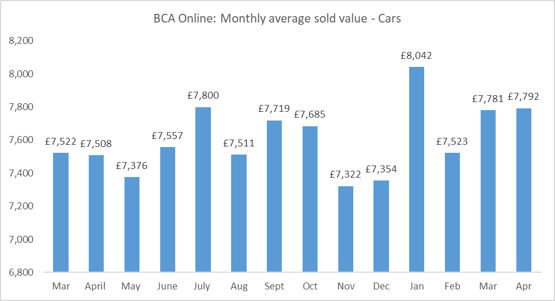

Used car prices rose marginally in April, with BCA’s online sales recording an average sale value of £7,792—just £11 higher than March.

BCA saw continued record buyer participation and strong online engagement, with sales conversions outperforming seasonal norms.

Performance against price guide expectations experienced some pressure during April, and while price movements shifted more significantly than over the past few months, the April-to-May movement was better than many previous years and BCA said this reflects a more seasonal easing of demand and the effect of a very late Easter this year.

Used car values averaged £7,777 at BCA in Q1, equivalent to 97.7% of guide price expectations across the board and ahead of the same period in 2024 in terms of price performance and sold volumes.

Buyer demand across BCA’s sales programme, combined with a relative shortage of prime three to five year old stock, "ensured a competitive environment and the healthiest sustained performance seen for some time".

Stock criteria is broadening

Sourcing stock continues to be a key challenge, with retailers reporting difficulty finding the right cars to meet customer needs.

Many dealers have been broadening their buying criteria to keep forecourts full, at least according to anecdotal feedback from BCA’s customers.

BCA chief operating officer Stuart Pearson noted: “April felt like another solid month across the used car sector with performance and volumes well ahead of the same period last year.

"While the intensity in the market has eased from earlier in the year, the best stock remained well fought over and buyer engagement remains at record levels.

"Condition and desirability are becoming more critical. There’s growing pressure on vendors to price realistically if they want to maintain conversion rates.”

BCA is expanding its refurbishment capacity and said an increasing number of clients are using its data-led reconditioning tools to improve first-time sale performance and reduce time-to-retail.

Looking ahead, Pearson cautioned that the May Bank Holidays and the usual early-summer lull could test resilience.

He added: “With some seasonality now impacting, any vehicle in poorer condition as well as some of the less-desirable repeat model vehicles, came under more pressure than we’ve seen for a while.

"What remains clear, is that there’s still a home for every vehicle and buyers continue to follow the decisive sellers that value stock competitively and are pragmatic with their expectations.

"While navigating the May Bank holidays and the run towards the summer can put pressure on the market, there’s a level of optimism that suggests with a little extra focus, it should be very possible to maintain the momentum that the used car market is experiencing."

Login to comment

Comments

No comments have been made yet.