Plug-in vehicles accounted for almost a quarter of all new car sales in February*, with year-on-year growth achieved by both pure battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs).

BEVs have tended to steal the headlines since 2020, as the UK strides towards the Government’s proposed 2030 cut off of the sale of new petrol and diesel new cars. Yet, on delving into the premium PHEV market - the less exciting yet, arguably, more practical solution for many buyers - there are interesting facts to be found.

In February’s private market, Land Rover dominated the plug-in hybrid car sector, with four of its models sitting in the top 10 PHEVs, and another two falling outside it.

In fact, Land Rover accounted for more than a quarter of the 1,242 PHEVs privately registered last month, with the Evoque being its star seller.

The appeal of its chunky, premium SUVs remains, albeit more buyers are looking for those fuel efficiency and CO2 emissions improvements that come from covering part of the journey under electric power.

Sister brand Jaguar had much more modest success, with 29 units registered in the private market, largely thanks to the F-Pace.

Jaguar was matched by Lexus, which was wholly reliant on the NX, and it was ahead of Audi, which recorded 23 buyers for its PHEV cars, largely picking the Q5 SUV which claims a 37-mile electric range and 166mpg official fuel economy.

Jaguar was matched by Lexus, which was wholly reliant on the NX, and it was ahead of Audi, which recorded 23 buyers for its PHEV cars, largely picking the Q5 SUV which claims a 37-mile electric range and 166mpg official fuel economy.

Over at BMW, the X1 SUV accounted for one-in-every-three of BMW’s 149 private PHEV sales in February – priced from £42,000 it’s quite a compelling offer although its maximum range of 32 miles doesn’t stand out.

Mercedes-Benz dealers found 79 private buyers for PHEV models in February. Interestingly, in a market dominated by SUVs, the CLA-Class four-door coupé and C-Class saloon, capable of up to 40 miles and 68 miles on electric power respectively, were most popular with customers. Both are being marketed with monthly payments below £600.

Perhaps it’s little surprise that Volvo notched up 91 PHEV sales to private customers in February, given the brand is proudly far along its electrification strategy.

It has plug-in hybrid powertrains on offer across its model line-up.

Good finance offers on its SUVs, combined with generous equipment and reasonable electric range are ensuring that models such as the XC40 are tempting consumers.

FLEET PHEV DEMAND

Economic pressures are not preventing fleet customers buying or leasing high-end PHEV cars.

Business drivers save cash due to the lower benefit-in-kind (BIK) tax bands such vehicles fall into thanks to their CO2 emissions being much improved compared with petrol and diesel cars.

A higher-rate income taxpayer could easily save four figures annually.

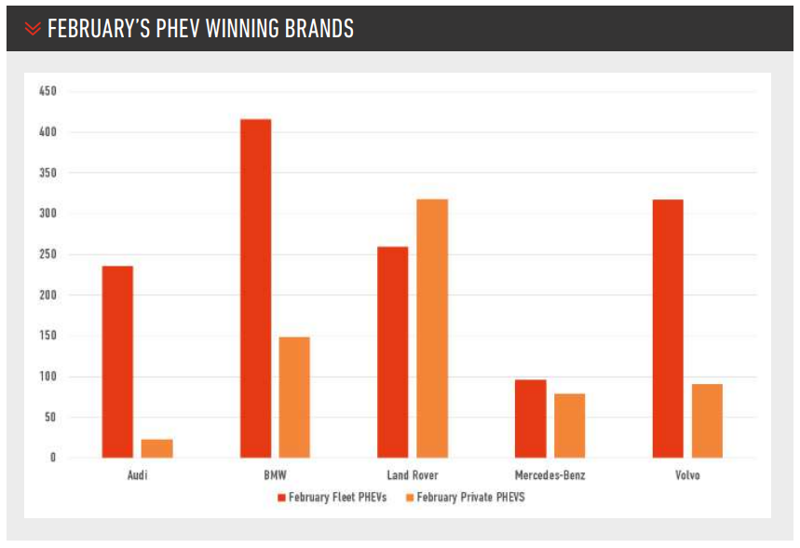

BMW, a corporate favourite as testified by its raft of Fleet News awards, was leader of the pack in February, getting 416 new PHEVs out to company car customers – almost 100 more than nearest competitor, Volvo.

The 3-Series was BMW’s star performer, accounting for more than half of its PHEV sales to fleets. Its SUVs fared less strongly.

At Volvo the scene was reversed – its XC SUV models dominated the order book and its saloons and estates were the also-rans.

Having sold the most PHEVs to private buyers, Land Rover could only manage third place in the fleet market.

Nevertheless, with 151 registrations its Evoque was the second most in-demand PHEV after the BMW 3 Series, and the rest of Land Rover’s range helped take the brand’s total up to 259 units.

Nevertheless, with 151 registrations its Evoque was the second most in-demand PHEV after the BMW 3 Series, and the rest of Land Rover’s range helped take the brand’s total up to 259 units.

Jaguar, however, managed a total of 22 – again outmatched by Lexus with 36.

Audi wasn’t far behind Land Rover, in fourth place, with 236 PHEV registrations to fleets. Surprisingly none were its biggest cars, the luxurious A7 and A8 where the emissions benefits can be keenly felt, but, unsurprisingly, more than half were its entry-level plug-in vehicle, the A3, winner of What Car?’s Best Hybrid Family Car award.

At Mercedes-Benz, again the CLA-Class was its highlight, with half of the German brand’s total 96 PHEV fleet registrations.

Amid the remainder was a handful of plug-in S-Class cars – seemingly Mercedes had more luck finding corporate customers for huge luxury saloons than Audi in February.

MAINSTREAM SUCCESSES

Between them, the premium brands accounted for more than half of all the PHEVs delivered to fleets in February, but, naturally, they don’t have the entire market sewn up. Among the mainstream brands there were a number of strong successes.

Kia had the best-selling mainstream PHEV here, the Sportage, with 204 finding fleet customers, while close behind were the Hyundai Tucson at 196 and the Volkswagen Golf at 195.

Kia had the best-selling mainstream PHEV here, the Sportage, with 204 finding fleet customers, while close behind were the Hyundai Tucson at 196 and the Volkswagen Golf at 195.

In the private market, however, the crown went to Ford’s Kuga with 86 sales, trailed by the Hyundai Tucson with 68.

What becomes evident from delving into PHEV sales is that the opportunity for franchised dealers is strong, and the financial benefits are helping them attract new car buyers who want a lower emission vehicle but aren’t yet ready to step into a pure electric car.

*This feature first appeared in the latest, and final, printed edition of AM Magazine. Access the full, digital version of AM's March edition by clicking here.

Login to comment

Comments

No comments have been made yet.