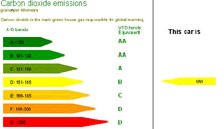

Customers buying a new car from April 1 will be subject to a new first year rate of vehicle excise duty, also referred to as a showroom tax, designed to steer buyers towards choosing lower-emitting models.

The one-off rate will apply to all new cars for the first year of registration with the exact cost based on the vehicle’s CO2 emissions.

The new tax system has not been well publicised and many customers will be unaware of the changes when they come into showrooms.

Cars emitting less than 130g CO2/km will be exempt from VED charges for the first year with rates between £110 for cars emitting 131-140g CO2/km to £950 for cars emitting more than 255g CO2/km.

Motorists will pay the first year rate of VED when buying their car, reverting to the new standard rate for every subsequent year.

For cars emitting 121-130g CO2/km this equates to a first year reduction of up to £120 on current rates or £90 on the new increased rates.

Based on the 2009 market, this will apply to approximately 7.2% of the new car market with the reduction encouraging sales of the lowest emitting models.

At the upper end of the market, the first year rate equates to a £545 increase for the first year and a £30 increase for each subsequent year. Just 1.5% of cars registered in 2009 would fall into this band.

Based on the 2009 market, the most popular band, accounting for 19.7% of the market, will be for cars emitting 131-140g CO2/km where motorists will experience a £110 charge, as per the standard rate.

Paul Everitt, SMMT chief executive, said: “We are disappointed that Government didn’t take the opportunity in last week’s Budget to defer the introduction of the first year rate or the increase in standard VED rates.

“Environmental taxes need to be clear and consistent so that motorists can be confident that they will reap the benefits from their decision.”

- To read more analysis and discussion on the showroom tax see AM's April 23 issue.

Login to comment

Comments

No comments have been made yet.