By Philip Nothard

Reviewing what took place in the new car market during 2013 – and attempting to assess the impact of that on market conditions in 2014 – without mentioning the pre-registration debate, is well nigh impossible. But 2013 was certainly a great year for the industry in terms of publicity and a rewarding one for its customers.

|

||

|

Philip Nothard joined CAP in 2010 as its retail and consumer price editor, analysing pricing data and interpreting strategic market trends. In his role, he is able to apply two decades of experience gained in franchised motor retailers, which culminated in running dealerships for the likes of European Motor Holdings, Lythgoe Motor Group and Arnold Clark. |

||

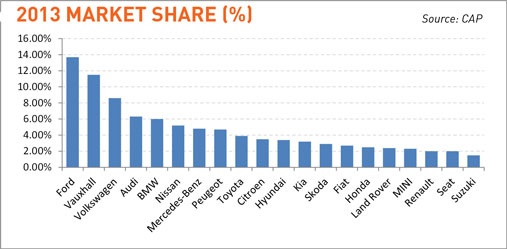

Indeed, 2013 was the first year when a strong argument could truly be mounted for buying new instead of used, thanks to large dealer contribution schemes and PCP offers. With Ford and Vauxhall clearly out in front – as anyone would expect – with well over 10% market share each, the really interesting competition takes place between third and eighth positions. This saw a constant ‘cat and mouse’ game between Audi and BMW as the former regained fourth place in 2013 with 142,040 registrations. Another remarkable statistic, when you recall the market of only a few years ago, was Mercedes-Benz pushing Peugeot back down to eighth with a market share of 4.8%.

With March upon us, a pivotal point of the year for all the manufacturers, the top five show little sign of change, other than Nissan nudging above BMW in January with 8,799 registrations.

Dacia – a manufacturer to watch in 2014

The one manufacturer not mentioned in the graph below is Dacia, which came in at 23 in 2013 – with a market share of 0.8%. It will be one to watch this year and has already kicked off 2014 with a January result of 0.9% market share.

There are no surprises among the registration figures for individual models, with predictably strong showings for the Fiesta, the Focus and of course the Corsa, and the supermini and lower medium sectors dominant in general.

Simon Greiner - 04/04/2014 14:21

Does anyone know if statistics are recorded on the number of finance deals that are or have been written as PCP/GFV agreements, if so are they published?