Average car prices continue to be pulled down by underpricing of exceptionally high demand stock, fuelled by recent trends in wholesale values, according to Auto Trader’s Retail Price Index which reveals a drop of -7.5% year-on-year (YoY) and like-for-like in January.

The used car market however saw a confident start to the new year, with both transactions and consumer demand recording growth in January,

Levels of consumer demand on Auto Trader remained buoyant in January, increasing 6.1% YoY, and well ahead of supply, which recorded a growth of just 1.2%. As a result, Auto Trader’s Market Health metric, which assesses potential market profitability based on supply and demand dynamics, rose to a healthy 4.8% on January 2023.

Robust consumer appetite was also evident in the record traffic to Auto Trader’s marketplace, which last month saw a total of over 85.5 million cross platform visits; a huge 27.5% increase on December, and 6.4% on the 80.4 million recorded in January 2023 - a record at the time.

This demand was translated into transactions, with early indications from Auto Trader’s retail sales data suggesting a 1.6% increase in used car sales compared to last year.

Despite such strong market fundamentals, however, a proportion of high-demand stock is still being under-priced on Auto Trader, although reassuringly, at a slowing rate from recent highs. Currently, circa 46,000 cars with a high Retail Rating score - a unique, machine learning derived measure of how fast a car is likely to sell if priced at its market value - of over 61 have been advertised below their market average from the first day of being listed. As a result, a potential profit of around £30m is being missed.

Looking at the data at a more granular level reveals that many of even the most in-demand vehicles in the market are being priced below their retail value. In fact, 3,400 retailers are choosing to list circa 9,300 of the ‘best-of-the-best’ cars - with a Retail Rating above 81 - on Auto Trader below 95% of their respective market average. It represents a potential profit opportunity for retailers of circa £8m.

Nuanced retail market

Highlighting the nuance in the retail market, the average price of sub three-year-old (£28,031) cars are down -9.7% YoY (hampered by the ongoing de-fleeting of the circa 750,000 electric vehicles sold over the last three years), whilst those aged 3-5-years (£19,114) and 5-10-years (£13,352) saw a decline of -9.2% and -4.8% respectively. Used cars aged over 10-years-old, however, are still recording positive price growth, with 10–15-year-old vehicles up 3.7% YoY to £6,457.

Looking at fuel type, prices for electric vehicles are down -21.8% YoY (£28,836), whilst petrol (£15,256) and diesel (£15,111) are down -6.2% and -5.8% respectively. This is despite very favourable market dynamics; across all fuel types, levels of demand growth is outpacing supply, which under normal conditions would maintain price stability. This is especially evident in electric vehicles, where demand growth has increased a massive 65%, whilst levels of supply, is down -2.4%, resulting in Auto Trader’s Market Health metric rising a whopping 69%.

Commenting, Richard Walker, Auto Trader’s data & insight director, said: “As well as our own metrics, it’s reassuring to see broader economic indicators pointing to stable and robust market conditions, including the latest consumer confidence data, which reached a two-year high in January. Although fewer than we’ve seen previously, given such positive market fundamentals, it’s disappointing to still see stock being priced under their true market value, particularly what we would call the best-of-the-best. By not applying a retail-back approach to pricing, retailers are at risk of selling themselves short and missing out on significant profit opportunities.”

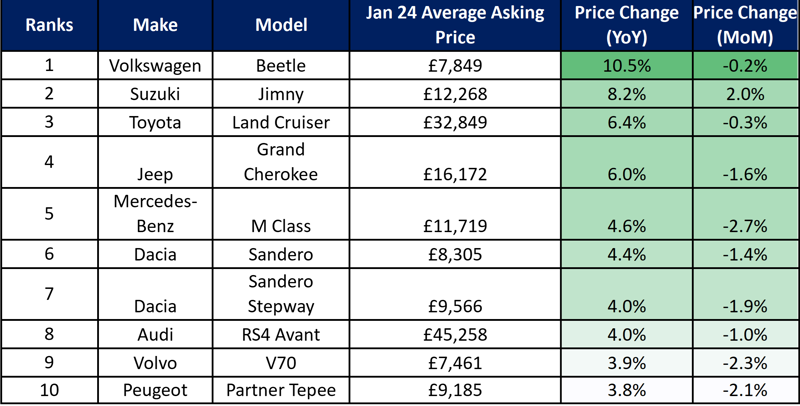

Top 10 used car price growth (all fuel types) | January 2024 vs January 2023 like-for-like

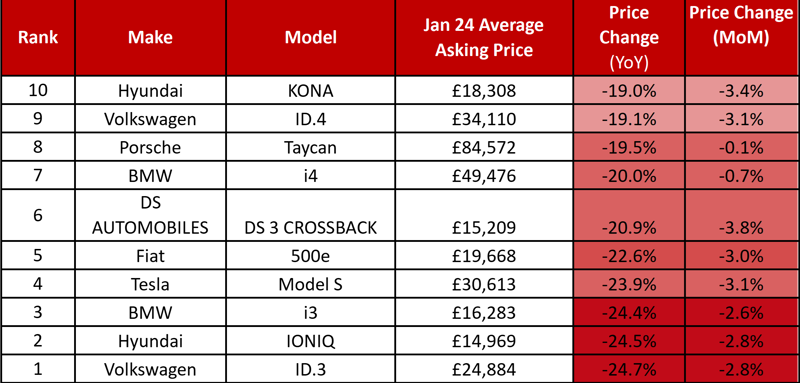

Top 10 used car price contraction (all fuel types) | January 2024 vs January 2023 like-for-like

Login to comment

Comments

No comments have been made yet.