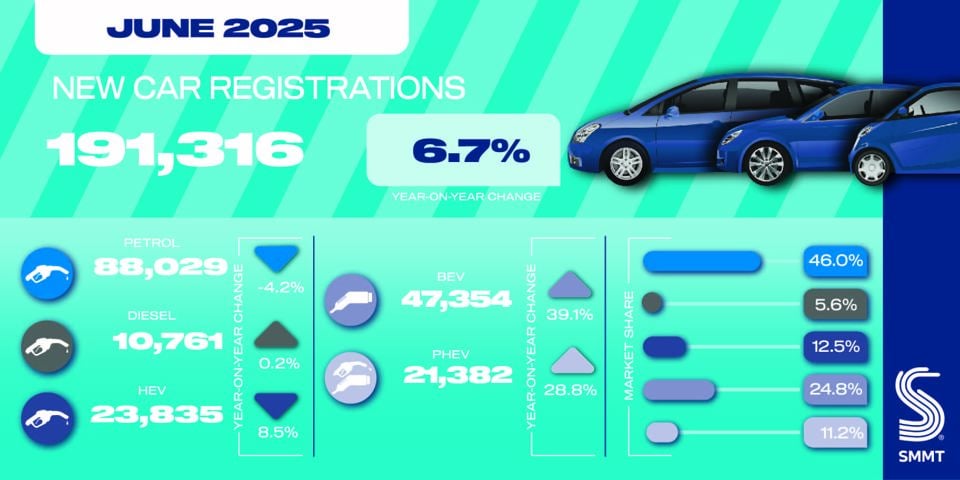

The new car market recorded its second consecutive month of growth in June, with registrations rising 6.7% year-on-year to 191,316 units, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

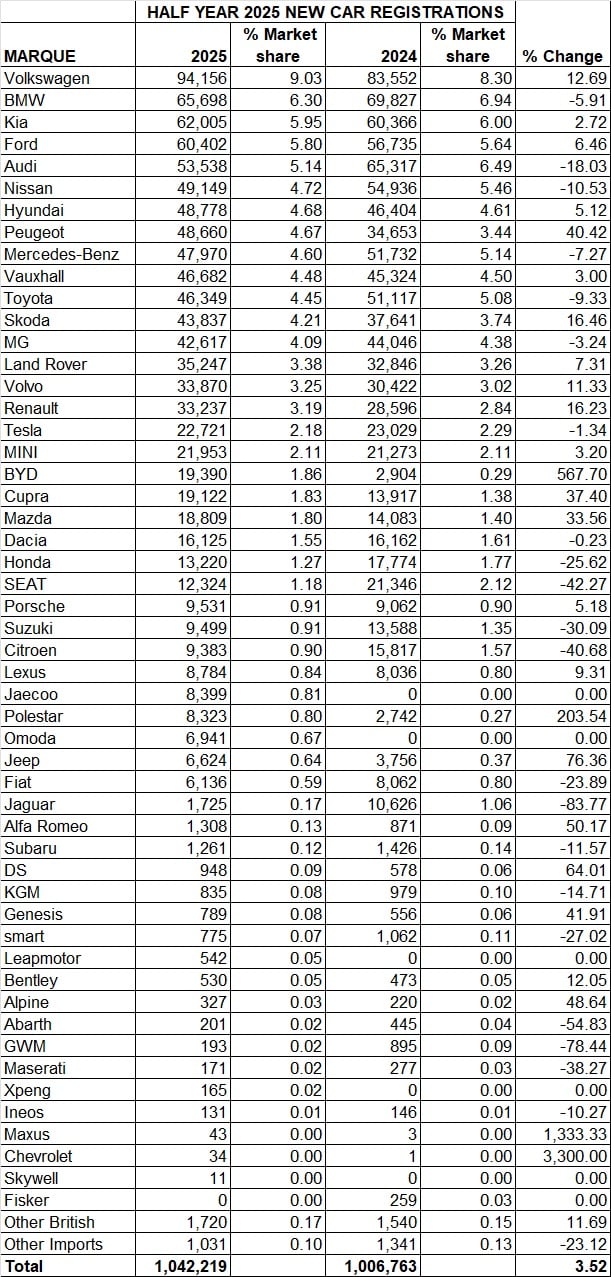

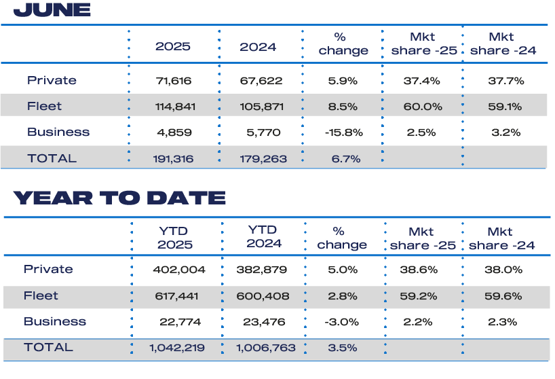

It was the strongest June performance since 2019, helping to lift the year-to-date total 3.5% above the same period last year. However, the market still sits -17.9% below pre-pandemic levels.

Fleet sales continued to drive the recovery, up 8.5% to 114,841 units, while private retail demand also grew, albeit at a slower pace, rising 5.9% to 71,616 units. Business registrations declined sharply, down -15.8% to 4,859 units.

Despite the market’s momentum, SMMT warned that the transition to electric vehicles (EVs) remains fragile and heavily reliant on industry-funded incentives.

“A second consecutive month of growth for the new car market is good news, as is the positive performance of EVs,” said Mike Hawes, SMMT chief executive.

“That EV growth, however, is still being driven by substantial industry support with manufacturers using every channel and unsustainable discounting to drive activity, yet it remains below mandated levels.”

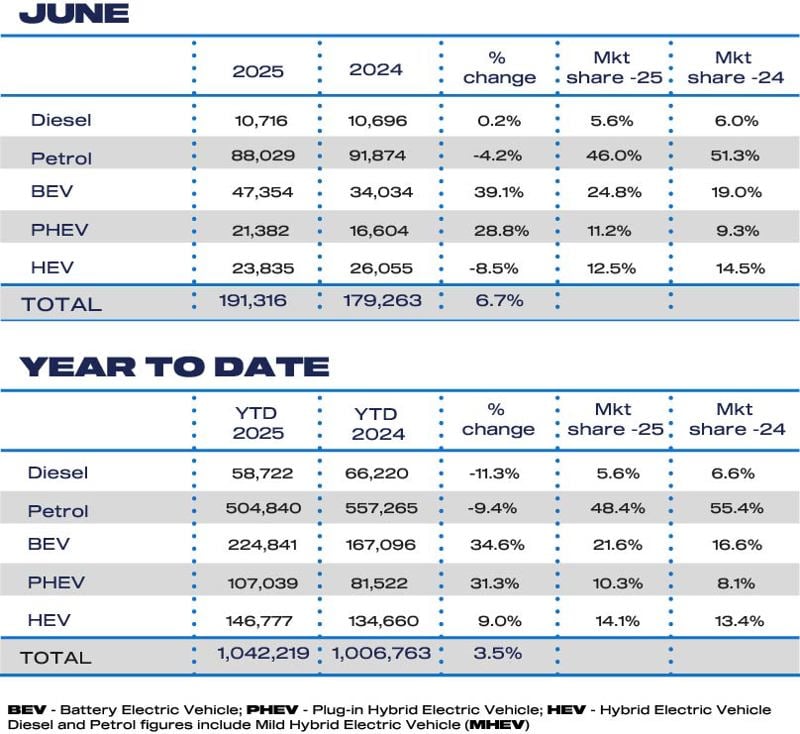

Electrified vehicles now account for nearly half (48.5%) of all new registrations, with battery electric vehicles (BEVs) making up 24.8% of the June market thanks to a 39.1% year-on-year rise to 47,354 units.

Plug-in hybrids (PHEVs) also saw strong growth, up 28.8% to 21,382 units. In contrast, the hybrid electric vehicle (HEV) market shrank by -8.5%, while new petrol registrations dropped -4.2% and diesel volumes remained flat.

> MORE: New car market registrations by brand

In the first half of 2025, BEV sales have surged 34.6% to 224,841 units – but this still falls short of the 28% market share mandated for the year, with the current figure standing at just 21.6%.

The gap, SMMT noted, has been bridged through £6.5 billion in industry-funded discounts over the past 18 months.

The gap, SMMT noted, has been bridged through £6.5 billion in industry-funded discounts over the past 18 months.

“As we have seen in other countries, government incentives can supercharge the market transition, without which the climate change ambitions we all share will be under threat,” Hawes warned.

A recent SMMT survey of automotive CEOs found that 55% believe the UK is “significantly behind plan” in its goal to ban the sale of new petrol and diesel cars by 2030.

SMMT has called for urgent government action to stimulate private demand for BEVs, including revising the recently introduced Vehicle Excise Duty (VED) Expensive Car Supplement (ECS). The ECS, now applied to EVs, is expected to cost buyers over £360 million this year alone – a move SMMT says is acting as a "brake" on demand.

Amending the ECS to exclude most BEVs and cutting VAT on new EVs and public charging could unlock substantial growth. According to industry modelling, such measures could deliver an additional 267,000 BEVs over three years, cutting six million tonnes of CO₂ annually.

“Fiscal incentives for private BEV sales are the biggest single action needed to boost BEV demand, economic growth and the UK’s automotive manufacturing base – a key objective of government’s new Industrial Strategy,” Hawes said.

“The new car market in June has considerably grown, with a 6.7% increase in registrations.” said Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK commenting on the latest SMMT new car registration figures.

Robinson concluded: “Whilst NFDA is pleased to see the new vehicle market’s growth, we are concerned that the macro environment remains difficult for franchised dealers. The industry still faces several pressures such as weak economic growth, inflation above BoE’s target and effects from April’s policy changes. Electric vehicles will likely continue their increase however they remain below the stretching ZEV Mandate targets for 2025. We will also monitor whether the funding for EVs announced in the Chancellors Spending Review will contribute to further growth.”

Login to comment

Comments

No comments have been made yet.