The consumer car finance market grew 2% by volume and 13% by value in December to complete a 2021 “rebound” despite the headwinds of COVID-19 and vehicle supply shortages.

New data published by the Finance & Leasing Association (FLA) revealed that, in 2021 as a whole, new business volumes grew by 9% compared with 2020 to almost 2.1 million cars financed, but remained 14% lower than in 2019.

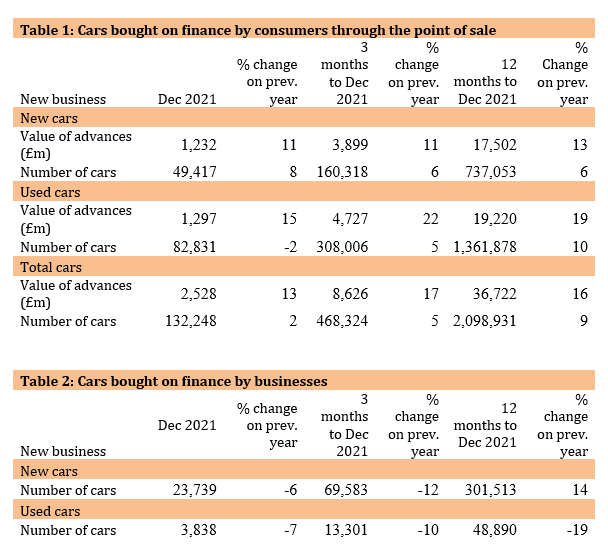

But a rise in the volume (to 132,248) and value (to £2.53bn) of trade in December, across both new and used car sectors, resulted in a partial recovery which the FLA expects to continue in 2022.

But a rise in the volume (to 132,248) and value (to £2.53bn) of trade in December, across both new and used car sectors, resulted in a partial recovery which the FLA expects to continue in 2022.

Geraldine Kilkelly, director of research and chief economist at the FLA, said: “The consumer car finance market rebounded in 2021, but the pace of recovery was hampered by increased economic uncertainty as new waves and variants of COVID-19 emerged, and the global shortage of semiconductors hit vehicle supply.

“Economic and market conditions will remain challenging this year as many households face a significant squeeze on disposable incomes from higher inflation, interest rates and taxes.

“However, supply issues are expected to ease and business investment is expected to recover as the year progresses.

“The FLA’s Q1 2022 industry outlook survey shows that 92% of motor finance providers expect new business growth over the next twelve months.”

The consumer used car finance market generated new business up 15% by value, but 2% down by volume in December compared with the same month in 2020, the FLA said.

In 2021 overall, new business volumes in the used car retail sector were 10% higher than in 2020, but remained 9% lower than in 2019, it said.

Login to comment

Comments

No comments have been made yet.