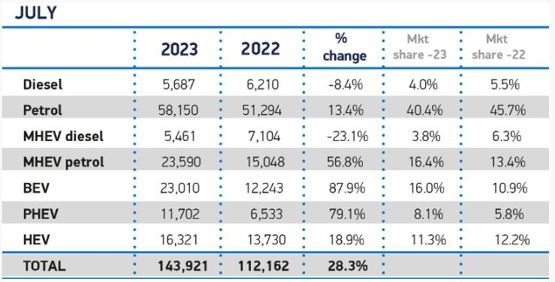

The number of new cars sold in July was up 28.3% versus July 2022, marking the 12th consecutive month of registrations growth since the market was hit by COVID disruption and supply issues.

In July 143,921 new cars were registered, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT), which noted that this was the best July performance since 2020, when pent-up demand for new cars was unleashed following three months of lockdown during the pandemic.

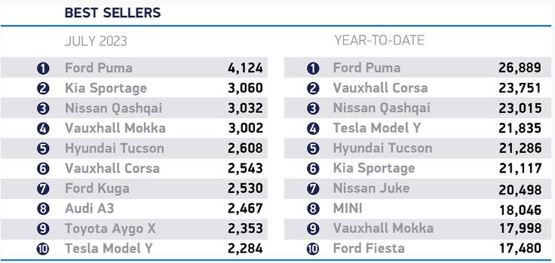

The best-selling car was the Ford Puma, with 4,124 registrations. It remains the top performer of 2023, recording 26,889 registrations in the first seven months of the year, well ahead of the next car, Vauxhall Corsa.

However Volkswagen was the overall top brand of July, outselling nearest rival Ford by 1,816 cars. And its sister brand Audi was only 167 units behind Ford in third place.

New Chinese brand GWM Ora outsold Abarth, the sporty Fiat sister brand.

Company registrations drove the growth, as uptake by large fleets increased 61.9% to 80,961 units and business registrations rose 28.7% to 2,915 new vehicles.

Private demand remained stable at 60,045 units (up 0.3%).

Hybrid (HEV) volumes grew, although their overall market share fell to 11.3%. Plug-in hybrid (PHEV) registrations had a significant uplift for the second month in a row as uptake rose 79.1% to account for 8.1% of the market.

Hybrid (HEV) volumes grew, although their overall market share fell to 11.3%. Plug-in hybrid (PHEV) registrations had a significant uplift for the second month in a row as uptake rose 79.1% to account for 8.1% of the market.

The biggest increase, however, was for battery electric vehicles (BEVs), which recorded an 87.9% increase to account for 16.0% of all new registrations for the month, a market share broadly consistent with that seen so far this year.

The latest market outlook now anticipates overall new car registrations to reach 1.847 million by the end of the year, a 0.9% rise on expectations in April. Of these, BEVs are expected to take a 17.8% market share or 330,000 units, a slight decrease on April’s outlook, while PHEVs are set to achieve 7.2% of the market with 134,000 units.

The latest market outlook now anticipates overall new car registrations to reach 1.847 million by the end of the year, a 0.9% rise on expectations in April. Of these, BEVs are expected to take a 17.8% market share or 330,000 units, a slight decrease on April’s outlook, while PHEVs are set to achieve 7.2% of the market with 134,000 units.

Looking further ahead, the outlook for 2024 has been downgraded marginally by -0.7% to 1.951 million units, reflecting wider concerns about the cost of living.

BEVs are expected to achieve an overall 22.6% market share next year reaching 440,000 units. With a further 155,000 PHEVs anticipated to be registered, commanding 7.9% of the market, plug-in vehicles are likely to account for three in every 10 new cars registered in 2024.

Mike Hawes, SMMT chief executive, said: “The industry remains committed to meeting the UK’s zero emission deadlines and continues to make the investments to get us there. Choice and innovation in the market are growing, so it’s encouraging to see more people switching on to the benefits of driving electric.

"With inflation, rising costs of living and a zero emission vehicle mandate that will dictate the market coming next year, however, consumers must be given every possible incentive to buy.

"Government must pull every lever, therefore, to make buying, running and, especially, charging an EV affordable and practical for every driver in every part of the country.”

Login to comment

Comments

No comments have been made yet.