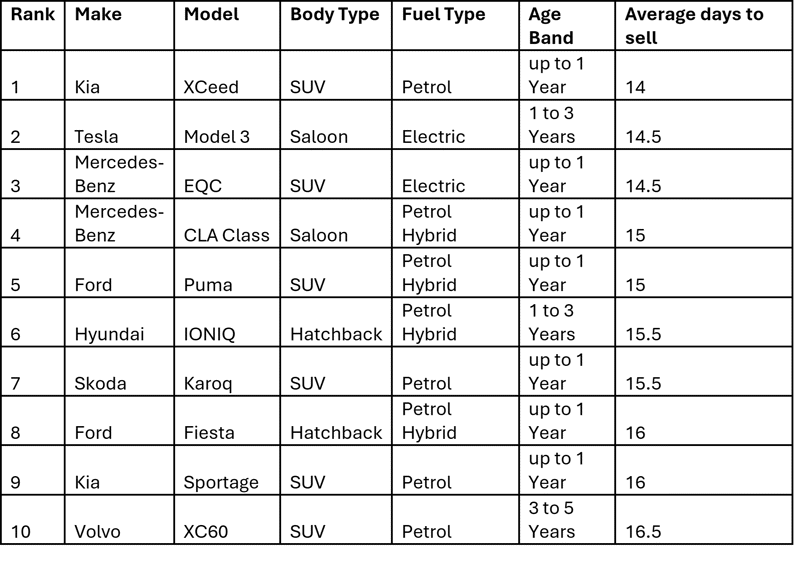

The Kia XCeed is the UK’s fastest-selling used car, taking on average just 14 days to leave retailers’ forecourts.

Slightly behind the crossover SUV from the Korean manufacturer in joint second position, was the all-electric Tesla Model 3 and the Marcedes-Benz EQC, which both took a similarly impressive 14.5 days to sell.

Other entries in the list included the Hyundai IONIQ which took 15 days to sell and the discontinued Ford Fiesta which changed hands in 16 days.

Demand for SUVs shows no signs of slowing down with the body type making up six of the ten current fastest selling used cars. These include the petrol hybrid Ford Puma, Skoda Karoq and Volvo XC60.

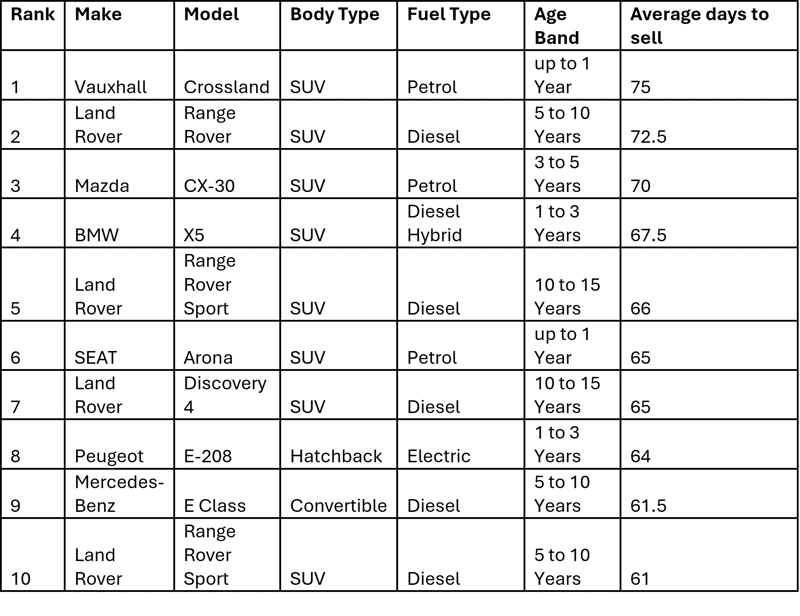

Whilst some vehicles have only taken two weeks to be snapped up, the top ten slowest selling used cars have all taken on average over two months to leave retailer’s forecourts. The Vauxhall Crossland is currently the slowest selling used car in the UK taking on average 75 days to sell, with the Land Rover Range Rover shifting in 72.5 days and the Mazda CX 30 in 70 days.

In terms of the fastest selling regions, Scotland topped the rankings taking on average 24 days for dealers to sell their vehicle stock to consumers. This was followed by the North East, West Midlands and Yorkshire & the Humber which were tied in second and took on average 25 days. The slowest selling location was London with retailers taking on average 31 days to shift used cars off their forecourts.

For the last six months, electric vehicles have been the fastest selling fuel type, but this month, used petrol cars have accelerated past their battery powered counterparts, taking just 26 days to sell, compared to 28 for both EVs and diesel cars. However, whilst a petrol car took the top spot, low emission vehicles made up the majority (60%) of the current top 10.

Richard Walker, data & insight director at Auto Trader said: “Demand amongst consumers continues to remain strong at the start of 2024 with used cars flying off forecourts just as quickly as last year. With many of the fastest selling used cars less than 12 months old, we’re seeing plenty of appetite for the used versions of the latest models. Although supply in this age cohort is up around 30% year-on-year, it remains below the very strong levels of demand, and as a result, offers a real profit opportunity. It highlights just how important it is to keep a close eye on the latest data to remain ahead of the curve.”

Fastest selling used cars as of February 2024 (between 15th January – 11th February)

Slowest selling used cars as of February 2024 (between 15th January – 11th February)

Slowest selling used cars as of February 2024 (between 15th January – 11th February)

Login to comment

Comments

No comments have been made yet.