Consumer champion Martin Lewis’s free tool for consumers to probe whether they were victims of discretionary commission agreements (DCA) has logged the filing of over half a million complaints.

"Last Tuesday,” he wrote in his weekly email to subscribers, “we launched our brand new car finance hidden commission reclaiming guide & tool and... wow! In just seven days you've sent over 530,000 complaint emails via it.”

“The regulator,” he adds, “the Financial Conduct Authority (FCA), estimates 40% of finance agreements had these dodgy commission arrangements (you won't know if you did as it was hidden) and the average payout per arrangement may be £1,100. So that potentially equates to up to £234 million coming back to people.”

The Money Saving Expert founder previously said he was following the FCA's review of historic DCAs closely: “We don't believe it likely the FCA would do this unless it has substantial evidence, so a payout is likely due when it reports in September. Yet as claims could be time-barred … the sooner you complain, the safer.”

The FCA launched its review after the Financial Ombudsman Service ruled in two cases that lenders' DCAs, combined with a lack of full disclosure to the customer, had put car buyers at a disadvantage and were unfair. The FCA said it hopes to quickly determine if this is a widespread issue and announced that it was sending in an independent expert to consult with car loans firms.

Previously, Lewis said: "I think it is very very likely it is going to rule that there was seismic, systemic mis-selling. A back of the envelope calculation shows this will likely end up being the second biggest ever UK reclaim campaign, after PPI."

"I think it likely that, when the investigation completes (currently planned to be September), the FCA will set up some type of mass-scale redress scheme – though there's a small chance it'll change its mind and say this is a damp squib. The best way to act is to assume that scheme is coming.

"Even though there's a pause on firms needing to deal with complaints, it’s important to get your complaint logged sooner, so there’s less chance you’ll be timed out."

Lewis reported that the number of emails sent to car finance providers since Money Savings Expert launched its tool has been unprecedented. "Many firms simply weren't prepared. However, many of the large firms have assured that they will be able to acknowledge response of your email within the 28 days. So, if you haven't had an acknowledgement yet, don't be too concerned, they're likely just swamped."

Zoe Morton, associate director at RSM UK, said: ‘The potential impact of the FCA’s review into discretionary commission arrangements is vast, much like Payment Protection Insurance (PPI) was, so it’s no surprise the FCA has put complaints on hold for now. While motor finance providers and consumers are effectively in limbo until September, companies are still likely to receive an influx of complaints, even those that have never offered DCAs. This places them under huge operational pressure."

She advised car finance firms to plan for the operational impact of dealing with these complaints (e.g. resource capacity), even for those firms who never offered DCA, pointing out that the operational impact in terms of dealing with these could still be sizable. "Firms will still have an obligation to respond to consumers, regardless of whether they used DCA." she said, adding that firms should consider progressing any DCA complaints already received, to ensure cases are adequately prepared in anticipation for the resolution.

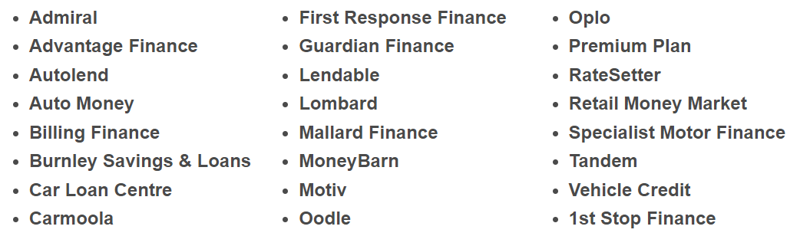

Martin Lewis said that some car finance firms told his researchers that they have never used DCAs. "We can't independently verify this," he said, "but it'd seem unlikely that regulated firms would make such a blanket statement unless it was true (and if it's not true, we'll formally complain to the FCA about misleading info).

"So if your car finance was with any of these firms, it's probably not worth making a claim. The current list is..."

The FCA recently said it has gone into the review with no prior assumption of what it will find.

The FCA recently said it has gone into the review with no prior assumption of what it will find.

Login to comment

Comments

No comments have been made yet.