Auto Trader is giving all its retail partners early access to its new data solution Trended Valuations, as well as to newly enhanced Retail Check functionality to help manage the complexity and nuance in the used car market.

Trended Valuations and enhanced Retail Check functionality is accessible through Auto Trader Portal, or for those already utilising Auto Trader’s powerful suite of API solutions, Auto Trader Connect, the data, insights and metrics can be integrated into their own systems.

The introduction of these new solutions comes at a time when multiple factors, including changes in supply dynamics, electric vehicle demand, and wholesale trends, are driving complexity and nuance in the used car market. In turn, they’re creating uncertainty for retailers, and making pricing strategies harder to manage.

This new layer of intelligence is designed to complement retailers’ experience and expertise to not only spot margin opportunities, but also drive greater performance across their forecourts.

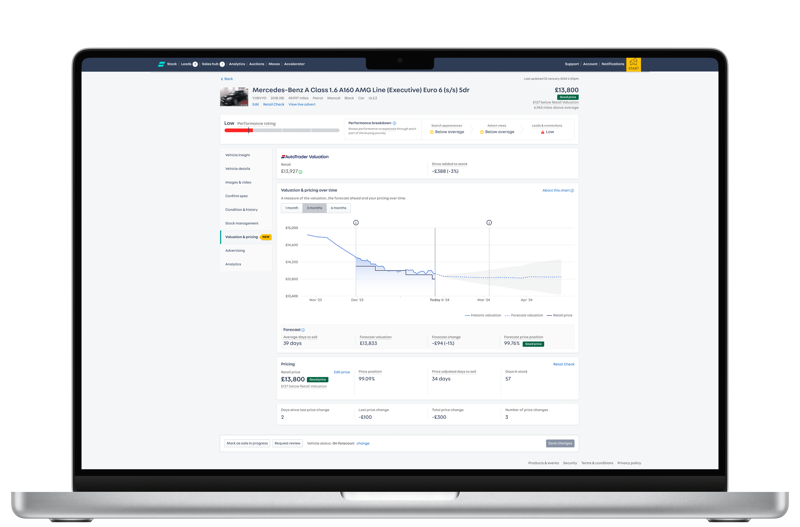

Trended Valuations show what a vehicle has been worth over the last six months, and how its value is forecast to change up to six months into the future. It’s based on a combination of historic valuations, live market prices, seasonality, and the age of the derivative within the lifecycle of its generation.

Auto Trader said its forecasts have been proven to be on average within 5% of achieved values up to six months in the future, with this improving to 3% up to three months, and just 1% up to a month forward.

Trended Valuations provides vital insight into profit opportunity, price sensitivity and margin risk. Dealers are using it to appraise a vehicle prior to purchase (estimating its valuation after preparation, the speed in which it will sell, and the point it becomes overage) as well as managing risk more effectively by identifying potential loss-making vehicles sooner.

Highlighting the broad range of benefits and applications Trended Valuations will have in day-to-day operations, Michael MacDonald, business manager at TrustFord Bristol, said: “Trended Valuations will be hugely powerful for managing part-exchanges, especially where new car lead times can mean the transaction is months away. Having an Auto Trader branded valuation forecast will help us manage consumer expectations.

"It’ll also help us manage risk and margin when sourcing with a clear view forward, so we don’t get stuck. I’ll also have a much better view of risk value on how long I keep cars in stock and know what’s going to happen to protect margin.”

Andrew Muffett, group used car buyer at Allen Motor Group, also commented on how having Trended Valuation data will be invaluable in navigating the disconnect between retail and wholesale trends: “I think Trended Valuations is essential. As retail and trade markets don’t always move in sync, a point in time trade valuation only tells part of the story when sourcing and puts margin at risk when you hit the retail market.

"Trended valuations will provide us with a broader view of retail pricing over time, to chart the trajectory of a vehicle’s past performance and, crucially, where it’s forecast to go.”

In addition to Trended Valuations, retailers now also have early access to Auto Trader’s enhanced Retail Check solution, which provides a broad suite of data and metrics, including Retail Rating, to give a precise picture of the live retail market at both a national and local level. With a deeper understanding of current market conditions, retailers can source and price with confidence, and ensure they’re generating the maximum profit out of every vehicle.

Retail Check monitors shifts in supply and demand, provides real-time market valuations, a competitive analysis of price position against similar stock in the market, and estimates how fast a vehicle may sell when priced at its market value. As well as informing buying and pricing strategies, retailers can use its unique insights to minimise losses and optimise forecourts by identifying stock that are cutting into profit and require disposal.

Commenting on Retail Check, Haston Masih, head of business intelligence and pricing at Carshop, said: “The beauty of Retail Check is that it gives us valuable insight into where a specific vehicle sits in the market and how other retailers are pricing similar stock. We utilise it daily to help action our pricing strategy and best optimise margin and stockturn from each vehicle.”

Auto Trader’s chief product officer Karolina Edwards-Smajda said: “Given the complexity in the market, we’ve worked hard and invested to create the solutions and the insights that we believe will best serve our partners, and give them the confidence they need to act in these changing times.

"We can already see just how powerful and integral our data has become in informing key retail decisions by the fact our valuations data was used over 240 million times last year, which is almost 100 million more than in 2022.

"Whilst there’s no question that the year ahead will have its challenges, access to this powerful combination of new intelligence will ensure all retailers, regardless of scale, have what they need to drive their success in 2024.”

Auto Trader is also launching its new Auto Trader Insight Academy, its e-learning hub offering bitesize masterclasses. Part of the launch includes updated masterclasses on sourcing, pricing and understanding metrics to help retailers use Trended Valuations to its full potential, visit

Both will be incorporated into advertising packages in April, and combined will help retailers to make quicker and more profitable sourcing, advertising, and pricing decisions.

Login to comment

Comments

No comments have been made yet.