Lexus was the used car brand that delivered most to car dealers in March, ahead of Subaru and Land Rover, according to data from trade sales marketplace Dealer Auction.

Its Retail Margin Monitor found the average car dealer profit in a Lexus was £3,350, almost £1,000 higher than its premium rivals BMW and Mercedes-Benz.

Dealer Auction's top 10 brands by retail margin was dominated by premium and near-premium marques, however Subaru, MG and Mitsubishi also featured in the table.

The company said Lexus's rise to the top "represents the most significant shift".

Its marketplace director Kieran TeeBoon said “Historically, Land Rover has ruled the roost, only once before being knocked off the top spot by JLR stablemate, Jaguar. So Lexus and Subaru taking the top two spots is very interesting.

"Though it's worth noting that Subaru’s well-documented supply issues could be playing a part in driving prices up, and the heavy snow fall at the start of the month may well have contributed as the marque is a popular affordable all-weather car.

“While the persisting presence of luxury cars in the table cannot be ignored, the performance of MG and DS Automobiles shows that by tapping into different revenue streams, dealers can outpace the market – and cash in.”

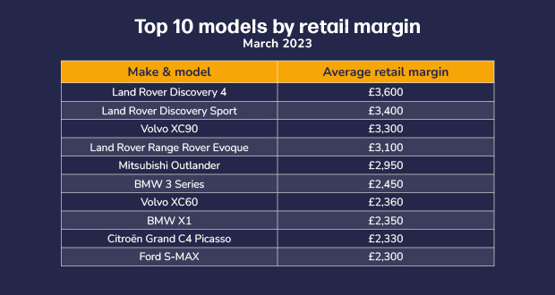

No Lexus car features in the top 10 models by retail margin, however. This table is led by Land Rover, whose Discovery 4, Discovery Sport and Range Rover Evoque all offered more than £3,000 margin.

"Amid the current suppressed supply of used cars, dealers shouldn’t be compromising on their stock-buying strategies," added TeeBoon.

"Amid the current suppressed supply of used cars, dealers shouldn’t be compromising on their stock-buying strategies," added TeeBoon.

"Acting on the available data insights will give them the confidence to leverage profit opportunities from both the consistently high-ranking products and the seasonally popular models, such as the S-Max and Grand C4 Picasso – providing unique opportunities for profit.”

At Auto Trader, which co-owns Dealer Auction with Cox Automotive, its director of insights Richard Walker said: that against a backdrop of political and economic uncertainty, used car prices remained strong in Q1 and the profitability of the models highlighted in the Retail Margin Monitor confirms this.

"Despite the strength of the used car market however, retailers missed out on nearly £25.5 million in potential profit in March by pricing their stock below their true market value with each retailer leaving an average of £3,300 in potential profits on the table as a result," Walker added.

Login to comment

Comments

No comments have been made yet.