Advertisement feature from Vyne

Money makes the world go round and payments power that movement. But over the last ten years, payments in automotive have remained stagnant with dealerships bound to manual bank transfers, debit card and credit cards. But what if there was a better way for automotive companies to pay and get paid? Enter Open Banking.

What are Open Banking payments?

Open Banking is a new, alternative payment method which is already actively used by six-million people in the UK. Put simply it’s the means of securely moving money from one bank account to another.

For the automotive industry Open Banking offers reduced transaction fees bypassing high-cost card acquirers, instant settlement of funds, a reduced risk of fraud and improved customer payment experiences by removing manual, clunky, slow payment options. To put it into context, the automotive industry can save anywhere between 40 - 80% with Open Banking compared to card transaction fees. So how can automotive companies use Open Banking powered payments?

Seamless online deposits and full payments

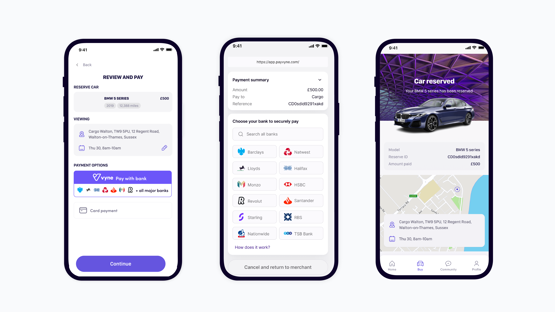

Card payments remain a dominant form of payment but with it comes barriers to conversion and clunky customer experience, especially with the new Strong Customer Authentication rules. Open Banking offers a cardless payment option which can be completed in as little as three taps. There’s no long card detail entry, no account creation - it’s simple, quick and easy for deposits and full payments to be completed.

No more manual payments to reconcile and manage

Today manual bank transfers are prevalent but they're rife with errors. Customers are at risk of miss-sending funds and companies often spend hours or days waiting for confirmation of funds received in order to release product.

With Open Banking, dealerships can send payment links directly to customers by email or SMS. These payment links allow the customers to pay for deposits or full payments from within the dealership or from the comfort of their own home. The funds land in the dealerships account instantly and the car can be taken home as soon as it is ready.

Effective, smooth after sales

Getting an MOT or service can be seen by many as life-admin. Open Banking takes away the stress caused by bad payment experience. Payment links can be sent with the invoice and details of the service once an MOT or servicing has been completed. The customer can then pay quickly and easily and the funds land in the business account instantly. No more waiting for confirmation of funds.

Instant payouts without the admin

When a customer sells a car to a dealership they need to provide account details and verify that they’re the owner of the account. This creates admin for the customer and the dealership, not to mention the headache of miss-sent funds. With Open Banking, dealerships initiate payouts which land in the customer's account instantly without any time-consuming admin. Happy customers equals great reviews.

If you’d like to learn more about adding Open Banking payments to your business visit Vyne, https://www.payvyne.com/ or email hello@payvyne.com

Login to comment

Comments

No comments have been made yet.