Hartwell is increasing sales to existing customers that have bought on finance at its Abingdon Motor Village by targetting them 18 months before the end of term.

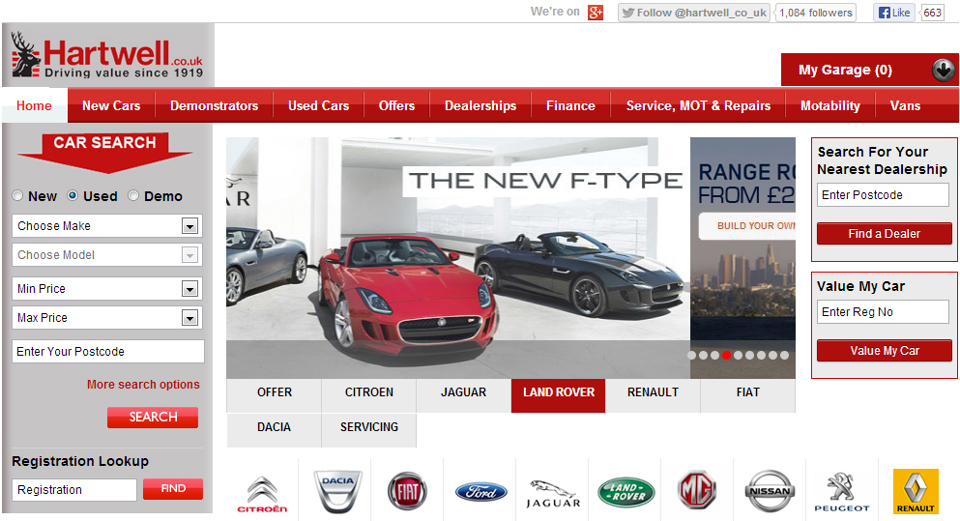

The multi-franchise site, which represents Ford, Citroen and Fiat, is trialling Ebbon-Dacs’ finance renewals tool ahead of a national roll out this year.

The system works by identifying the opportunity for new finance deals for existing customers that still have some time to run on their agreements.

Typically, many dealerships leave it until the last minute before contacting potential finance customers, by which time the equity in their current vehicle could have dropped and a decision may have already been made.

Hartwell can control what intervals it contacts customers on finance renewals. The group found that 18 months lets the customer build up a reasonable amount of equity in the vehicle, allowing the dealership to use that to offer an attractive rate on a new vehicle. Any manufacturer marketing support can also be factored into the deal at this point to make it more attractive.

Hartwell has also seen higher value part-exchange vehicles come into the business as a result.

Ian Wilmore, general manager at Abingdon Motor Village, said: “This new service has not only saved us a great deal of time but has enabled us to ensure that no re-finance opportunity will ever drop through the net.

“We are basically selling more cars to existing customers in a shorter timescale.

“By reducing the time to collate all of the necessary information to make an informed call to a customer, we are contacting more people with a compelling reason to speak to us. Our appointment rate has gone through the roof and in less than three weeks, I have sold eight cars to customers that I know we wouldn’t have spoken to previously.”

In the trial, the dealerships involved were given access to around 500 qualified leads to existing finance deals which still had 18 months to run, generated from Ebbon-Dacs Enquiry Builder solution.

Mark Taylor-Jones, Ebbon Dacs head of sales, said: “We make the calculation based on data held within the DMS, or we can also take data feeds from finance companies.

”The system values the vehicle based on the actual or an estimated mileage and calculates the settlement to work out if the customer is in equity and by how much. These customers are hot leads and the automated feed can be sent to the salesperson’s diary or to the sales manager for distribution.”

Mike - 30/04/2013 15:28

Nothing new here...Isn't this standard Customer Relationship Management... Been doing it for years... Whatever next ?.. :-)