Resilient partnerships will be critical in navigating the economic and structural complexities of the retail landscape, according to industry chief John O'Hanlon.

At the Vehicle Remarketing Association’s (VRA) latest seminar, the chief executive of Waylands Automotive provided insights into how industry players could thrive in an ever-evolving automotive landscape where adaptability and collaboration are paramount.

O’Hanlon spoke about the intricacies of the agency model where manufacturers will increasingly adopt a direct sales approach, stressing that there is a delicate balance required to ensure success for all: the original equipment manufacturer (OEM), the dealer, and most importantly, the customer.

O'Hanlon recounted firsthand experience of his work with one Waylands franchise, where a collective effort achieved the best outcome for all stakeholders. "Because all three are winning, we're in a great place. We worked incredibly hard to try and get the best outcome for the OEM, for the dealer, and for the customer.”

The Impact of Margin Shifts

One of the significant challenges, O'Hanlon noted, is the potential decrease in profit margins for dealers, particularly those traditionally strong in retail. As prices rise, he pointed out that dealers don't necessarily benefit from increased margins, forcing them to focus on volume to overcome rising costs. However, the limited market capacity poses a challenge, which is likely to lead to casualties in the industry.

Above all, the shift to an agency model, while promoting increased car sales, presents challenges in maintaining historic profit margins. "That little margin grab has an impact on our world," he observed, stressing the need for dealers to adapt to the new economic landscape.

"Agency is predicated on selling more cars but every manufacturer can't sell more cars. We've got a limited market. So we know there's going to be winners and losers as the opportunity for additional sales is more limited than ever."

Navigating The New Normal

With the manufacturer taking control of finance, dealers must now work even harder to make sure they don’t lose out, with O'Hanlon underscoring the importance of selling finance as a gateway to selling insurance and other add-ons.

He warned that if financing is not sold by the dealership, subsequent sales efforts risk becoming ever more challenging. "If we don't sell the finance, it’s much more difficult to sell insurance," he said, pointing to the risk of potential friction points in the customer journey.

The customer experience becomes paramount, and O'Hanlon stressed the need for flawless systems, well-resourced teams, and compelling offers from the outset. “What does good look like? What good looks like for an agency is fantastic systems and when I say fantastic systems, I mean both customer-facing and retailer-facing and we can work together when those systems are supported by highly trained well-resourced dealership teams that can deal with the little bumps along the road.”

Here, there is a crucial role for the franchise dealer to play in ensuring that great customer experience is the end point, a product of what he calls agency and dealership working closely in ‘a virtuous circle’. “If we can sell a car and it's smooth and wonderful and the customer feels at the centre of that experience, then we're winning,“ he said, adding that this would naturally lead to a new customer ownership cycle and customer retention.

“A manufacturer doesn't have that capability today. Perhaps it's around understanding, maybe it's around some of the systems maybe it’s around the growth. But those are the friction points we're seeing.”

“Whether it's a Mercedes, whether it’s a Volvo, you'll begin to see some of that pain come in for them. How quickly they get through the learning curve will be the interesting question. I don't know where we’ll get to. I'm ever hopeful because there are some real wins in terms of inventory, in terms of speed.”

The Electric Revolution

Turning to the electric vehicle landscape, O'Hanlon reflected on the strategic partnerships that Waylands has forged with brands embracing electrification, noting the importance of choosing partners with a clear industrial strategy, recognising there is a critical role these partnerships could play in making the retailer's job easier and positioning them for success in that growing market.

O’Hanlon said he had a unique opportunity in 2017 to choose the partners with which he wanted to work, selecting brands such as MG, Kia, Volvo, and Polestar with each representing a distinct aspect of the market and who would likely contribute to the business’ viability.

“If you look at the growth that they're expected to achieve, that makes my job as a retailer much easier. If I can actually benefit from the hard work and heavy lifting these brands do by growing, I stand a fighting chance,” he said.

Aftersales EV Challenges

O'Hanlon spoke of the aftersales challenges posed by the advent of electric vehicles, flagging the looming threat to traditional revenue streams, particularly in terms of the sale of oil and second services.

O'Hanlon spoke of the aftersales challenges posed by the advent of electric vehicles, flagging the looming threat to traditional revenue streams, particularly in terms of the sale of oil and second services.

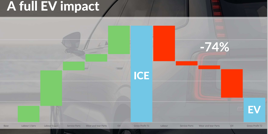

"Our gross profit is made up from some key parts. Look at oil, 30% of my gross profit comes from the sale of oil. Under the agency model, we need to sell over 23% more cars just to stand still never mind to offset that aftersales loss."

“If we went overnight (to only selling EV vehicles), then basically most of the work we would do would be on a second service – that would be 74% of my gross profit - wiping out 75% of my net profit.”

“This is something that is key to our viability so understand that EV aftersales is coming – and, because I position my brand to sell more new cars that are electric, I'll be faced with that sooner rather than later.”

With a significant portion of that gross profit traditionally derived from oil sales, the shift to EVs necessitates therefore a proactive approach to aftersales services, with O’Hanlon underlining the importance of annual Electric Vehicle Checks (EVC) and retention improvement strategies to offset that hit to aftersales revenue.

Partnerships, Future Scaling

Crucially, the evolving automotive landscape will necessitate a shift in dealership strategies. On this, O'Hanlon advocates for scaling up and forming partnerships that understand the intricacies of the dealership business.

“As the EV mandate grinds on,” he said. “We know we'll have to sell more and more EVs. They'll be a few dealerships who will jump on board who need to fill showrooms. But that's not the answer. We need to be very diligent with the partners that we work with going forward,” warning that “an empty showroom might be better than a showroom with the wrong brand.”

He predicted a shift in the optimal size of dealerships, stating: "I think the days of the single site, two-site dealership are going away. We need to get bigger and future-scaling partnerships should be our focus."

“We need to be working with partners who understand our business, we need to understand what they can do, and then we can push forward at a time when scale and speed will be the critical factors.”

“The challenges have grown in terms of the sector we work in whether they be economic or whether they be structural. They've got harder and we need to understand and work with strong partnerships through our businesses to be able to solve them.”

Login to comment

Comments

No comments have been made yet.