Coronavirus has been acknowledged among a series of “significant challenges” facing the automotive retail sector in the middle to long-term in Cox Automotive’s monthly Market Tracker report.

Philip Nothard, customer insight and strategy director for Cox Automotive, said that powertrain confusion and uncertainty about the medium-term impact of coronavirus on automotive supply chains, consumer confidence and economic growth would all impact business planning.

The series of market forces come as franchised car retailers turn to used cars and aftersales in an attempt to fill the gap left by faltering new car registrations, which are being additionally impacted by car manufacturers’ responses to the EU’s new CAFE vehicle emission regulations.

Nothard said: “We are witnessing a fundamental shift in the global automotive sector, with much of the commentary in the past decade about the electric vehicle horizon, automation and Industry 4.0, and Mobility as a Service (MaaS) now making itself felt in the auction halls and on the forecourts across the country.

“While no one could have predicted the specifics of the coronavirus, or exact environmental policy announcements, the direction of travel has been clear for some time now.

“Forward-thinking automotive manufacturers, retailers and fleet management organisations have already begun to diversify their portfolios and introduce new products and services to their offering.

“Putting the customer – or driver – at the heart of decision-making has led to increased digitalisation, flexibility, personalisation and technology innovation. However, these approaches will be tested over the coming months and years as the pace of change is accelerated due to global shifts.”

Nothard added: “While plenty of industry influencers and thinkers are racking their brains to put in place the business models which will best support a future automotive sector which is focused on service rather than product, the short-term presents some more immediate challenges.

“With the long-anticipated Budget this week, a need to push forward with electric and hybrid vehicles to manage current air quality concerns, and consumers challenged around disposable spending in light of any potential community lockdowns or employer closures, retailers will need to think carefully about attraction, retention and margin strategies.”

Cox used car value tracker

Cox monthly Market Tracker report revealed that used car values had continued to rise in February, both through its online channels and Manheim remarketing centres.

February’s values the second highest for the month in the past five years, it said, with the figures for February 2020 putting average prices at £6,756 for the month.

Only February 2018 doing better in the past five years, at £7,160.

Stock availability remains a challenge in the wholesale market, with a few anecdotal reports of declines of up to 20% in stock volumes for this time of year.

Stock availability remains a challenge in the wholesale market, with a few anecdotal reports of declines of up to 20% in stock volumes for this time of year.

Although wholesale volume declines are comparatively small, down just 2.4% YoY compared with a decline of almost 15% the previous year, this marks the lowest February total in the past five years, Cox reported.

With fewer good quality vehicles in the wholesale markets, it said that first time conversions had increased for the third consecutive month, reaching 88.1%, a 3.8% increase YoY.

Average age and mileage are also down YoY, 2.5% and 4.1% respectively, reflecting the start of a move to dispose of and renew vehicles slightly earlier in the process. Combined, this has led to an average price increase of 10.2% YoY.

Data from NextGear Capital, the stock funding arm of Cox Automotive, suggests similar trends, with the average price funded in February increasing to £7,902, up 3.6% YoY.

The volume of vehicles funded was down 2%, however, as the value increased 1.5% YoY, again indicating stock shortages are pushing prices up across the board.

Average days in stock fell 2.3%, to 61.5 days, implying when good quality stock is on the forecourts, it “doesn’t hang around for long”, the report stated.

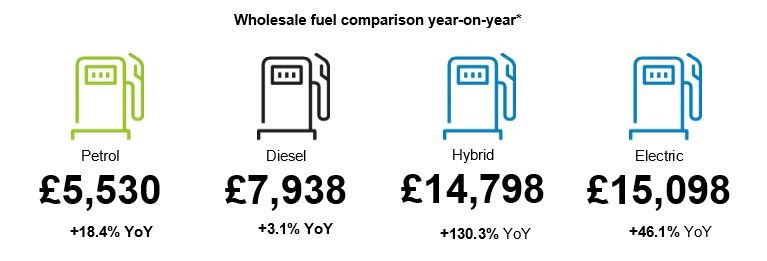

Both petrol and diesel derivative wholesale prices have increased, up 18.4% and 3.1% YoY, respectively.

Both petrol and diesel derivative wholesale prices have increased, up 18.4% and 3.1% YoY, respectively.

Although still comprising eight-out-of-10 new cars registered, new petrol and diesel new car registrations are only going in one direction, according to Cox, and Nothard pointed out that the ongoing shortage of good quality stock will affect a wholesale market.

He added: “By the end of 2020, there should be almost 100 different battery electric and plug-in hybrid models on sale in the UK.

“However, questions remain over how quickly such technologies will be adopted without wider infrastructure investment.

“Hybrid and EV volumes remain low in the wholesale market but prices show strong growth YoY, reflecting greater understanding of the residual value of such models.”

Dealer sentiment survey

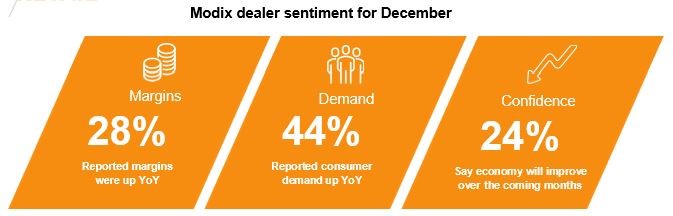

Modix, the digital marketing arm of Cox Automotive, reflected the volatility in the market since the start of 2020 in the results of its latest dealer sentiment survey.

While almost two thirds (60%) of surveyed car retailers were confident in economic improvement in the January survey, just under a quarter (24%) felt the same this month.

While almost two thirds (60%) of surveyed car retailers were confident in economic improvement in the January survey, just under a quarter (24%) felt the same this month.

Just below half of dealers (44%) felt an improvement in retail demand YoY in February, while a fifth (20%) said it was the same as in 2019.

Nothard said: “There are opportunities, with the Consumer Confidence Index for February moving from -11 to -7. It will be interesting to see what happens when we get the March figures and if there is a significant movement.”

The upward trend for online activity continues to provide dealers with growth, with nearly two fifths (36%) suggesting this channel had increased.

Physical footfall also showed a positive movement, with almost a third of dealers (32%) feeling activity in the forecourts had improved YoY.

Almost a third (32%) of dealers reported margins were up in January, dropping to just over a quarter (28%) this time around.

Conversely, a third (44%) felt margins had declined YoY in February, leaving the remaining fifth (28%) to say that margins had stayed the same.

Reflecting the wider market, most dealers reported a clear reduction in overage and days in stock for used cars, at 70% and 64% respectively, as supply pressures mount up.

Stock availability remains of significant concern, with half (52%) of dealers indicating current challenges will remain and the other two fifths (40%) predicting it could get even worse.

Reflecting the recent SMMT results, three fifths (61%) of dealers reported an increasing in consignment stock.

Nothard commented: “It is clear, in an exceptionally volatile market facing significant global pressures, stock availability is a key concern for retailers.

“Good quality stock is making top prices in the wholesale markets, which is good news for vendors.

“Less so for the buyers who are having to cast their net wider and use more creative avenues to source vehicles which offer retail opportunities.”

Login to comment

Comments

No comments have been made yet.