Used car supermarkets sold vehicles almost twice as fast as their independent counterparts as they cut retail prices to drive sales in June.

Data published by eBay Motors showed that stock levels declined for a sixth consecutive month to a new low of 39.9 units, down from 42.3 units in May and 40.8% below the pre-pandemic average of 67.5 units in June 2019.

At the same time, its data showed that dealers’ ‘time to sell’ had improved to an average of 36.5 days – led by price reductions at car supermarkets.

But this may have come at the expense of smaller margins, as average prices for the top 50 leading makes and models on Motors.co.uk dropped 1% from £12,149 to £12,024 – following the 1.9% sector-wide drop reported in May – despite the continued rise in wholesale prices.

Dermot Kelleher, head of marketing and research at eBay Motors Group, said: “The widely reported impact of the wholesale shortage of used cars is being felt by dealers across all sectors with retailers struggling to restock to meet continued consumer demand.

“Another monthly drop in average list prices is unwelcome news for dealers, especially at a time when book prices continue to rise month-on-month, although this could be the consequence of retailers being forced to replace sold stock with older inventory.

“Dealers will need to hold firm on advertised prices over the coming weeks or face the prospect of buying high and selling low.”

eBay Motors’ data indicated that a sector-wide shortage of nearly-new vehicles meant car supermarkets had been the hardest hit by falling stock levels.

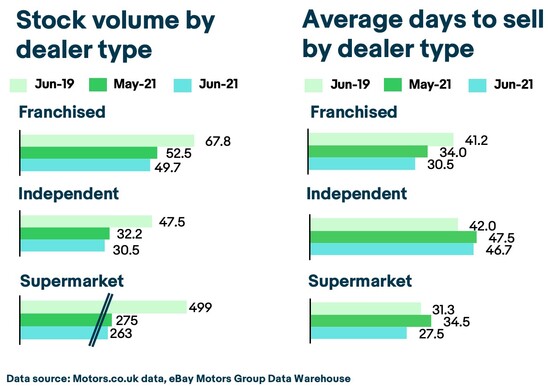

Volumes tumbled 47% to an average of just 263 units, compared to pre-COVID levels of 499 in June 2019, it said.

This represented a month-on-month drop of 4.3% from 275 units in May.

Independents saw their stocks drop 36% from 47.5 units in June 2019 to 30.5 and franchised sites’ stocks fell 27% from 67.8 to 49.7.

Independents saw their stocks drop 36% from 47.5 units in June 2019 to 30.5 and franchised sites’ stocks fell 27% from 67.8 to 49.7.

June’s price drop was led by supermarkets, according to the data.

Supermarkets’ used car prices declined by 1.9% to £12,570, as independents were down 1.4% to £8,890 and franchised dealers saw a 0.9% increase to £14,216.

Car supermarkets’ aggressive pricing resulted in the sector’s fastest sales.

Supermarkets averaged 27.5 days per sales, according to eBay Motors, while independents took the longest at 46.7 days and franchised dealers took 34 days.

The fastest selling cars were found at the higher end of the price spectrum, with cars retailing between £15,000 and £40,000 averaging just 34 days to sell, it said.

This could be a result of new car buyers switching their sights to a used alternative amid lengthy lead times prompted by the global shortage of semiconductors.

eBay Motors reported that the fastest selling used car in June was the Skoda Yeti Outdoor, averaging just 19.4 days to sell, followed by the Kia Sorento (22.3 days) and Land Rover Discovery (23.1 days).

Diesel-engined cars were the fastest sellers by fuel type, averaging 34.8 days, compared to petrol at 37.3 days.

eBay Motors fastest-selling cars rankings for June, 2021:

Login to comment

Comments

No comments have been made yet.