Used car retailers are being warned of unsettled market conditions for the next five years as the UK-wide economic uncertainty leads to a consolidation of dealer networks.

Forecasts for the used car market show it mirroring the predicted ‘W’-shaped economic recovery with a period of growth as interest rates remain low, followed by a further downturn as interest rates begin to rise from 2011, according to a new report from Trend Tracker, entitled ‘The future of the used car market in Great Britain 2009 to 2014’.

Fuelled by factors contributing to a recession feared to be the worst since the Second World War, doubts around the validity of early signs of recovery have led to warnings of long-term uncertainty.

Trend Tracker admits that in the 12 years its report has been produced the outlook for the used car market has never been so uncertain.

“If the UK economy manages a sustainable recovery from the existing recession with households balancing their need to maintain consumption while reducing outstanding debt, then the market will recover steadily, but at a subdued growth rate in line with the overall trend in consumption,” the report says.

“However, given the UK consumer’s tendency to take a very short-term view of the economic outlook, we believe consumers in the UK will be lulled into a false sense of security by current historically low interest rates in the belief these will remain low and households will resume borrowing where possible to benefit from an expected rise in asset values, especially of property.”

The consequences of the economic factors are a fall in new car sales, leading to a shortage of used stock, the impact of the scrappage scheme, drivers keeping their cars longer leads it to make the following conclusions:

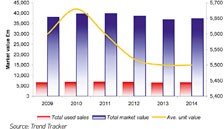

- Market value will be highest in 2011 rising by 5% compared to 2009 to £39.9 billion before falling by 6% to £37.5 billion in 2014

- The used car market will grow in terms of volume sales by 5% to 7.13 million units by 2011, but will then fall to 6.82 million sales by 2014

- Average purchase prices will rise by 2% from £5,600 to £5,685 in the short term before falling back to £5,500 in 2013 and 2014

The impact on dealers is likely to be further consolidation and, with manufacturers relaxing their rules, “an increase in multi-franchising of new car sites”.

“A period of consolidation among vehicle manufacturers will mean that a number of dealership locations will be lost as solus locations are closed in favour of multi-franchise locations.

“Dealer groups are likely to be as affected as much as family-run dealerships,” the report says.

‘The future of the used car market in Great Britain 2009 to 2014’ is available through Sewells.

The report looks at factors such as the UK economy, car ownership trends, market segmentation, fleets, franchised and independent, plus a brand-by-brand analysis.

Follow the link under Industry Reports at www.sewells.co.uk

Login to comment

Comments

No comments have been made yet.