A rise in the number of car valuation requests in the run-up to the March plate change raises hopes for ‘15’ plate sales, according to GForces and CAP.

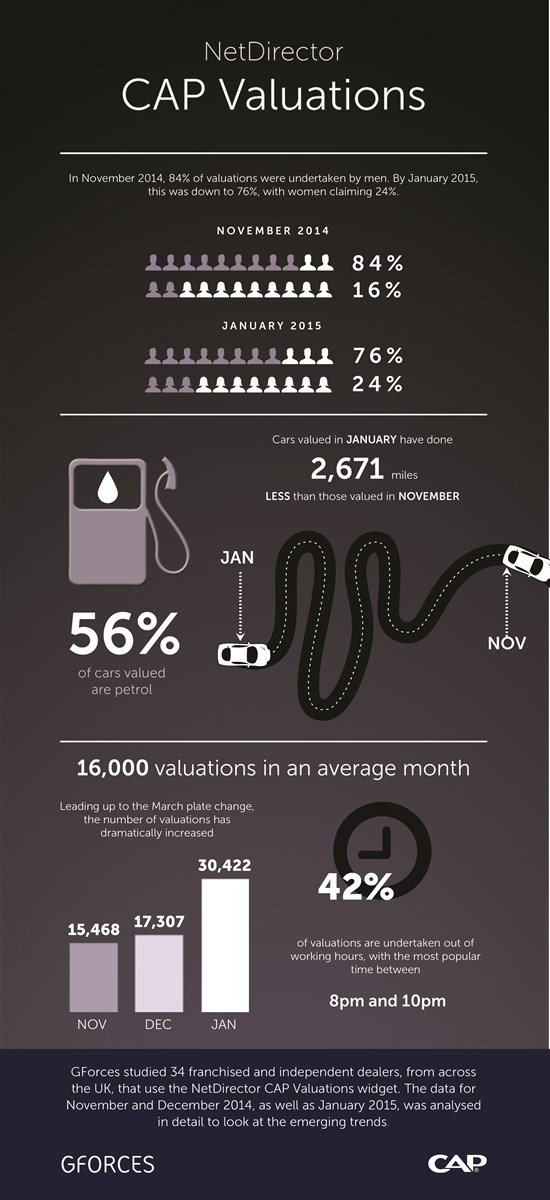

Using data taken from a mixture of 34 independent and franchised dealers across the UK, 62% more valuations were delivered to car owners between November and January via dealers using the NetDirector CAP Valuations web tool.

The number of web visits to GForces’ client’s websites were also up by an average of 36%.

This rise in both visits and valuations is an indication that a greater proportion are in the market for a new vehicle and are undertaking all-important online research.

Group strategy director at GForces Tim Smith said: “The sheer number of people valuing their vehicles since the beginning of the New Year is a clear demonstration of continuing consumer desire to purchase vehicles.

“Many of the valuations we have studied were for vehicles registered between 2010 and 2012 – well within the age range for end of finance term exchange. Google research shows that the average car buyer takes 2.7 months from beginning research to making a purchase; strong web results in January are therefore a good predictor of a strong March.”

In addition to the volume of valuations undertaken, GForces and CAP looked at the changes in the vehicle variants being valued between November and January, ranking the top 50. Predominantly, the vehicles most likely to be traded in are in the A and B segment (such as the Fiesta and Corsa), while owners of D and E-segment vehicles (such as the Mondeo and E-Class) were less likely to trade.

“Despite the dominance of the A and B-segment, it’s interesting to note that with the recent marketing around the new Volkswagen Passat, it has climbed five places since November – the biggest gain of any D-segment car. The big faller within the top 50 was the Jaguar XF, losing 16 places compared to November last year.

Notably; “In November around 84% of valuations were undertaken by men. By January this had reduced to 76% – perhaps demonstrating that the buying process becomes more family-orientated as consumers get closer to making a purchase,” Smith said.

Login to comment

Comments

No comments have been made yet.