Mazda's CX-5 was the fastest selling model in Dealer Auction’s top 10 profit achievers for May.

Dealer Auction has added two new metrics to its Retail Margin Monitor to further support dealers in identifying the most profitable stock for their forecourts.

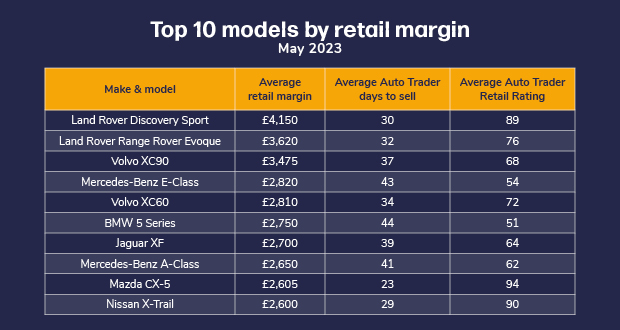

The digital platform has included ‘Average Auto Trader days to sell’ and ‘Average Auto Trader Retail Rating’ alongside its top 10 profit-generating models for May 2023 to add extra context to the results.

The new metrics show that models appearing lower down the top 10 profit chart might prove the most suitable stock for dealers.

For example, the Mazda CX-5 at number nine might have a lower average retail margin (£2,605) than those above it, but it’s the fastest seller in the top 10 (23 days, on average) and also has the highest Average Auto Trader Retail Rating (94).

The consistent top performer, the Land Rover Discovery Sport, continued to reign supreme – with an average retail margin of £4,150, an Average Auto Trader days to sell of 30 and an Average Auto Trader Retail Rating of 89.

Kieran TeeBoon, Dealer Auction’s marketplace director, said: “You could say the Land Rover Discovery is the ultimate ‘triple treat’ for your stock.

“The new data metrics reinforce what we’ve always said – it’s essential for dealers to have a healthy stock mix of ‘quick wins’ and opportunities for higher profit.

“The performance of the Mazda CX-5 and also the Nissan X-Trail shows that dealers shouldn’t shy away from mainstream brands when seeking extra profit.

“In theory, you could sell two Mazda CX-5 models with a combined profit of £5,210 in a similar amount of time to selling one BMW 5 Series with a £2,750 profit.”

The newly included metrics will now be featured in the Retail Margin Monitor going forward.

The ‘Average Auto Trader days to sell’ reflects the estimated number of days it will take a dealer to sell that specific vehicle to a consumer, while the ‘Average Auto Trader Retail Rating’ uses three key metrics to determine consumer demand for the vehicle, with a higher score being more desirable.

At brand level, Land Rover topped the chart with an average retail margin of £3,510, followed by BMW (£2,720) and Mercedes-Benz (£2,670).

TeeBoon said: “It’s clear that dealers are paying close attention to data and insights to support their instincts when sourcing quality stock.

“Our evolution of the Retail Margin Monitor reflects this – drawing on the real-time data capabilities of Auto Trader to highlight models that can offer not just solid profit, but a quicker turnaround too.

“We look forward to seeing how this shift in reporting impacts the overall performance of the top 10 going forward.”

Richard Walker, Auto Trader’s data and insights director, said a car that isn’t selling is not only eating into its own potential margin, but it’s also preventing the sale of stock that could be sat in its place.

He added: “These new metrics offer a powerful new layer of intelligence, which will help retailers to maximise overall profit potential by not only identifying stock with the best individual return, but also those most likely to fly off forecourts.”

Login to comment

Comments

No comments have been made yet.