Fleet operators are spearheading the UK’s transition to electric vehicles (EVs), but costs around insurance, repairs and skills shortages are threatening to undermine progress—posing challenges for dealer groups with major fleet operations.

While the Government’s recent £120 million commitment to support EV adoption was welcomed by the industry, insurers warn that fleets could be blindsided by the costs they are finding around insurance and repair.

“Fleet operators are at the forefront of the UK’s push for net zero,” said Jon Dye, director of underwriting for motor at QBE Insurance.

“But many are underestimating the hidden costs that come with EV ownership—particularly around insurance and repair.”

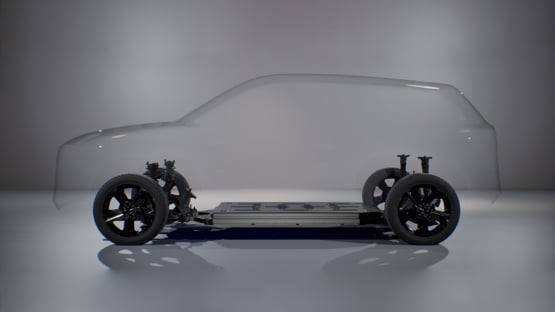

EV battery repair costs

According to the Association of British Insurers (ABI), EVs are 25% more expensive to repair than their petrol or diesel equivalents.

Insurers point to a mix of high parts costs, limited availability and longer repair times.

QBE Insurance battery damage in particular is costly—averaging £7,200 for a replacement—and QBE said even seemingly minor incidents can lead to full write-offs due to complex diagnostics.

Thatcham Research has highlighted that something as simple as a charging flap on a lower-cost EV can cost up to £2,500 to replace.

Supply chain disruptions, rising raw material prices and global trade tensions are exacerbating these costs.

This is having a direct impact on insurance premiums.

EV insurance premiums up by 50%

QBE reports that EV insurance costs are nearly double those for ICE vehicles, with the average UK EV policy now standing at £1,344—up 50% year-on-year.

For dealer groups with strong fleet sales channels, this rising cost of ownership risks slowing down momentum in what has been a key growth area.

Many have benefited from early corporate demand for EVs, particularly amid slower retail uptake, but affordability concerns could impact renewals and long-term adoption.

“There’s also a significant shortage of technicians trained to repair EVs,” added Dye.

“This leads to longer waits and higher labour costs. Fleets are facing a costly and unpredictable maintenance burden.”

Dye believes a coordinated approach is now needed to keep they key fleet EV market on track to safeguard the fleet EV market.

“Investment in technician training, battery diagnostics and recycling must be prioritised.

"Manufacturers also need to improve vehicle repairability and ensure spare parts are readily available and affordable."

Without such steps, Dye believes "these rising costs could make fleet electrification financially unsustainable—and risk undermining the UK’s broader EV strategy".

For franchised dealers with established fleet divisions, the challenge will be working with OEMs, insurers and policymakers to mitigate these risks and maintain momentum in what remains a critical segment for the transition to zero-emission transport.

Free fleet data resource for dealers from AM and Epyx

AM and Epyx recently launched a free data resource for dealers to help with their fleet business.

Called the 1link Index, it is based on data drawn from Epyx’s 1link Service Network platform, used by more than 8,500 garages to offer servicing, maintenance and repair to businesses operating more than four million vehicles.

Information is provided in four areas – average cost of a basket of parts, average labour rates for franchise and non-franchise dealerships, average cost of servicing for cars three years old and under, and the percentage of jobs (not including tyres) carried out in franchised dealerships.

It covers a period from the start of the decade and will be updated every month.

Login to comment

Comments

No comments have been made yet.