Advertisement feature from Car Benefits Solutions

Following the Spring Statement last week, discussions over the National Insurance (NI) increase are in full swing, but there is no doubt - it will impact your business.

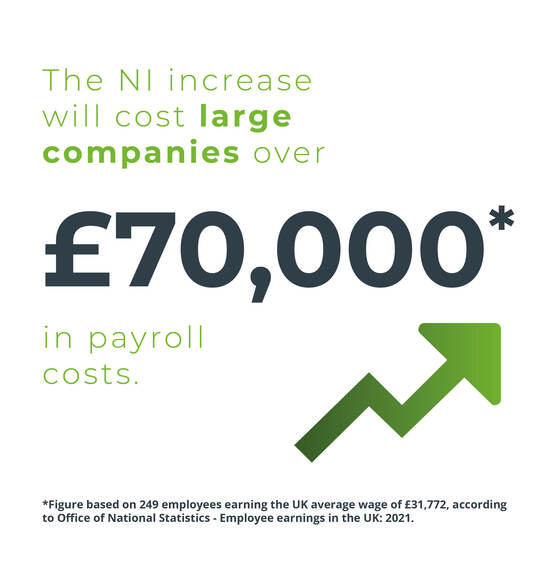

The increase is 1.25 percentage points, for employers it’s going up from 13.8% to 15.05%. However, the percentage that this converts to in terms of contribution is actually closer to 9%. Using the average wage in the UK, which is currently £31,772^, the difference in contribution for the new tax year is £287. The planned increase will have a direct impact on all businesses via National Insurance Contributions (NICs) for payroll. Multiply the additional contributions for a small company of 49 people, and it will cost businesses almost £15,000 more per year. For a larger company with 249 employees, it will total more than £70,000.

The planned increase will have a direct impact on all businesses via National Insurance Contributions (NICs) for payroll. Multiply the additional contributions for a small company of 49 people, and it will cost businesses almost £15,000 more per year. For a larger company with 249 employees, it will total more than £70,000.

As well as businesses facing the additional payroll costs, the NI increase also impacts Class 1A NICs, which are applicable on employee benefits such as staff car schemes, medical insurance and high street discount schemes.

With the impending increases, a solid strategy is required to identify where savings can be materialised elsewhere in your business to compensate for the additional costs.

Car Benefit Solutions (CBS) have created a free report, which lists three areas of consideration to help aid your business strategy ahead of the changes.

- How the NI increase will impact payroll costs.

- A solution to deliver business savings.

- What the increase means for businesses long-term?

To learn more, read our free report or contact us to discuss how a CBS car scheme could help you offset or surpass the NI increase costs for your business.

^Office of National Statistics - Employee earnings in the UK: 2021

Login to comment

Comments

No comments have been made yet.