The Finance and Leasing Association has predicted a 6% decline in car finance during 2023 after new business volumes declined 5% in February.

The FLA’s director of research and chief economist Geraldine KilKelly said that, while the economic outlook has improved, businesses and households would be impacted by the impact of higher prices, taxes, and interest rates.

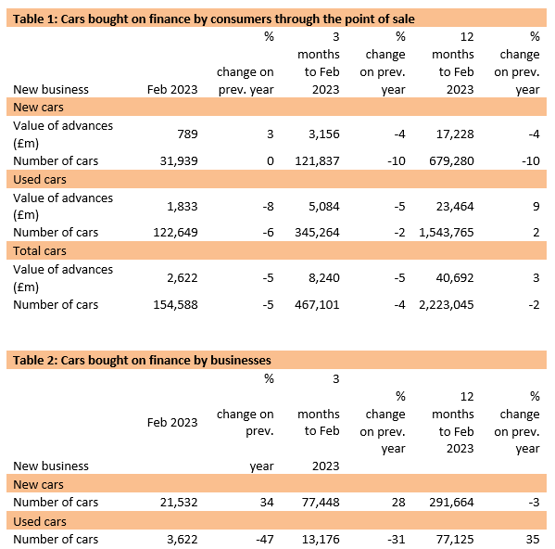

Across new and used car sectors the motor finance sector shrunk 5% by value, to £2.62 billion, and 5% by volume, to 154,588, in February.

Kilkelly said: “The consumer car finance market reported new business volumes only 3% lower in the first two months of 2023 than the same time last year, with single digit falls in both the consumer new and used car finance markets.

Kilkelly said: “The consumer car finance market reported new business volumes only 3% lower in the first two months of 2023 than the same time last year, with single digit falls in both the consumer new and used car finance markets.

“While the economic outlook has improved, challenges remain for households and businesses as they deal with the impact of higher prices, taxes, and interest rates.

“We expect the consumer car finance market to report a fall in new business by value of around 6% in 2023 as a whole.

“As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”

Kilkelly's forecast comes a month after the FLA predicted that the UK's used car finance market would shrink by 12% this year.

The FLA’s breakdown of data across the new and used car sectors showed that consumer new car finance delivered new business up 3% by value at £789m in February, as volumes remained flat at 31,939 units.

The consumer used car finance market reported a fall in new business of 8% by value, to £1.83bn, and 6% by volume, to 122,649, compared with the same month in 2022.

Login to comment

Comments

No comments have been made yet.