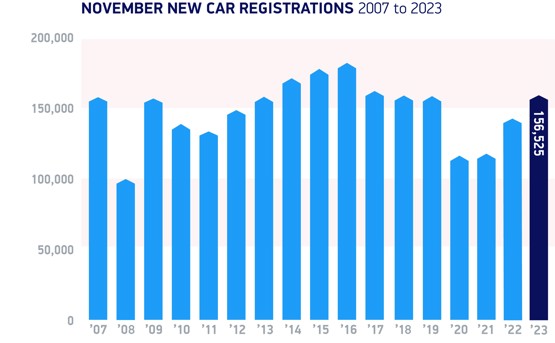

The UK new car market enjoyed its best November for four years with registrations staging a near return to pre-pandemic levels, down just 96 cars (-0.1%) on 2019, according to the Society of Motor Manufacturers and Traders (SMMT).

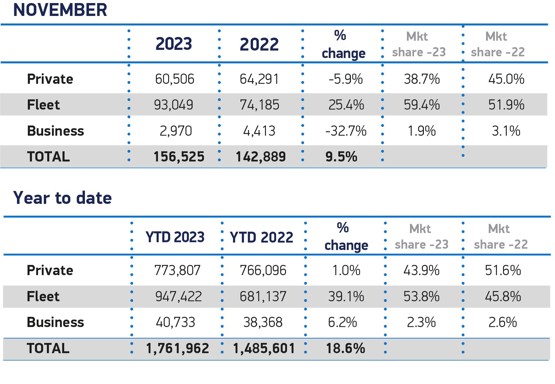

Its latest figures show that the market grew by 9.5% in November to reach 156,525 units, with growth driven entirely by fleets with registrations rising 25.4% to account for 93,049 units and 59.4% of the market.

Private demand was depressed however, dropping -5.9% to 60,506 registrations, while business uptake fell -32.7% to 2,970 units.

The overall market remains up 18.6% at 1.762 million units, though. with a return to growth in the corporate market fuelling a recovery that has been underway for 16 months.

November proved a strong month for both hybrid electric vehicles (HEVs) and plug-in hybrid vehicles (PHEVs), rising by 27.8% and 55.8% respectively.

Fleets also continued to transition to battery electric vehicles (BEVs), driven by tax incentives.

Of the 24,359 new BEVs reaching the road in November, 77.4% were taken on by fleets and businesses. While overall BEV volumes fell by -17.1%, leading to a reduced market share of 15.6%, last November was atypical with significant deliveries following supply chain disruptions. Year to date, BEV uptake is up 27.5% with a 16.3% market share – expected to rise to 22.3% next year.

However, the SMMT warned that with new regulation coming into force in January mandating that 22% of each manufacturer’s new vehicle registrations must be zero emission, sustained recovery depends on inspiring consumers with fiscal incentives, as well as greater investment in essential charging infrastructure that gives drivers confidence.

“Halving VAT on new BEVs and reducing VAT on public charging to 5% in line with home charging would increase the attractiveness of driving electric and make the zero emission transition more accessible to a larger number of consumers,” it said.

Even more urgent is the need to delay tougher new UK-EU Rules of Origin which will begin on 1 January 2024.

“Failure to postpone these rules would see EVs traded both ways incur tariffs that would raise prices for consumers at a critical moment in the transition. With less than four weeks to go, carmakers and governments on both sides of the Channel have called for a common-sense approach to retain the current EV battery rules for a further three years, which will support consumer choice and affordability.”

Mike Hawes, SMMT chief executive, said, “Britain’s new car market continues to recover, fuelled by fleets investing in the latest and greenest new vehicles. With car makers gearing up to meet their responsibilities under new market legislation, and COP28 currently underway, now is the time to take sensible steps that will multiply that economic growth and minimise carbon emissions. Private EV buyers need incentives in line with those that have so successfully driven business uptake – and workable trade rules that promote rather than penalise the transition.”

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA) said the latest figures for November demonstrated that 2023 was a year of growth for the sector.

Robinson added that an absence in the Autumn Statement of EV price incentives or any further clarity on EV charging infrastructure from the Chancellor was of concern.

“In a recent survey to members 50% of respondents identified that an introduction of private EV incentives would be most beneficial to them. NFDA urges Government to listen to the needs of consumers, and the sector, if we want private EV buyers to match fleet adoption.

“The fall in private electric vehicle sales for November is unsurprising with the upcoming ZEV mandate implementation set for January, although NFDA would argue that this is not a true reflection of the market and consumer demand for EVs remains strong. Manufacturers have crucial sales targets to reach from January 2024 and will be strategically planning for the mandate to come into effect; As the customer facing side to the industry, Electric Vehicle Approved (EVA) dealers will continue to support consumers on their transition to electric through expert levels of knowledge and high levels of service.”

Lisa Watson, director of sales at Close Brothers Motor Finance, added that the new registration figures had remained resilient despite a challenging economic environment and the usual winter slowdown.

“However, the lack of any incentives for motorists in the Chancellor’s Autumn Statement will not have spurred the demand for alternative fuel vehicles (AFVs), with numbers remaining skewed by fleet sales. As motorists continue to battle the cost-of-living crisis and high upfront cost of AFVs, more will need to be done to encourage widespread adoption if the revised 2035 ban on new petrol and diesel vehicles is to go ahead.

“Dealers will need to make sure they are utilising all available insight and tools to ensure they are keeping track of changing trends and stocking their forecourts to best meet demand, particularly as motorists look for cheaper options.”

Ian Plummer, commercial director at Auto Trader commented: “November’s drop in electric vehicle sales is a sign of what’s to come if the government doesn’t support the industry in making the transition by incentivising consumers on this journey as we know private electric car registrations have been lagging that of the fleet sector for a while now. Legal confirmation of the ZEV mandate last night at least gives the industry the clarity it needs, even though some manufacturers will struggle to hit these targets as they are behind the curve on electric sales.

“But the latest tranche of fear, uncertainty and doubt that accompanied this parliamentary vote won’t help consumers confidence in electric vehicles and is ultimately misleading as electric cars currently offer savings of up to £155 for each 1,000 miles driven compared to petrol cars. And with around two thirds of new electric vehicles enjoying some kind of financial offer right now, there’s never been a better time to make the switch - this is what consumers need to know.”

Login to comment

Comments

No comments have been made yet.