Auto Trader expects used car values to rise in early 2023 after remaining flat in the traditionally weak festive trading period.

Values decreased by an average of just 0.1% on a like-for-like between November and December to leave the average value of a used car on the online used car marketplace up 3.4% year-on-year at £18,066.

Auto Trader said that the stability of historically high values had been underlined by the sector’s continued defiance of pre-COVID depreciation trends, which had seen declines across the same period of 0.2% in 2019, 0.9% in 2018, and 0.5% in 2017 and 2016 respectively.

Values that were up a record 30.5% year-on-year in December 2021 remain 45% up on pre-pandemic December 2019, according to Auto Trader’s data and a statement from the business said it was likely that values would once again “begin to rise in the New Year”.

Its director of data and insights, Richard Walker, said: “From a political and economic perspective, 2022 can be defined as one of change and instability. But whilst transactions and demand have softened on the record levels we saw at the beginning of the year, used car prices, and the market more broadly, have remained stable, which means we’re entering the new year with momentum behind us.

“Throughout this year, the market has been driven by the levels of supply, more than demand.

“We’ve consistently seen on our marketplace, that where there’s stock there’s been strong consumer appetite. With neither a crash in demand or a surge in supply in sight, we believe this dynamic will continue into the new year and will help keep prices stable.”

Prices have remained stable despite the economic backdrop due to the ongoing demand and supply dynamics in the market.

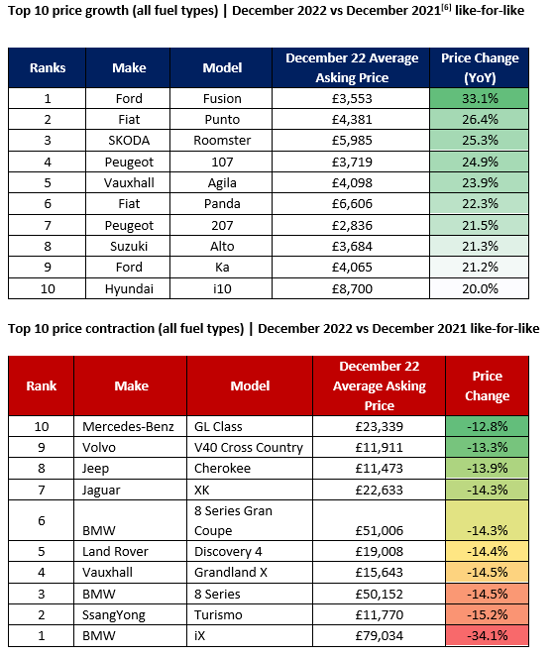

The trend is reflected in the least and most depreciating cars analysed by Auto Trader.

Cap HPI director of valuations Derren Martin recently revealed that used electric vehicles (EV) were seeing the sector’s biggest value declines due to a more plentiful supply of new car registrations.

It was a trend underlined by Auto Trader as it raised concerns that the electric vehicle (EV) market was faltering last week.

Affordable hatchbacks emerged as the most in-demand cars in Auto Trader’s latest data.

Affordable hatchbacks emerged as the most in-demand cars in Auto Trader’s latest data.

No doubt influenced by the cost-of-living crisis, the sub-£6,000 Ford Fusion, Fiat Punto, Skoda Roomster, Peugeot 107 and Vauxhall Agila were the UK’s least depreciating cars.

The high value Mercedes-Benz GL SUV was the most depreciating car, meanwhile.

Overall, Auto Trader said that demand for used cars would remain robust, with circa 500,000 of people waiting for a driving test, the disruption to public transport and the combined five million new and used car sales lost since the start of the pandemic all playing a part.

Advert views on the platform remain up 7% on the same period in 2019, despite available stock being 12% lower, it added.

Login to comment

Comments

No comments have been made yet.