Mitsubishi Motors in the UK will follow-up the launch of its Buy Online retail offering with a new focus on city centre car stores and pop-up shops as its network expands in the New Year.

Outgoing managing director Lance Bradley told AM revealed plans that would put the brand on a path to grow the size of its network from the current 115 to 120 but revealed that the format was set to change, stating: “That doesn’t mean full scale dealerships.”

Bradley, who will officially step down on March 31, after 17 years with the brand – initially as sales and marketing director and as managing director for the past nine years – said that Mitsubishi’s first UK store would open in a London shopping centre prior to his departure.

“We are looking at stores in shopping centres and will have out first store at the end of March,” he said, adding: “It’s a model which solves the cost of representation issue in city centre locations like London, Birmingham and Manchester.

“It also creates a hub and spoke approach with a small representation in urban centres that can support dealerships in outlying areas, rather like a Sainsbury’s and Sainsbury’s Local.”

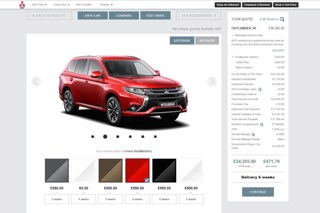

Bradley said that the model was also complimented by the new Mitsubishi Buy Online platform which was launched last month in a partnership with online retail specialist Rockar.

He said that the fact that customers now have the choice to complete the entire customer journey online could reduce the demands of space and staffing on dealerships, meaning that the brand could avoid the high-cost real estate demands of other brands.

Mitsubishi’s new online platform claims to major on flexibility, allowing customers to choose how much of the car buying process they complete online, with an end-to-end offering available which will see cars delivered to a customer's door by the brand’s dealer partners and logistics and remarketing partner BCA facilitating part-exchanges.

New platform, same remuneration

Bradley told AM that Mitsubishi dealers receive a full margin from cars sold online even when the sale is completed entirely online, with the retailer only contributing a delivery and handover service.

He said: “The remuneration doesn’t vary. It has to be the customer that chooses how they buy the car. If you said to dealers, if you work in the showroom you get this much or online this much the dealer would understandably try to deter people from online and that would defeat the point of the whole exercise.

“There’s no point having a process that the dealers hate. We had to take the dealers with us.”

Bradley said that all but one of Mitsubishi’s UK retail partners had signed up to Buy Online, but would not share the reasoning behind the lone dealer who declined to embrace the concept.

A total of 100 people had registered with the Buy Online service within the first fortnight in operation, Bradley said, with three completing an end-to-end online car purchase.

He claimed that the first had actually been completed in the area of the network’s lone non-participating dealer.

He said: “I don’t know why you wouldn’t embrace Buy Online. We embarked on the project in consultation with retailers and they generally acknowledge that what they will be getting from it is ready-made leads.”

Bradley described Buy Online as an “incredibly useful marketing tool” which allowed the brand to analyse people’s online habits such as what part-ex was being traded, which finance deals were considered and ultimately chosen.

It also allows the brand to look at dealers’ capacity and identify possible open points in the network.

Dealer feedback

In September Mitsubishi finished eight from bottom in the NFDA’s Summer 2017 Dealer Attitude Survey with a 4.4 score from dealers asked to rate their manufacturer overall.

The result marked an improvement on the Winter 2017 survey’s 3.9 score, but Bradley voiced frustration at the brand’s continued low scores.

He said: “The NFDA survey continues to be a huge source of frustration for us. You get a response from a number of dealers and you don’t know who they are or what their issues really are.”

Among the results, Bradley highlighted Mitsubishi’s 6.8 score for its ‘cost of training’ – which fared well against an average score of 5.9 – and questioned why it wasn’t higher. He said: “All our manufacturer training is free.”

He added: “We do an internal dealer survey and the satisfaction rating is 90%. We pay much more attention to that.”

New product, new pastures

Bradley said that he did not know what his next step would be after leaving Mitsubishi but said that he had been “flattered” to have had a number of enquiries.

A plan to move on from his managing director role after 10 years was the main motivation for the move, he claimed, adding that he wanted to leave the brand in “good shape”.

In early 2018 Mitsubishi will welcome the new Eclipse Cross and seven-seat Shogun Sport into the range, products which lie in a burgeoning SUV sector and a sector in which his dealers are “very good at selling”, said Bradley.

In the year to the end of October Mitsubishi’s registrations were 13.51% down on 2016’s at 13,742 (2016: 15,889).

Bradley claimed that the brand would defy the market to deliver strong results with its new product in 2018.

He said: “I know all manufacturers will be claiming as much, but we expect to grow our sales next year and deliver a few surprises along the way too…”

Login to comment

Comments

No comments have been made yet.