Auto Trader reports that a 40th consecutive month of year-on-year used car price growth now leaves the average second hand car some £4,000 more expensive than in April 2020 when prices began to climb.

Its Retail Price Index data for July, based on circa 800,000 daily pricing observations across the whole retail market, showed a 2.4% year-on-year uplift to £17,920.

Its data contrasts with recent claims in the used car wholesale sector that values are dropping. Cap HPI last week reported a 1.9% fall in values during July.

Auto Trader noted that July's supply of used cars was down 1.5% while demand was up 11.5%, driving the price growth.

It said the supply constraints are impacting 3–5-year-old sales the most, with sales down 15% in the second quarter of this year; in contrast, the supply of cars under a year old is over 50% higher than a year ago.

In the 1-3 year old cohort, electric makes up an increasing share and with supply outstripping demand for these cars the overall picture for 1-3 year old supply is a 2.8% year-on-year price drop.

Auto Trader’s director of data and insight, Richard Walker, said: “Despite the doubters, pricing in the used car market continued its long run of growth in July, albeit at a slightly slower pace. The current dynamics of the market, with robust customer demand and lower supply levels than historical standards, means we don’t see any signs of this slowing in the data.

"We do see used car supply continuing to improve and with concerns over the current health of the economy and the eventual effect of interest rate rises, we continue to track the data closely.

"Based on what we’re seeing in the data into August, we remain confident over the health of the market for the coming month.”

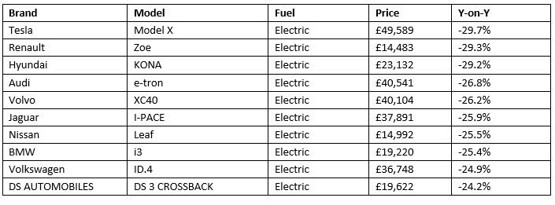

July marked further decreases for electric vehicle values (EVs), with the average retail value £31,568 falling 21.3% YoY to mark a seventh consecutive month of YoY decline.

Since their peak in July last year (£40,728) prices have dropped more than £9,000, which is actually good news for consumers as the cars become more affordable.

It said that in contrast with the dynamics of the overall used market, consumer demand for second-hand EVs has been robust but unable to keep pace with the sharp increase in availability – soaring 173.6% YoY in July and driving down prices as a result.

The fall in the EV market contrasts with a £595 or 4.7% rise in prices to £16,448 for petrol models, and a 4.9% increase in the cost of average diesel cars to £16,571 compared to 12 months earlier.

Login to comment

Comments

No comments have been made yet.