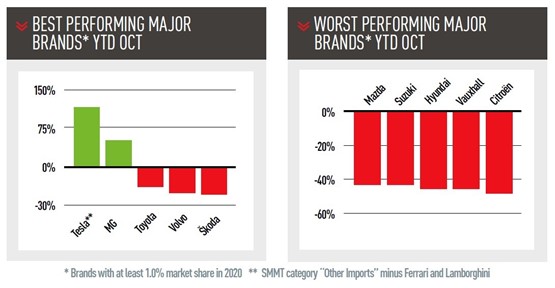

We start our review of the October market by dealing with the fast-developing elephant in the Society of Motor Manufacturers and Traders’ (SMMT) room: Tesla.

We start our review of the October market by dealing with the fast-developing elephant in the Society of Motor Manufacturers and Traders’ (SMMT) room: Tesla.

Tesla does not officially report registration statistics, although all its cars are, naturally, part of the overall registration tally.

Instead, Tesla hides coyly (not a word generally associated with Elon Musk) behind the category “Other Imports”. Once Ferrari and Lamborghini (not identified

separately by the SMMT) are removed from the total, you are left with a category with a growth rate of 116.7% year-to-date (YTD), accounting for 1.16% of the UK

market.

Not every single registration in this category is automatically a Tesla, as a tiny niche manufacturer could also be hiding in there. However, it is pretty safe to assume that, if not all the cars are Teslas, probably 99% of them are, and it is not worth getting all Donald Trump about whether 99% certainty about a count is sufficient.

That makes Tesla easily the fastest growing car brand this year in the UK and now a major player.

The vast majority of sales are the Tesla 3 – Tesla insiders suggest the Model 3 accounts for approximately 90% of UK Tesla sales YTD. That makes the Tesla 3 the

UK’s best-selling battery electric vehicle (BEV), and the UK’s second best-selling compact executive model behind the BMW 3 Series.

Of course, the big question is whether that market share is just the start of Tesla’s march to domination (as the price of Tesla shares implies), or just a grace

period until the big boys develop electric models and Tesla loses its battery USP.

Elon Musk believes that “it is financially insane to buy anything other than a Tesla”, but then he predicted that he would supply one million robotaxis by 2020.

Among the more conventionally-managed manufacturers, Ford is largely maintaining its lead over VW thanks to the very strong performance of the Puma

small crossover.

In its first year, the Puma has become the clear leader in its sector, outselling the second-placed Vauxhall Crossland by 36.1%. That is in stark contrast to Nissan,

whose new second-generation Juke is only in third place – a big come-down from the days when the first-generation Juke dominated the small crossover market.

Another Ford that is taking a bigger share of its (very small) segment is the Mustang which is up by 4.0% this year and has registered more than 1,000 units. That

is not a big number in the overall scheme of things but, by the standards of non-premium coupes, it is remarkable: five times more than the Toyota Supra and

10 times more than the Nissan 370Z.

However, the far more significant news for Ford is that the new Golf has just overtaken the Focus, and could now consolidate its position as the leading small

family hatchback.

Behind Ford and VW, Audi is closing on Mercedes-Benz and BMW. It outsold its two competitors last month and is now on 6.6% YTD, compared with 6.9% for its rivals.

Audi won’t catch them this year, but it will certainly try in 2021.

In sixth place is Toyota, although it is fewer than 700 units ahead of Vauxhall. To put that into perspective, Vauxhall was 49,000 ahead of Toyota at this stage last

year. The main reason is that the Astra appears to be on premature run-out. Historically, it was a top three small family hatchback, but it is now No15, behind the

Hyundai Ioniq and Nissan Leaf.

Kia is in eighth place, having slightly out-performed the market with a fall of “only” 26.8%. One of the reasons for Kia’s success is that it has successfully surfed

the crossover wave: 62.8% of sales are from crossovers like the Niro, or SUVs like the Sorento. Kia is slightly ahead of Nissan, which pretty well invented the

modern crossover with the first Qashqai, but has since been displaced.

The ageing second-generation Qashqai is down 40.3% and, as discussed, the second generation Juke is failing to cut through. As 72.3% of Nissan sales come from these two cars, sales of other models do not really affect overall Nissan share.

Rounding out the top 10, Land Rover has also done slightly better than the overall market (-25.4%), thanks to two new models: the Evoque and the Defender. The full Defender range is not yet available (the three-door Defender 90 is only being launched now), but YTD sales are already closing in on the Discovery and

Velar.

There is less good news at sister-brand Jaguar. Apart from the excellent I-Pace, which is up by 37.2% YTD, all models are down by more than the overall market.

The XE and XF saloons are down by more than 60% YTD, and Jaguar has just announced that the XE will be withdrawn from the vitally-important US market, as

sales have been negligible.

And what of the rest of the year, as England returns to lockdown? The precedent of Wales’s slightly earlier second lockdown is not encouraging. Last month,

registrations in Wales went down by 25.6%, while those in England fell by 3.2%. The SMMT has reduced its forecast for UK registrations to 1.56 million for 2020, the lowest figure since recession-hit 1982.

In the aftermath of the 2008 financial crash, the then boss of Fiat, Sergio Marchionne, bemoaned the fact that Italian registrations had dropped to the levels of

the 1970s. “We have lost 40 years of growth,” he said.

Bosses in other markets were grateful that the situation in their home markets were not as bad. Well, today, the UK has just lost 38 years of growth – and the

situation in the UK arguably looks worse for 2021 than it did for Italy then.

The SMMT is also warning that, in the case of a no deal Brexit, the price of conventional cars will rise by an average of £1,900 and the price of BEVs will go up

by an average of £2,800 – almost the same figure as the current £3,000 incentive for such cars.

DAVID FRANCIS

This article first appeared in the November 2020 Issue of AM magazine.

Login to comment

Comments

No comments have been made yet.