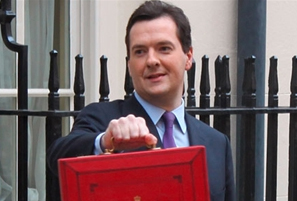

George Osborne has delivered his Budget 2013 and announced that corporation tax will be cut from 28% to 24% next year and then down to 20% in 2015.

This will mean the UK has the lowest tax rate of any major to western economy. The Government will also unify the small profits rate and the main rate in 2015, so that there is a single rate of corporation tax.

The Government will also increase the income tax personal allowance by £560 to £10,000 in 2014-15, a year ahead of schedule.

By April 2014, 2.7 million low income individuals under 65 will not pay income tax and from April 2014 the typical basic rate taxpayer will pay £705 less income tax a year in cash terms.

The basic rate limit will decrease to £31,865 in line with the 2012 autumn statement decision to increase the higher rate threshold by 1 per cent to £41,865.

Osborne said the UK would avoid a triple dip recession, but growth in 2013 would be 0.6% - half the 1.2% he predicted four months ago in his autumn statement. Growth for 2014 is expected to increase by 1.8% in 2014 and 2.3% in 2015.

Osborne has also scrapped the planned rise in fuel duty in September, which would have added 13p to the price of fuel.

There will be two new company car tax bands from 2015 to be introduced at 0-50g/km and 51-75 g/km CO2.

Trade agreements with Japan were highlighted as a priority by Osborne, which could help import costs for dealers with Japanese franchises.

Government economic forecast

GDP growth in 2012 was slightly stronger than expected in the autumn statement in 2012.

However, reflecting the lower than expected momentum in the final quarter of 2012 and smaller contributions to growth from net trade and consumption, forecast for GDP growth in 2013 has been altered from 1.2 per cent to 0.6 per cent and from 2.0 per cent to 1.8 per cent for 2014.

The forecast for GDP growth from 2015 onwards is unchanged from its forecast in the autumn statement in 2012.

Employment is expected to rise in every year reaching 30.5 million by 2017.

Total market sector employment is expected to rise by around 2.6m between the start of 2011 and the start of 2018.

The unemployment forecast has been revised by 0.3 percentage points to 7.9 per cent in 2013 and by 0.2 percentage points in 2017 to 6.9 per cent.The inflation forecast is up slightly, attributed to higher oil prices and higher import prices inflation is expected to return to target by early 2016.

Fiscal forecast

Public sector net borrowing is forecast to fall by a third over the three years from 2009-10, from its post-war peak of 11.2 per cent of GDP, to 7.4 per cent of GDP in 2012-13.

It is then forecast to continue to fall to 5.0 per cent of GDP in 2015-16 and 2.2 per cent of GDP in 2017-18.

Public sector net debt as a share of GDP is forecast to peak at 85.6 per cent of GDP in 2016-17, before falling to 84.8 per cent of GDP in 2017-18.

Industry comment:

Robert Forester, Vertu chief executive, said on Twitter: “Delighted to see stamp duty on AIM shares abolished and corporation tax reduced again. Great news for our business.”

Matt Hodgson, tax partner at ASE, said: "Corporation tax cuts simply means that there will be more cash on the bottom line of UK businesses.

"The raise in annual income tax allowance to £9,440 from April this year, rising to £10,000 in April 2014 will mean more money in the consumer’s pocket.

"And combined with the Chancellor’s comment that the UK now manufactures more cars than it imports, which can only be positive for the long term security of the UK’s motor industry, this looks to be one of the most positive Budgets for both individuals and businesses in the UK for a number of years.

"Hopefully with more cash in our pockets and improved confidence levels the decision to buy that next car will be an easier one to make."

Chris Morgan, head of tax policy, at KPMG in the UK, said: “Overall this was a business-friendly budget on tax. There were lots of juicy tax carrots, and a very large stick.

“The ‘carrots’ were a corporation tax rate cut, a national insurance allowance for small businesses, an extension of the CGT holiday for seed enterprise and an extension of the creative sector tax reliefs. The ‘very large stick’ comes in the form of a raft of anti-avoidance measures. These include the widely anticipate General Anti-Abuse Rule plus details of rules on the government only awarding procurement contracts to business that are compliant on tax.

“The government has reiterated that it intends to deliver the most competitive tax system in the G20. It is on track to do that as evidenced by our own KPMG survey issued earlier this year. What they have also made crystal clear is that they will not tolerate non-compliance on tax. The Chancellor has yet again spelled out his ‘play fair by us and we’ll play fair by you’ policy on business tax.”

Alex Henderson, leads PricewaterhouseCoopers (PwC) Budget team and is a partner in its tax practice, said: "The Chancellor gets marks for sticking to his plans, emphasising Britain is open for business by cutting the corporation tax rate, and simplifying the system too. There was actually very little unexpected, but the tone was upbeat. Having set low expectations, this Budget should help build business confidence even though, on the whole, it was fairly steady as she goes.

"There were various measures for small business, with the new employment allowance likely to make the biggest difference. But relief for entrepreneurs and employee incentivisation is relatively small."

Francesca Lagerberg, head of tax at Grant Thornton UK, said: "The good news was undoubtedly in short supply, but we did get a commitment to a further reduction in the mainstream corporation tax rate – down to 20% in 2015, making us one of the most competitive countries in the EU on this measure. It also removes the complexity of having a mainstream as well as a small companies rate at a stroke.

"To promote employee ownership, there will be a consultation on a new capital gains tax relief on the sale of a controlling interest in a business. This measure will not see the light of day until 2014.

"And for investors in fledging businesses there is a two year extension to the capital gains tax break if they qualify for the seed relief announced last year

"There was also the much-hyped commitment to a £10,000 personal allowance for those entitled to it. This means around three million earners fall out of the tax net. This measure was always in the offing being a manifesto pledge, but bringing it in by 2014 will be a useful aid to those who are on low incomes, who have little hope of significant pay increases."

"There was no surprise that the speech was heavy on rhetoric against aggressive tax planning. The General Anti-Abuse Rule (GAAR) comes in to effect in July (after Royal Assent to the Finance Bill 2013) and will change the face of tax planning in the UK.

"The detailed guidance that will run alongside the legislation will be out in the middle of April."

Sue Robinson, NFDA director,

said: "Many of the measures in this year’s budget will help consumers by increasing the amount of disposable income they have available.

"Increasing tax allowances, reducing duty of beer and scrapping increases in fuel duty will assist the hard pressed consumer. We urge Government to commit to reducing the tax burden on consumers to help stimulate the UK economy.

"The news that corporation tax will fall to 20% will be welcomed by businesses across the UK. The merging of the small business rate to form one corporation tax rate for all businesses is a positive move fully supported by the NFDA."

Simon Walker, director general of the Institute of Directors, said: “We applaud this budget. The Chancellor has stuck to his guns and held his nerve - which is exactly what we wanted to see. Deficit reduction is not an optional policy, it is an absolute necessity, and he is right to reject the siren calls to abandon it.

“Businesses will be glad that George Osborne has also continued the downward pressure on corporation tax. Britain must become the most competitive place to do business, and lower taxes will attract welcome investment from abroad.

“The new allowance to reduce the tax on employing people is a welcome boost for businesses who are working hard to grow. The private sector has done a huge amount to improve the employment figures, and it is right that they are rewarded for doing so. This will see more people helped out of unemployment, which is a very good thing.

“We have long called for a co-ordinated set of policies to encourage the development of a UK shale gas industry. The Chancellor is absolutely right to set attractive conditions for shale exploration - this will create thousands of jobs, and reduce our reliance on expensive foreign imports.”

James Tew, director at motor dealer technology company iVendi, said: “There is little in the Budget to cheer dealers but, with the lack of wriggle room available to the Chancellor, this is only to be expected.

"Osborne went to some lengths to underline, the economic picture for the immediate future remains, at best, flat. As a result, we believe that the dealers who continue to prosper in the next year will be those who follow the same strategy that has enabled the best to maintain profitability throughout the post-credit crunch period – working to increase the number of opportunities available to them and ensuring those opportunities are maximised. We believe that achieving this will be increasingly realised by making use of new technology that is both productive and cost-effective.”

The Forum of Private Business chief executive Phil Orford said: “The Chancellor was absolutely spot on to make this decision today. No one wants to see fuel prices any higher than they are and small businesses will welcome that.

"Let’s not forget though that prices are fast approaching record highs – any increase would have been reckless so this was just basic common sense.

"We still feel the Government needs to implement some kind of fuel stabiliser. The only way we’re going to see anything approaching a fair price for fuel in the UK will be via a mechanism that works to bring fuel tax down when prices are high. Such a system would mean prices as they stand now would not be hovering just shy of £1.50 and taking money from the pockets of consumers better spent elsewhere in the economy.

“Unfortunately the UK will now suffer for another year at the mercy of fluctuating oil prices right when we need it least because of the Chancellor’s failure to introduce such a system.”

Michael Wistow, head of tax at City law firm Berwin Leighton Paisner LLP, said: "It can only be good news to reduce corporation tax rates from 2015 to 20% and to abolish transfer taxes on AIM shares and to have an emphasis on reduced tax rates which result in the rich paying a higher proportion of total taxes raised than the populist concentration on rates of tax."

Clive McGregor – Dealer Principal Marshall Group - 21/03/2013 10:19

George Osborne delivered the budget statement with vigour equating to a positive tone, this alone creates optimism among the masses. The budget weighted towards tax cuts and popular consumables that the public identify as a good thing – a shrewd move on Osborne’s part. The increased tax allowance has it’s obvious merit’s which can only be good for the majority.