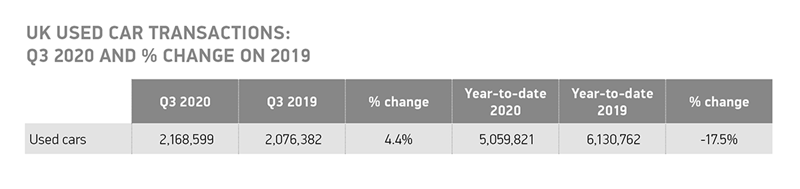

Used car sales volumes rose by 4.4% in Q3 2020 after COVID-19 lockdown measures eased across the UK, according to the Society of Motor Manufacturers and Traders (SMMT).

A total of 2,168,599 vehicles changed hands during the period, with growth recorded in each month of the quarter and the car retail sector’s key September number plate-change month driving highest increase of 6.3%.

But transactions remain 17.5% down year-to-date – with some one million fewer transactions than the first nine months of 2020 – and SMMT chief executive, Mike Hawes, warned of a “less positive” outlook for the remainder of the year as trading restrictions return with the Welsh ‘firebreak and ‘Lockdown 2’ in England.

Hawes said: “With England entering a fresh lockdown, and tighter COVID restrictions in place across the rest of the UK, the car is playing an even more important role in keeping society moving as public transport becomes less attractive for many.

Hawes said: “With England entering a fresh lockdown, and tighter COVID restrictions in place across the rest of the UK, the car is playing an even more important role in keeping society moving as public transport becomes less attractive for many.

“It is encouraging to see used car sales returned to growth but, as the pandemic continues and outlets in many areas are being made to close again, the short-term outlook is less positive.

“Given these premises are often proven to be COVID-secure, we need them to re-open quickly to protect vital jobs and ensure no further delay to the fleet renewal necessary to deliver environmental improvements.”

Data published by the SMMT this morning (November 10) showed that demand for pre-owned electric vehicles (BEVs) had grown by 34.4% (4.4% YTD) following a decline of 29.7% in the.

At the same time, sales of plug-in hybrids increased by 35.7%, with 10,040 changing hands, as petrol and diesel cars both delivered sales volume increases of 4.5% and 2.6%, accounting for 97.42% of all used transactions.

Superminis remained the most popular segment, with a 2% increase in transactions delivering 698,587 purchases, accounting for 32.0% of transactions.

The SMMT said that the lower medium segment was the next best seller, with 27% of the total market share.

Meanwhile, the dual-purpose segment showed the largest percentage growth (16.6%) with 13.0% market share as more of these popular vehicles entered the used market, it said.

Late last month Cap HPI reported that used car values had dropped for the first time since before March's COVID lockdown, declining 2.1% in October as "wholesale prices fell across the board".

Derren Martin, head of valuations UK at cap hpi, said: “The market appears to now be undergoing some realignment. There are several factors at play. Values do tend to drop in the final quarter of the year, by varying degrees, as demand drops away in the run-up to Christmas and supply levels usually increase.

"We do appear to be experiencing that drop off in trade demand, but it is exacerbated this year by economic uncertainty, high prices and reasonable predictions that the consumer appetite for used cars that has driven up prices cannot last forever.”

Last week Auto Trader renewed its earlier COVID-19 lockdown call for car retailers to “hold firm” with their used vehicle pricing as England returned to a state of COVID-19 lockdown.

Richard Walker, Auto Trader’s director of data and insight, said: “As we stressed during the original lockdown, retailers should avoid the temptation to slash their prices in order to entice car buyers, as it simply isn’t necessary and could have a lasting negative impact on the market.”

Login to comment

Comments

No comments have been made yet.