Compliance & risk management - Page 2

News

News

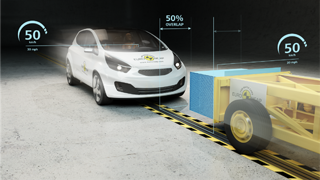

Euro NCAP sounds alarm over ‘car bloat’ and head-on crash compatibility

Independent car safety authority, Euro NCAP, has issued a warning over the growing trend of heavier, bulkier vehicles - highlighting the impact that so-called "car bloat" may have on road safety.

Manufacturer News

21 May 2025

News

Biennial MOT testing plan gets push back from Independent Garage Association

Plans to introduce biennial MOT testing in Northern Ireland, where there is a large backlog of tests required, will put lives at risk and undermine environmental aims, according to the Independent Garage Association.

Supplier news

16 Apr 2025