Compliance & risk management - Page 3

All articles

Biennial MOT testing plan gets push back from Independent Garage Association

Plans to introduce biennial MOT testing in Northern Ireland, where there is a large backlog of tests required, will put lives at risk and undermine environmental aims, according to the Independent Garage Association.

Government throws industry £2.3bn lifeline and greater flexibility to support EV switch

The 2030 phase-out date for new petrol and diesel cars has been officially reinstated and full and plug-in hybrid vehicles can be sold until 2035 as part of a new package of government reforms and funding

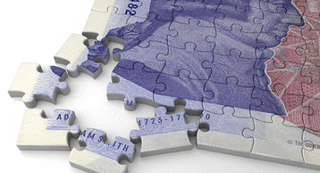

Car loans commission case ends, ruling not likely until the summer

The UK's motor finance industry must wait until the summer to hear whether the Supreme Court will overturn the notion that lenders and their partner car dealerships have been unfair with their customers because of the finance commission paid to dealers.

Third of drivers unaware they could be due compensation in commissions probe

A third (34%) of drivers are unaware they may be entitled to compensation due to historic discretionary commission arrangements (DCAs), according to a new survey by direct-to-consumer online lender Carmoola.

Customers trusted car dealers while unaware they earned finance commission, survey finds

New research reveals that 65% of car finance customers who took out loans before the ban on discretionary commission arrangements (DCAs) trusted their dealer to offer them the best deal

Executive View: Trust and transparency are the key drivers sought by the FCA and courts

Eddie Flanagan, partner at law firm Shakespeare Martineau, notes that it while a spotlight remains on the UK's motor finance market due to important legal actions it is critical for lenders to be continuously refining their data and practices.

Executive View: Gaining ground with GAP insurance

It’s a year since the FCA’s investigation into GAP insurance, casting light on the character of the motor finance industry. But GAP is back on the table and motor retailers can make strides to re-build revenue, writes Duncan McClure Fisher, CEO at Intelligent Motoring.

Executive View: Why data protection is key to the industry’s future

Since the creation of the first car in 1886, the automotive industry has had a long-standing history of adopting and embracing cutting-edge technologies, writes Chris Linnell, associate director of data privacy at Bridewell.

Finance industry braces for Supreme Court ruling on commission disclosure

The Finance and Leasing Association admits it is bracing for all possible outcomes - both good and bad – in the imminent Supreme Court’s ruling on commission disclosure which will ultimately determine a lender’s fiduciary duty and whether it will be enshrined as a permanent legal standard.

Black Horse owner Lloyds puts aside £1.25bn awaiting car loan commissions outcome

Lloyds Banking Group, which owns Black Horse Motor Finance and Lex Autolease, has put another £700 million into its pot for potential compensation while it awaits the outcome of the car loan commission saga at the Supreme Court.