Car dealers are not being bribed by their finance company partners and are not expected to show loyalty to their car buying customers, at the expense of their own commercial interests, the UK's Supreme Court has ruled.

But the importance of commission being at fair levels, and being made clearly apparent to buyers, has been upheld.

The Supreme Court has made its decision on motor finance commissions in the Johnson v FirstRand Bank (trading as MotoNovo), Wrench v FirstRand Bank and Hopcraft v Close Brothers cases. It rejected arguments by Wrench and Hopcraft, but has upheld Johnson's claim.

The court determined that because dealers know that in order to sell the car they also need the customer to finance it, they rightly have a personal and commercial interest in arranging the customer's finance - they are not acting as the car buyer's agent or fiduciary.

They do not have a single-minded loyalty to the customer.

It means the end of the three linked cases which threatened to open floodgates to widespread compensation claims costing billions of pounds, which would also damage the level of healthy competition in the motor finance market and impact on the car markets, which generate huge VAT receipts for the Treasury.

Three companies have already withdrawn from the UK's motor finance market in the last 12 months.

Nevertheless, the court has determined that in one case, Johnson v FirstRand Bank (trading as MotoNovo), Johnson's relationship was unfair, in breach of the Consumer Credit Act 1974, because of the considerable level of commission the lender paid the car dealer, worth 55% of the total cost of the credit, and because the documents did not disclose the financial position and in fact intended to create the impression that the dealer offered a panel of products and recommended one.

The factors which all must be taken into account to determine an unfair relationship under the Consumer Credit Act include the size of the commission in relation to the credit supplied, the nature of the commission, the characteristics of the consumer, the extent and manner of disclosure and the compliance with regulatory rules.

Johnson is entitled to compensation in the form of the commission, plus statutory interest.

Background:

Car loans commission: What were the key points for the Supreme Court?

Earlier in the process since the Court of Appeal's decision last Octover the Treasury attempted to intervene.

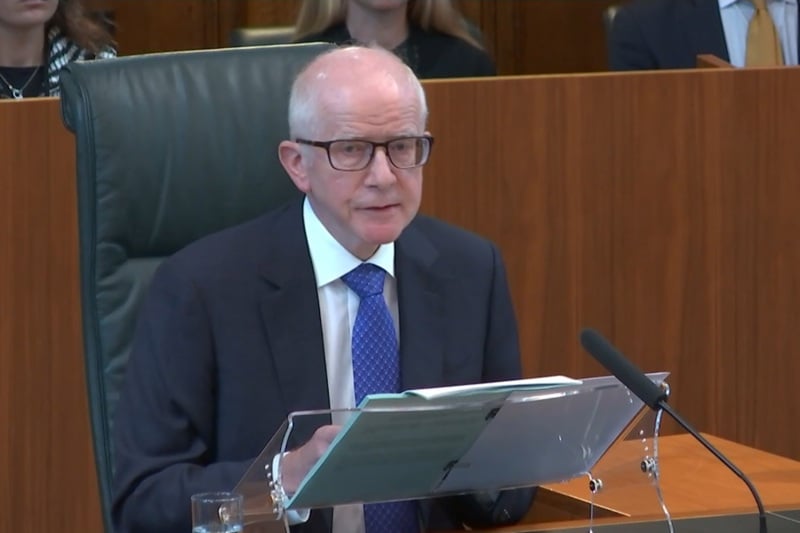

Lord Reed, president of the Supreme Court, made reference to this and hightlighted that the Treasury's intervention was rejected because it focused solely on the potential economic impact of this case. "The Supreme Court is only concerned with the legal issues in this case," Lord Reed added.

Lord Reed (pictured) also highlighted the activities of the claims management companies who have been marketing and signing up consumers with the promise of compensation claims, even though it was too early for the court's decision to be known.

also highlighted the activities of the claims management companies who have been marketing and signing up consumers with the promise of compensation claims, even though it was too early for the court's decision to be known.

Reed's delivery of the judgement's summary took just 20 minutes. On the dealer-customer-lender relationship, he said: "We reject the claims based on bribery on the basis that the payment of the commission was not a bribe. Under the civil law of bribery, as opposed to the criminal law, a bribe is a payment made to a fiduciary which creates a conflict with his duty of single-minded loyalty to the person on whose behalf he is acting."

He added: "In the present cases, the car dealers plainly and properly had a personal interest in the dealings between the customers and the finance companies, as I have explained: they were motivated throughout by their interest in selling cars at a profit. It follows that they did not owe any fiduciary duty to the customers. Each party to the three-cornered arrangement – the customer, the dealer and the finance company – was engaged at arm’s length from the other participants in the pursuit of their own objectives. Neither the parties themselves nor any onlooker could reasonably think that any participant was doing anything other than considering its own interests."

Sign up now to join our special interactive webinar on August 7 discussing the outcome and next steps

Following the end of the case a HM Treasury spokesperson said: "We respect this judgment from the Supreme Court and we will now work with regulators and industry to understand the impact for both firms and consumers.

"We recognise the issues this court case has highlighted. That is why we are already taking forward significant changes to the Financial Ombudsman Service and the Consumer Credit Act.

"These reforms will deliver a more consistent and predictable regulatory environment for businesses and consumers, while ensuring that products are sold to customers fairly and clearly."

The consumer credit and insurance sector regulator now says it will announce on Monday what its next steps will be.

Nevertheless, the recent sleepless nights for many industry executives are over, for now.

National Franchised Dealer Association chief executive Sue Robinson told Automotive Management: "This means so much. We're so grateful, this is really positive news for the industry."

She pointed out that this is a sector that is already heavily regulated, and franchised dealerships in particular operate at the most professional level of the car market, and to get confirmation in law that dealerships rightly have a commercial interest in both selling cars and

"NFDA provided both written and oral submissions that have helped the Supreme Court reach this verdict. As the consumer facing part of the sector, NFDA want to see the regulator act fairly to ensure that UK consumers receive a satisfactory result. This has been achieved today.

"Automotive retail accounts for approximately 78% of the broader automotive workforce, we provide a perspective that is at the coal face of dealing with customers. As we move forward from this case NFDA will continue to provide support to its members ensuring that the UK has a healthy and functioning motor retail market."

Stephen Haddrill, Director General of the FLA, said: "This judgment is an excellent outcome. It properly reflects the role and responsibilities of dealers, lenders and customers, and it has restored certainty and clarity to the largest point-of-sale consumer credit market in the UK. In addition, it has also restored confidence to the sector, confirming that it remains a solid investable option – which in turn means the supply of affordable motor finance will continue for customers.

“Cars are an essential part of UK life – and for many people, relying on a car means relying on motor finance. It’s a product that’s trusted and valued by our customers – just over 80% of new cars are bought on finance, as is a large percentage of used cars.

“The FCA now has the legal clarity to continue its work to establish if a redress scheme is needed, and of course the thousands of unfounded complaints submitted to lenders by claimant law firms and CMCs can now be removed from the system.”

Richard Coates, partner and head of automotive at leading law firm Freeths, said: "This is a significant judgment for lenders and dealers. As we predicted, whilst the Supreme Court found that dealers do not owe a fiduciary duty of trust and confidence when arranging car finance for their customers, the judgment opens the gateway for consumers to bring claims under the Consumer Credit Act, where particularly large commissions have been paid and the relationship is therefore unfair. It is anticipated that the FCA will bring redress for those cases where it is deemed that the relationship is unfair and we expect to learn more from the FCA about this redress scheme within the next six weeks.”

Login to comment

Comments

No comments have been made yet.