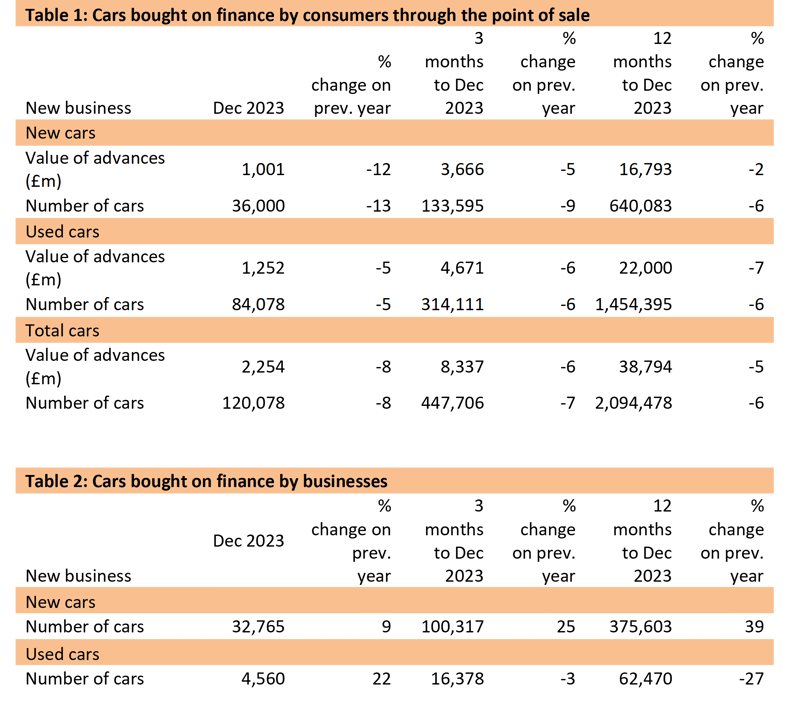

Consumer car finance new business volumes fell by 8% in December compared with 2022, according to new figures released by the Finance & Leasing Association (FLA).

The corresponding value of new business was also 8% lower over the same period while for 2023 as a whole, new business by value and volume decreased by 5% and 6% respectively, compared with 2022.

The consumer new car finance market reported a fall in new business in December of 12% by value and 13% by volume compared with the same month in 2022. In 2023 as a whole, new business volumes in this market were 6% lower than in 2022.

The consumer used car finance market reported a fall in new business in December of 5% both by value and volume compared with the same month in 2022. In 2023 as a whole, new business volumes in this market were 6% lower than in 2022.

Commenting on the figures, Geraldine Kilkelly, director of research and chief economist at the FLA, said: “The consumer car finance market reported a modest fall in both the value and volume of new business in 2023. The value of new business in this market at almost £39 billion was the second highest on record.

“Consumer confidence has begun to increase as the outlook for their personal finances has improved. Nevertheless, consumer spending is expected to remain subdued this year and our latest forecasts suggest that the point of sale consumer car finance market is likely to see new business grow by around 2% in 2024.

“As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”

Login to comment

Comments

No comments have been made yet.