A 2.8% fall in new car registrations in February to 80,805 units was caused by lower demand in all segments.

Private registrations were 2% down versus February 2017, at 35,227, while fleet was 2.5% down at 44,544 and business registrations totalled 974 units, 30.4% down.

Diesel continued to suffer, down 23.5% and taking a market share of 35% versus its 44.5% share of February 2017. The SMMT said this was “a disappointing performance given the latest low emission vehicles can help address air quality issues”.

Continuing recent trends, demand for petrol and alternatively fuelled vehicles (AFVs) rose in February, up 14.4% and 7.2% respectively, with the former driven by some new, smaller models coming to market.

Mike Hawes, SMMT chief executive, said, “Although the new car market has dipped, it remains at a good level despite the drop in demand for diesel. Consumers should be reassured, however, that the latest cars are the cleanest in history and can help address air quality issues, which is why they are exempt from any restrictions.

Mike Hawes, SMMT chief executive, said, “Although the new car market has dipped, it remains at a good level despite the drop in demand for diesel. Consumers should be reassured, however, that the latest cars are the cleanest in history and can help address air quality issues, which is why they are exempt from any restrictions.

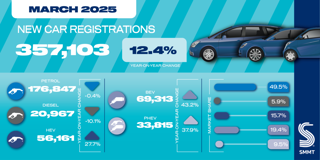

“Looking ahead to the crucial number plate change month of March, we expect a further softening, given March 2017 was a record as registrations were pulled forward to avoid VED changes.”

Nathan Coe, chief operating officer at Auto Trader, said the new car market reflects the “serious decline” in diesel sales and the broader UK economic environment, including fears over Brexit. He believes used cars will provide dealers with the most interesting opportunity in 2018.

“So whilst new cars are down, used cars will be more stable and this year will offer car buyers a great choice of newer, cleaner and better cars which in most cases can be paid for on a monthly basis.”

He said in the past five years the number of cars under four years old listed for sale on Auto Trader has increased by a third.

His views were echoed by Sue Robinson at the National Franchised Dealers Association. She said: "Encouraging notes come from the used car market, which NFDA car retailer members report to remain buoyant. At the same time, the 7.2% growth in the alternative fuel vehicle segment shows that more needs to be done to encourage a consistent uptake of these vehicles as their market share remains low.

His views were echoed by Sue Robinson at the National Franchised Dealers Association. She said: "Encouraging notes come from the used car market, which NFDA car retailer members report to remain buoyant. At the same time, the 7.2% growth in the alternative fuel vehicle segment shows that more needs to be done to encourage a consistent uptake of these vehicles as their market share remains low.

“We look forward to the traditionally strong month of March, where customers can usually take advantage of substantial discounts and offers resulting from the plate change.”

Login to comment

Comments

No comments have been made yet.